In this issue

May 22, 2017

The EEOC’s Increased Focus on Leave Policies

Several years ago, the Equal Employment Opportunity Commission (“EEOC”), the federal agency that enforces the nation’s anti-discrimination laws, filed suit against AutoZone, Inc., accusing the auto parts retailer of violating the Americans with ...

May 22, 2017

Farm Loan Methods and Cautions

The first time you take out a CCC loan, you and your tax specialist will need to analyze the best choice for your operation and either treat the loan as a loan or treat the loan as income. Once the precedent has been set you will by default ...

May 22, 2017

Are You Managing Your Clients? (Or Are They Managing You?)

A recent family vacation got me thinking about management. We took a trip to Florida and booked rooms at a Hilton resort, where I enjoy Diamond level status in their loyalty program. When I booked the rooms online last August, I requested adjoining ...

May 22, 2017

Is 70 the New Retirement Age?

Is 70 becoming the new retirement age? According to a recent CareerBuilder survey, 30 percent of U.S. workers ages 60 and older plan to retire at age 70 or older. Another 20 percent don't believe they will ever be able to retire.

May 22, 2017

Spring Training for CPA Teams

Baseball fans get excited when spring rolls around. It’s the first step of a new season — the moment when everyone sees what your team is made of. Although there are no leagues or playoffs in public accounting, managers still needs to gear up all ...

May 22, 2017

May 2017 Firm Management Channel

Important Components of a Professional Liability Insurance Policy Covered and excluded services- Ensure that your policy contains no limitation to fees, areas of practice and or persons covered. You want to ensure coverage for a broad variety of professional services and persons that work for you. Coverage must be full tort (not restricted to negligence)....…

May 22, 2017

Are Portals Finally Coming of Age?

Portals have been in existence in the accounting profession for around 20 years. Many public practice firms set up proprietary portals that had integration benefits to their practice management systems and were integrated into early web sites.

May 22, 2017

Reaching Clarity On Remote Work Policies

Remote work is a popular topic of discussion at many firms across the country. Yet few firms sit down to flesh out detailed policies for remote workers before their first virtual employee is in place. Typically, one valuable employee requests to work ...

Technology May 22, 2017

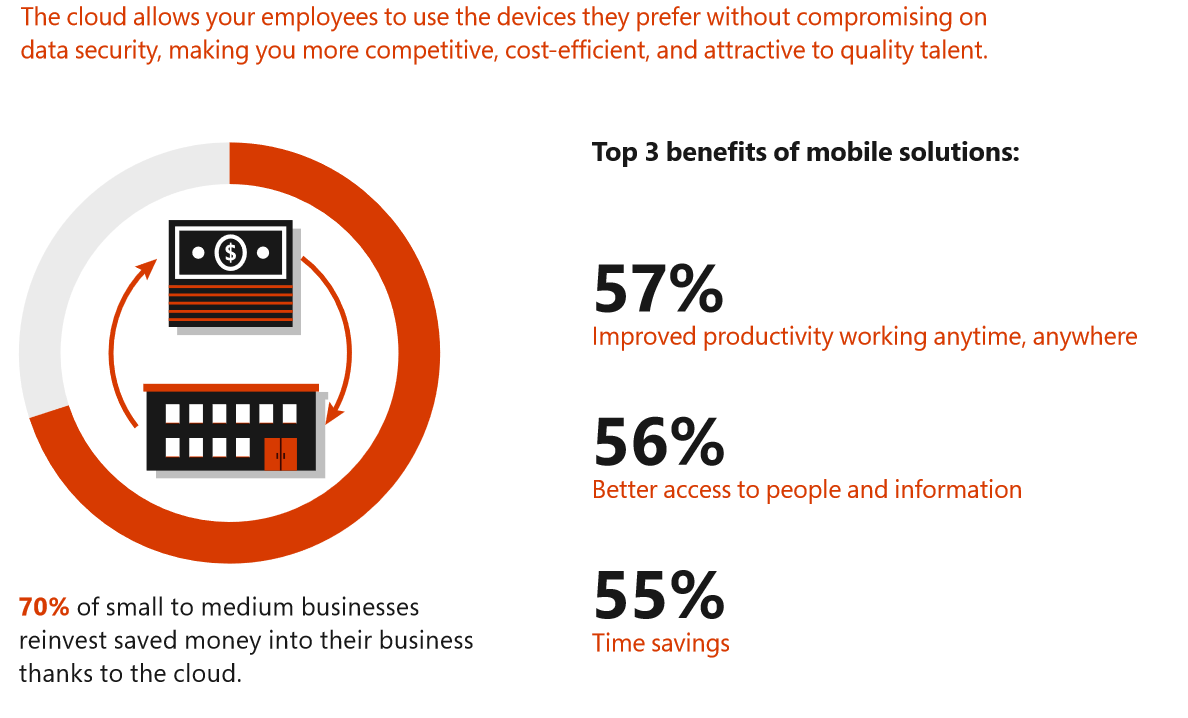

Top Business Trend for 2017: Achieving Work-Life Balance

Transitioning from a traditional IT setup to the cloud can not only save your business IT dollars, but it has nontangible benefits as well. One of those benefits is creating a better work-life balance for your employees.

May 22, 2017

10 Tips for Firm Retreats

As a former managing partner (MP) with a firm who religiously held an annual retreat, I can offer a few tips to you from experience that will help you get the most out of the process. You're investing a lot of time (= money) taking your top talent ...

May 22, 2017

Apps We Love: Insurance Tools

When you’re thinking about your insurance needs, where do you turn? We wondered if there were apps to help us and started doing some research. Here’s what we found, with the help of some of our members of the CPA Practice Advisor community.

May 22, 2017

Ten Income Tax Benefits for Farmers

Farming has often been viewed as the backbone of the American economy. While technology and other recent developments may have changed this thinking, farmers still enjoy a preferred status, at least as federal income taxes are concerned. For instance, ...

May 22, 2017

May 2017 Tax Channel

I have a client, a husband and wife, and about fifteen years ago the wife went to prison for embezzling money from her employer. In 2007, when she began serving her sentence, her retirement accounts and everything else were liquidated to pay ...

May 22, 2017

When Does “Placed in Service” Start for Depreciation Purposes?

Generally, a business is entitled to claim depreciation deductions for property, including real estate, beginning in the year the property is “placed in service.” Similar rules apply to Section 179 deductions and “bonus depreciation” deductions, as ...

May 22, 2017

Agriculture Services Marketing Tips

Similar to the tax season, agriculture clients have busy seasons too – planting and harvesting. It’s tough to reach clients, and it’s even tougher to gain new clients, during that time. What’s a practitioner to do?

May 22, 2017

Treating LLC Members as Employees

For an LLC that’s electing to pay tax as an S-Corporation or C-Corporation, it is perfectly fine to treat the members of the LLC as employees. Where it goes awry is when LLC members of partnerships or disregarded entities are treated as employees, and...

May 22, 2017

2017 Reviews of Asset Management Systems

The more assets a business obtains, the more complicated it becomes to adequately manage those assets. And for service businesses, or those with a large number of company assets such as equipment and machinery businesses, tool rental businesses, or ...

May 22, 2017

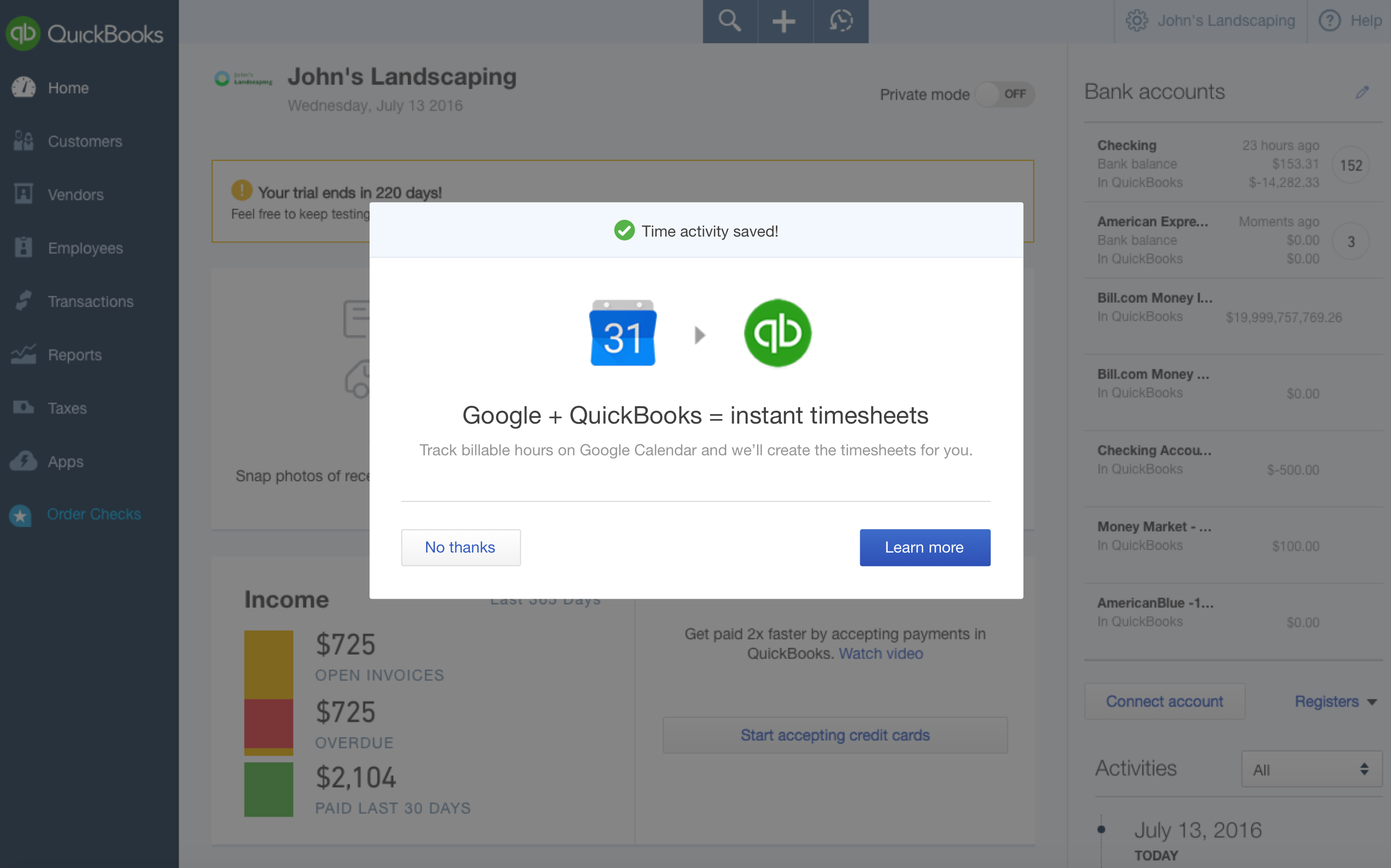

Intuit Announces QuickBooks Online Integration with G Suite

New invoicing capabilities with Gmail and Google Calendar offer small businesses faster payments and seamless customer communication

May 22, 2017

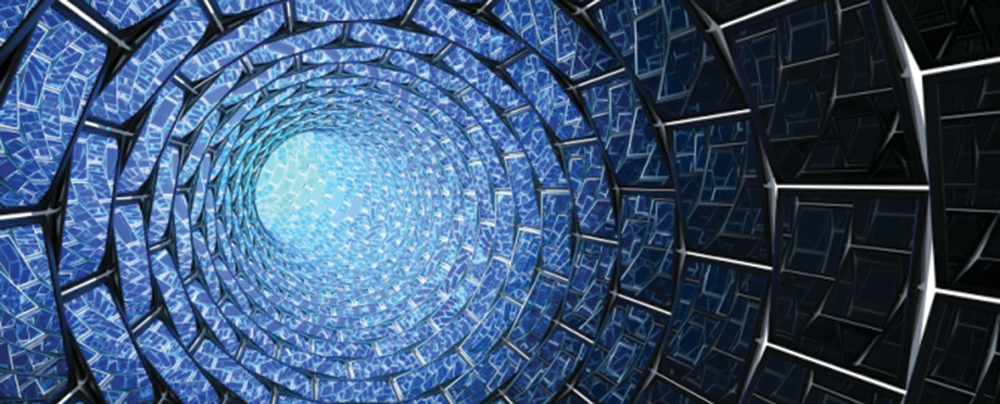

3 Tech Trends for Accountants to Watch in 2017

Some industry experts believe that blockchain technology can be used to revolutionize accounting in several areas, but the term and some of its descriptions have left many people confused. One of the best explanations of what blockchain technology is ...

May 22, 2017

Farm Income Taxation: Reaping What Good Lobbying Has Sown

Farms are as American as apple pie. Thus, they have become one of American politicians’ favorite businesses. Unsurprisingly, they get tax advantages unavailable to most other businesses. A well-advised farmer should be aware of these advantages, on ...

May 22, 2017

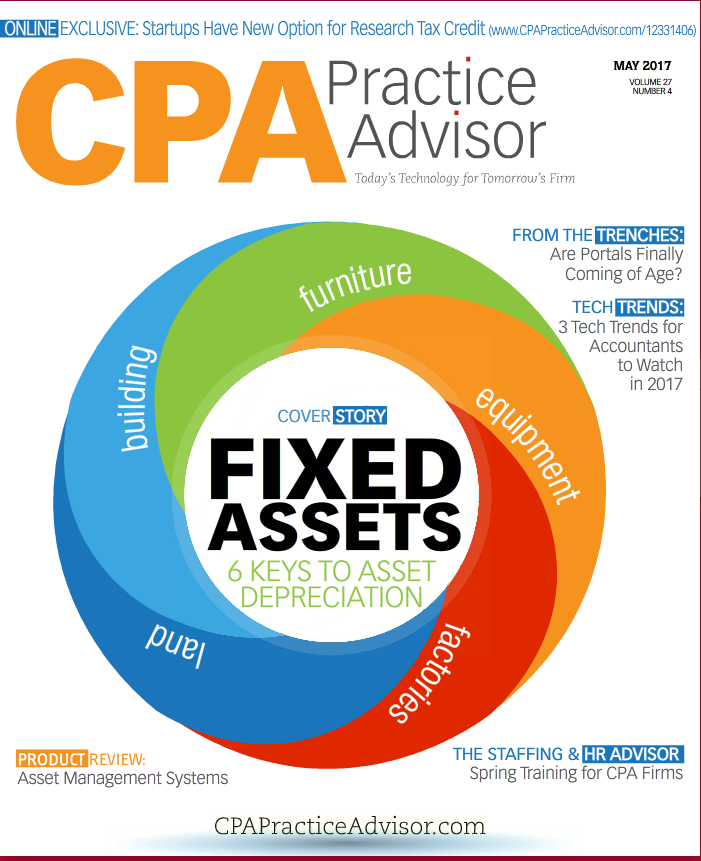

6 Keys to Asset Depreciation

The term “depreciation” may have negative connotations, but it usually elicits positive vibes from tax practitioners. Thanks to the depreciation deduction rules, your clients who are business owners can recoup most -- if not all -- of the cost of ...

May 22, 2017

America’s Aging Workforce

According to a new survey by the global consulting and advisory giant Willis Towers Watson one in four U.S. employees believe they won’t be able to retire until after age 70, if at all, and nearly one-third (32 percent) say they ...

May 22, 2017

May 2017 Small Business Channel

It's one of today's most vexing economic puzzles: Why can't employers find workers to fill their positions when approximately 7.5 million Americans are unemployed, and millions more are working part-time because they can't find full-time positions or ...

May 22, 2017

How to Turn Agricultural Clients into Agribusiness Clients

Our goal is to turn agricultural producers into agribusiness producers. We want to help the agribusiness producer to think and make decisions as a business owner. We strive to challenge these producers from decision-making based on emotions or tax ...

May 22, 2017

AICPA News – May 2017

Recent top news and announcements by the American Institute of Certified Public Accountants.

May 22, 2017

May 2017 Accounting & Audit Channel

The next generation exam, which began testing on April 1, has added additional assessment of higher-order cognitive skills that test a candidate’s critical thinking, problem solving and analytical ability. The exam also makes greater use of task-based ...

May 22, 2017

Spring Cleaning and a Fresh Start

It’s Spring and that gets me thinking about renewal, growth, and change. I’ve been engaged (in what spare time I can find) in a spring cleaning project that includes inventorying my books and also the boxes that are stored in our attic.

May 18, 2017

The Top Myths About Remote Work And How To Overcome Them

In a previous column, I talked about an important part of creating an environment within your accounting firm where everyone can thrive: allowing opportunities for remote work. When thinking about remote work, this can apply to either an associate who works solely at home or one who works remotely when needed. Even though demand for...…

May 9, 2017

AICPA ENGAGE Conference Set for June 11-15

AICPA ENGAGE, an event that combines six public accounting, tax, personal finance and marketing conferences under a single roof, offers one of the most unique opportunities for career advancement, networking and practice development in the accounting ...