In this issue

November 12, 2018

Defining Personal Success

More often than not, our goals are something tangible. At one point in my life, making partner in my firm was the ultimate goal — the epitome of success I’d been working toward my entire life. However; I found throughout my career, I have pivoted ...

November 24, 2017

Supervisor Support Critical To Employee Well-Being And Workforce Readiness

For employees whose supervisors do not support and encourage their career development, only 15 percent say their employer provides opportunities for them to develop the technical skills they will need in the future, only 20 percent say their employer ...

November 23, 2017

Are Your Small Business Clients Capturing Accurate Payroll Data?

Nearly 34% of America's employees are not required by their employers to track their hours worked. This is according to the 2017 "Getting Paid In America" survey conducted by the American Payroll Association (APA) during National Payroll Week in ...

November 23, 2017

The Top FLSA Mistakes made by Employers

A single dissatisfied employee who files a allegation of violation with the DOL can quickly turn this assumption into a costly error. In fact, even a competitor can file a complaint with the DOL if they believe an employer is violating employment law.

November 23, 2017

2018 Minimum Wage Changes – State-by-State

Twenty-seven states — plus Washington, D.C. — index their minimum wages to rise automatically with the cost of living. More states will index minimum wage increases annually, starting in the following years, like: Minnesota (2018), Michigan (2019) and ...

November 21, 2017

Architecture and Engineering Firms Can Use Tax Strategies to Free Up Cash

Architecture and engineering firm CFOs have many responsibilities to their firms and owners — one of which is identifying ways to minimize income taxes and free up cash flow for growth, debt reduction, distribution to owners, and other operational uses.

November 21, 2017

November 2017 Accounting Channel

73% of CFOs Trust the Cloud for Financial Data By Isaac M. O’Bannon, Managing Editor Just three years ago, according to CFO respondents in the Adaptive Insights CFO Indicator report, only 33% trusted the cloud for financial data. Today, 73% of CFOs trust the cloud for financial data, reflecting a significant technology shift for Finance,...…

November 21, 2017

Apps We Love: Mobile Payments

From tracking KPIs or managing client communications, or even digging them out of a financial hole while cruising at 35,000 feet, these business apps keep busy professionals tuned into their firm and client needs, which definitely helps productivity.

November 21, 2017

Engineering Marketing for the Accounting Firm Go-Getter

As a risk-averse group, engineers like to know that what they are looking at is safe. Therefore, having an SSL Certificate on your site will help in a couple of ways. First, it demonstrates to the search engine that you’ve put additional security ...

November 21, 2017

A Step Into the Future of Cloud Accounting

As a cloud-based accounting firm, we are major proponents of using modern technology to better serve our clients and build a stronger business. Peering into the future of the accounting industry and anticipating its potential impacts is an important ...

November 21, 2017

2017 Review of Time Management Systems

Much more than simply a tracking time, these time management systems help firms manage staff productivity, assess client profitability, while also offering an easy to use mechanism for tracking time and billing information, including any related expenses.

November 20, 2017

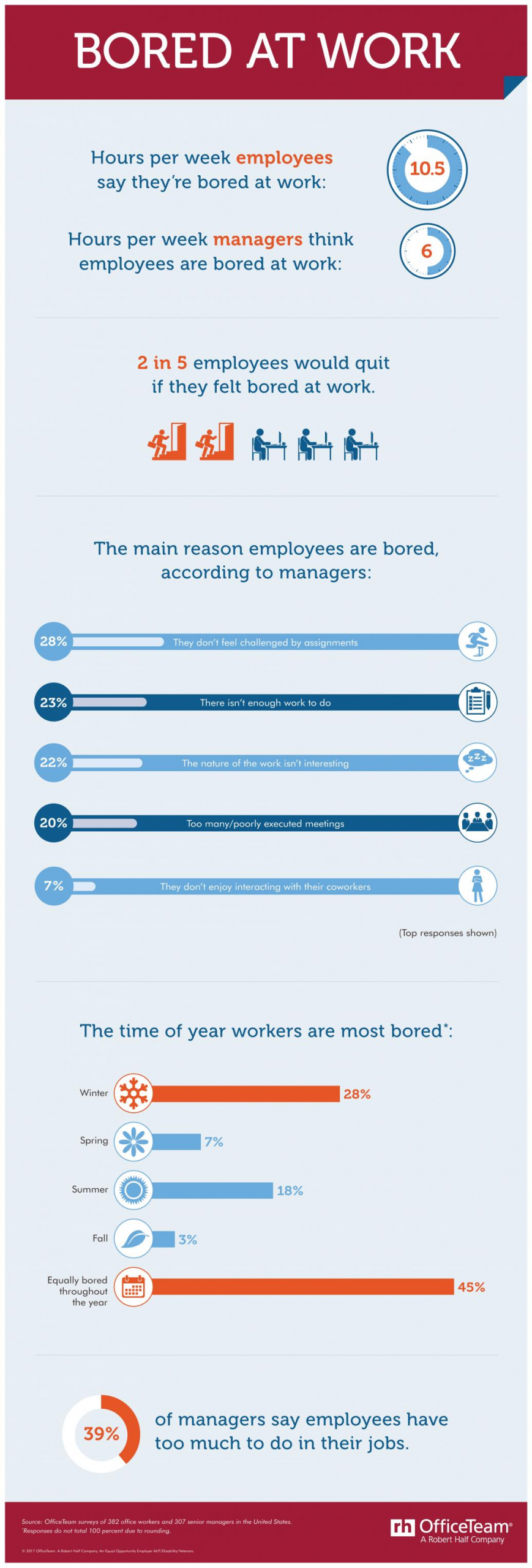

Workplace Boredom Kills Productivity

If you've ever had a case of the blahs at work, you're not alone. According to a new survey from staffing firm OfficeTeam, professionals admit they're bored in the office an average of 10.5 hours per week. That's more than a full day a week, or the ...

November 20, 2017

November 2017 Small Business Channel

Veteran Business Owners Thriving, Extremely Upbeat on Economy By Isaac M. O’Bannon, Managing Editor Optimism among veteran small business owners is outpacing the nation’s small businesses as a whole, according to this year’s Allstate/USA Today Small Business Barometer. The annual index study released new data ahead of Veterans Day showing that veteran entrepreneurs’ optimism is...…

November 20, 2017

November 2017 Firm Management Channel

Accounting Firm Cybersecurity: Training Your Staff and Protecting Your Business By Christina Wiseman, Thomson Reuters From the Thomson Reuters blog. It probably won’t surprise you to hear that tax identity theft is on the rise. In response to this increase in tax-related ID theft, last year the IRS rolled out new security requirements that recommended...…

November 20, 2017

November 2017 Payroll Channel

The IRS has announced the 2018 cost-of-living adjustments (COLAs) with respect to retirement plan limits. Many limits, which are adjusted by reference to Code Sec. 415(d), are changed for 2018 since the increase in the cost-of-living index met the ...

November 20, 2017

5 Must-Have Workplace Policies

By implementing or updating as needed, and consistently enforcing five (5) practical and well-known workplace policies, most employers can dramatically decrease the potential that a workplace decision involving an employee will result in ...

November 20, 2017

5 Hiring and Salary Trends for 2018

Demand for accounting professionals remains high, while unemployment for accountants and auditors remains low, below the national average. This is putting pressure on and intensifying hiring competition for accounting firms.

November 20, 2017

Credit for the Past, Capital for the Future

Intuit introduces a new lending solution, QuickBooks Capital, to help small business owners grow their businesses

November 20, 2017

Is the Password Dying?

It’s not hard to see why people don’t like passwords. We share a lot of sensitive personal information with companies, including Social Security numbers, health records, and bank account and credit card numbers. Even password managers don’t eliminate ...

November 17, 2017

November 2017 Tax Channel

All in an effort to minimize filing fraudsters, the IRS has accelerated major information form filing. And to drive home their emphasis, the IRS has drastically increased preparer penalties.

November 16, 2017

Technology Tools for Productivity

New technology tools are frequently showcased first at the Consumer Electronic Show (CES) in Las Vegas every January. While many innovative products have been initially introduced during CES, there have been a number of useful hardware and software ...

November 7, 2017

5 Topics Every Accountant Should Address with Clients

The start of a new year is the perfect time to touch base with your clients or reach out to new ones. Don’t limit your discussion to traditional tax issues. Take the time to ask existing and prospective clients about their business plans overall.

August 30, 2017

Estate Planning Part II – When You’re Not Subject to Estate Tax

Just because you don’t have a taxable estate doesn’t mean that you shouldn’t do estate planning. If you die without an estate plan, then you die testate, meaning your assets will be divided up according to state law. Everyone needs some sort of an ...