Firm Management February 6, 2026

Wipfli Partners with The Caddie Network

Wipfli and The Caddie Network will bring to life the connection between elite caddies and trusted advisors.

Firm Management February 6, 2026

Wipfli and The Caddie Network will bring to life the connection between elite caddies and trusted advisors.

February 6, 2026

February 6, 2026

February 6, 2026

February 6, 2026

Staffing September 8, 2025

Professionals on the Move is a round-up of recent promotions, hires, and other staffing announcements from around the public accounting and accounting technology space.

Financial Reporting September 8, 2025

Despite this shift, just 35% report having comprehensive ERM processes in place, and only 32% rate their organization’s overall risk oversight as “mature” or “robust.”

Accounting September 8, 2025

New Illinois CPA Society research reveals readiness divide between early-career professionals and managers, with growing skills gaps fueling generational friction.

Firm Management September 8, 2025

Atlanta-based Bennett Thrasher was founded in 1980 by two accountants who left their corporate jobs to start a firm on their own.

Taxes September 5, 2025

In a letter, the Association of International Certified Professional Accountants requested guidance and made recommendations on the Pillar Two framework co-existing with U.S. tax rules for U.S. multinational enterprises in a side-by-side system to the OECD.

Payroll September 5, 2025

Job growth cooled notably last month while the unemployment rate rose to the highest since 2021, fanning concerns the labor market may be on the cusp of a more significant deterioration.

Technology September 5, 2025

Grant Thornton says the investment wil provide AI tools and technology to the entire workforce at its multinational professional services platform, which stretches from the Americas across Europe to the Middle East.

Payroll September 5, 2025

A new study from The Conference Board shows U.S. companies are planning to increase their salary budgets by an average of 3.4% in 2026—in line with 2025 reported increases.

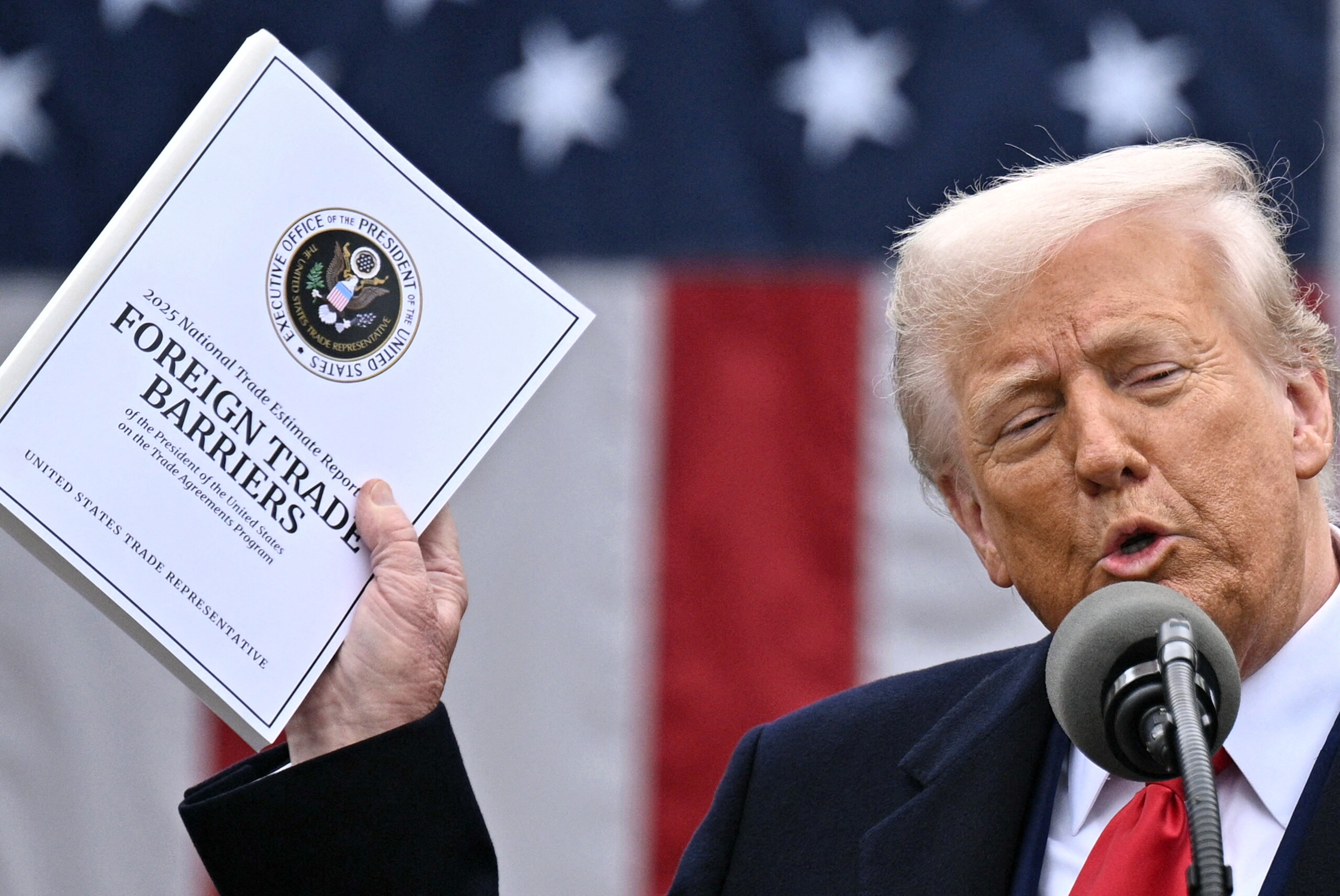

Taxes September 5, 2025

Donald Trump promised to slash red tape for business. His tariff regime has gotten American companies increasingly tangled up in it.

Auditing September 4, 2025

The Technology Innovation Alliance Working Group has provided the audit regulator with four recommendations on how it can proactively and strategically promote the use of technology in auditing.

Taxes September 4, 2025

The IRS has already shared the residential addresses of more than 40,000 foreigners with immigration authorities, who are seeking to have the confidential information of at least 1 million more people incorporated directly into their database.

Technology September 4, 2025

Threat prevention is an ongoing, ever-evolving process rather than a static, one-time effort. Accounting firms need to have a balanced approach to threat prevention—they must remain vigilant and invest in technology and people.