Accounting February 6, 2026

AICPA News – Feb. 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

Accounting February 6, 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

February 5, 2026

February 4, 2026

February 4, 2026

February 4, 2026

Taxes November 21, 2024

Fears of a vengeful Donald Trump caused dozens of House Democrats to rethink prior support for the legislation.

Small Business November 21, 2024

Credit card rewards would not be affected because those are determined by banks that issue cards, not the networks that process transactions.

Technology November 21, 2024

The Studio360 platform reduces system and data complexity and enables real-time insights for accounting and finance teams.

Small Business November 20, 2024

ATC for Lodging gathers, processes and organizes lodging tax data specifically for the lodging and hospitality industries – making it the ideal solution for organizations that require lodging tax content for tax calculations.

Firm Management November 20, 2024

Most firms are planning to raise fees across services by 5% or 10% due to rising business costs, according to the Ignition report.

Small Business November 20, 2024

The survey, which polled more than 275 executives across the public and private middle market, looks into the key trends, challenges and successes that businesses are set to experience in 2025.

Firm Management November 20, 2024

The combination expands the top 300 firm's presence into Bellevue, joining its three other offices in the state of Washington.

Small Business November 20, 2024

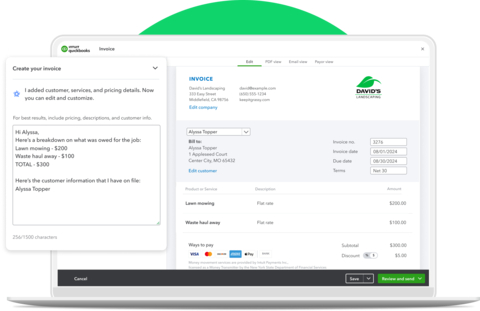

Intuit’s AI-driven expert platform is embedded in the company’s products, including QuickBooks, TurboTax, Credit Karma, and Mailchimp.

Small Business November 20, 2024

ADP and Fiserv will offer U.S.-based small businesses access to an integrated, all-in-one solution combining the full power of RUN Powered by ADP and the Clover small business management platform.

Technology November 20, 2024

Firms can use the free tool to price advisory services like tax planning and CFO support based on measurable client outcomes.

Firm Management November 20, 2024

Here's how reducing burnout can lead to higher-value clients and, thus, help to scale your accounting and/or tax business.

Accounting November 20, 2024

The CPA and CMA brands do more than strengthen the initial impression others will have of you. Achieving the right professional credential also builds your bench strength, or your ability to step in and tackle greater responsibilities.