Accounting February 6, 2026

AICPA News – Feb. 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

Accounting February 6, 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

February 5, 2026

February 4, 2026

February 4, 2026

February 4, 2026

February 14, 2021

The U.S. Department of Labor’s Employee Benefits Security Administration has confirmed that “Improving Investment Advice for Worker & Retirees,” an exemption for investment advice fiduciaries, will go into effect as scheduled on Feb. 16, 2021.

February 12, 2021

The ED aligns with the International Auditing and Assurance Standards Board’s (IAASB) quality management standards. The proposed standards include changes such as using the terms quality management and engagement quality review instead of quality ...

February 12, 2021

Thomson Reuters has launched a new tool that may be used to determine if an employer is eligible to take a tax credit for providing qualified leave wages for coronavirus (COVID-19) related reasons.

February 12, 2021

Commercial real estate overhead has never faced more scrutiny. While today’s highly agile workforce brings with it a newfound level of productivity, there are various impacts and considerations felt across a business.

![img-logo-marks-paneth[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2021/02/img_logo_marks_paneth_1_.6026b2fd00f4a.png)

February 12, 2021

The accounting, tax and advisory firm Marks Paneth LLP has launched the firm’s first annual Leadership Academy, a year-long comprehensive leadership program offered to supervisory-level staff and managers.

February 11, 2021

Instead of focusing on tax or audit, for example, scholarships are intended for students who are interested in financial strategy and creativity, automation, and accounting software implementation, as well as leveraging data to make informed decisions.

February 11, 2021

The FPA Pro Bono Program connects passionate financial planning practitioners to individuals, families and communities in need. In 2020, nearly 50 FPA chapters and more than 1,000 FPA members delivered 14,750 hours of pro bono financial advice.

February 11, 2021

While the 2020 survey saw employees purchase gifts, drinks and dinners, one of this year’s respondents admitted to expensing an engagement ring – a notable purchase as we approach Valentine’s Day.

February 10, 2021

The Bonadio Group’s 2021 survey of New York construction companies and contractors shows that while 43 percent of construction firms were forced to reduce their workforce in 2020 due to COVID-19 challenges, only nine percent plan on further reductions...

February 9, 2021

According to the International Accounting Bulletin’s January 2021 country surveys, Allinial Global once again ranks as the largest association in the United Kingdom in terms of fee income and total staff.

February 9, 2021

The Texas Society of CPAs (TXCPA) announced the recipients of the organization’s 2020-2021 academic scholarships. Each year, TXCPA’s Accounting Education Foundation honors Texas accounting students with scholarships for their academic achievements.

February 9, 2021

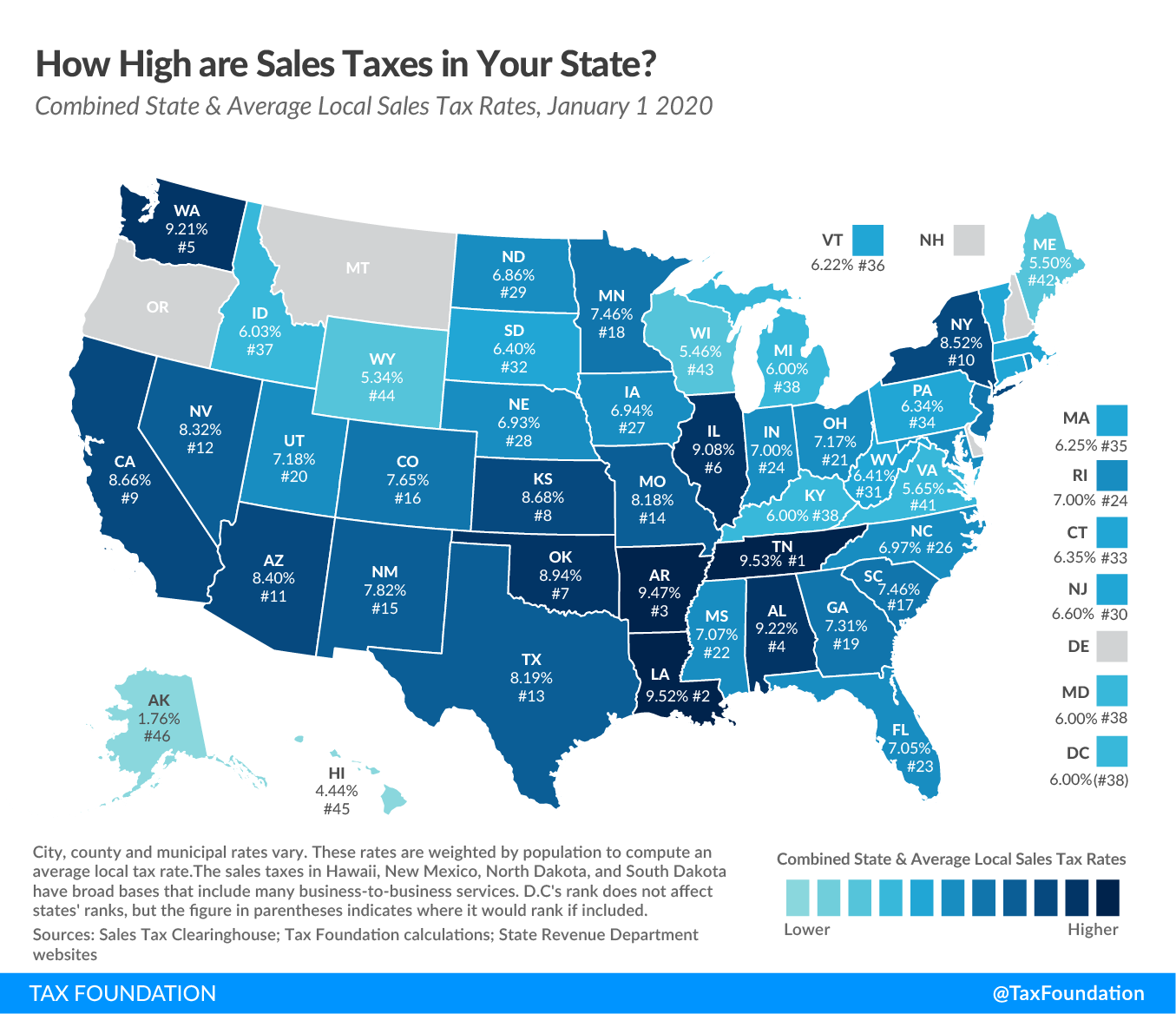

Vertex consistently tracks sales tax rates and rules and produces detailed mid-year and end-of-year reports featuring tax data over a 10-year period. These reports are widely referenced by industry groups and indirect tax think tanks.