Accounting February 6, 2026

AICPA News – Feb. 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

Accounting February 6, 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

February 5, 2026

February 4, 2026

February 4, 2026

February 4, 2026

![NJCPA[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/04/NJCPA_1_.5ea6f8a551272.png)

April 27, 2020

More than 220 high school and college accounting students applied for the awards, with students from Rutgers University, The College of New Jersey and Seton Hall topping the list of college recipients.

April 27, 2020

The series will focus on a variety of issues, from corporate planning in an evolving accounting ecosystem to diversity within the profession. Leaders from both Thomson Reuters and PrimeGlobal will participate in a series of virtual events highlighting ...

April 26, 2020

As of April 17, 2020, the IRS reported that 115,961,000 individuals had filed their 2019 tax returns, compared to 137,233,000 returns filed for 2018 by April 19, 2019. That is 21,272,000 less— a drop-off of 15.5%.

April 25, 2020

Supplemental Security Income and Department of Veterans Affairs beneficiaries need to act by May 5 if they didn’t file a tax return in 2018 or 2019 and have dependents so they can quickly receive the full amount of their Economic Impact Payment.

April 24, 2020

As the COVID-19 pandemic has strained the U.S. economy and put millions out of work, Americans have experienced the biggest drop in their personal financial satisfaction in more than a decade.

April 24, 2020

Under the Coronavirus Aid, Relief and Economic Security (CARES) Act that was signed into law on March 27, 2020, businesses may delay paying the employer portion of the Social Security payroll taxes on wages paid for the period from ...

April 24, 2020

Firms that already had at least one cloud system in place prior to the COVID-19 pandemic fared far better than firms that did not have any cloud systems in place.

April 24, 2020

The final bill includes $320 billion to make new loans under the Paycheck Protection Program, which provides forgivable loans to small business that keep employees on the payroll for eight weeks. The measure includes $60 billion in EIDL.

April 23, 2020

As the country works to navigate changes in federal and state tax filing and payment deadlines as a result of the global coronavirus pandemic, the American Institute of CPAs (AICPA) is providing recommendations for administrative, filing and payment ...

April 23, 2020

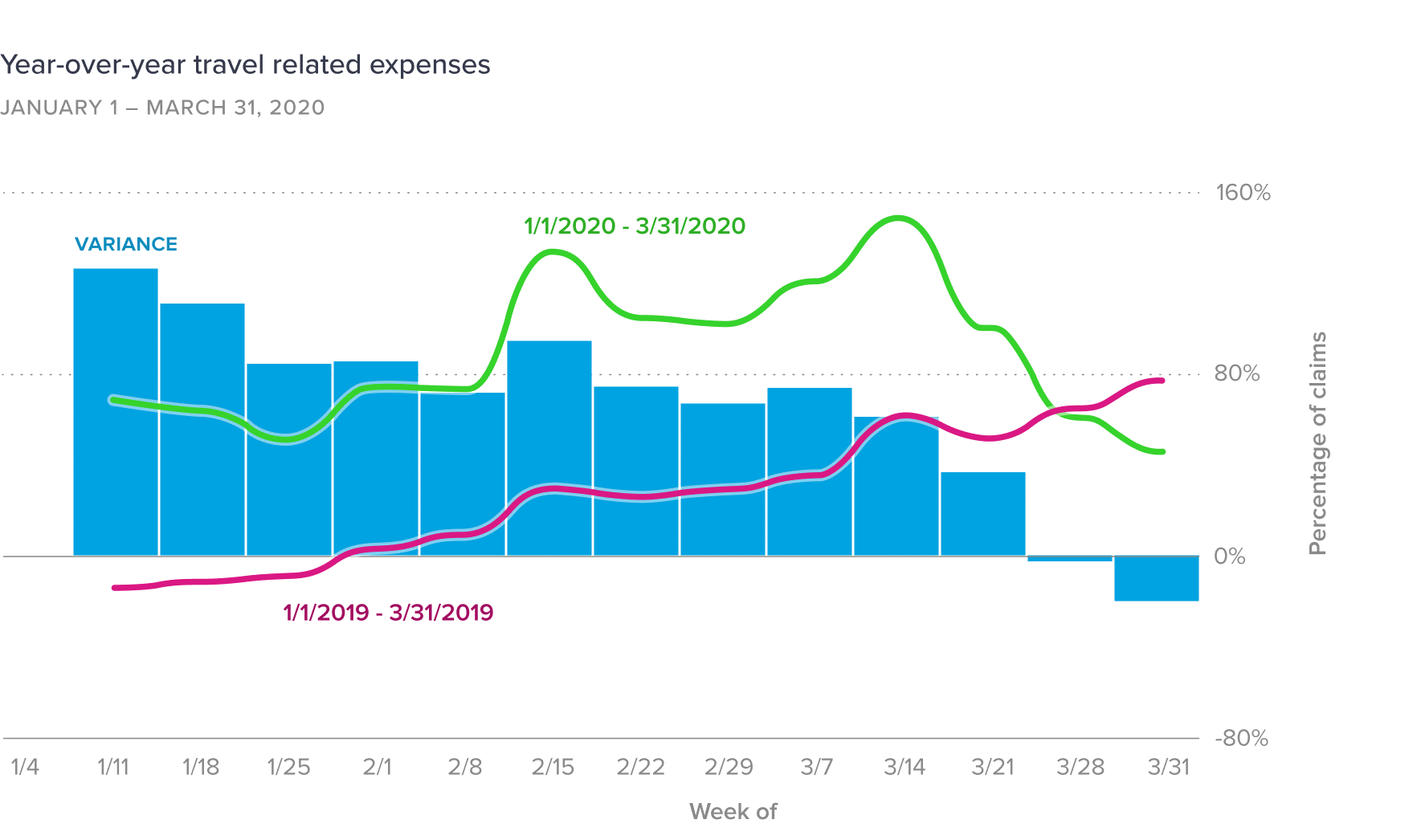

Business travel and entertainment have come to a standstill. Many companies have switched almost entirely to working from home to enforce social distancing or comply with mandatory shelter-in-place mandates.

April 23, 2020

The AICPA, after discussions with its coalition partners, and key banking leaders and stakeholders, is working to drive a common understanding and approach around the firm – lender relationship related to the implementation of the PPP.

April 23, 2020

The new cash application engine includes many new features that enable accounting, finance and operations teams to automatically identify, import and match unapplied payments with invoices, balances and customers.