Accounting February 6, 2026

AICPA News – Feb. 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

Accounting February 6, 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

February 5, 2026

February 4, 2026

February 4, 2026

February 4, 2026

April 8, 2020

In this emergency action, the CPA Endowment Fund of Illinois is awarding 16 laptops for students at nine Illinois schools, including DePaul University, Governors State University, Illinois State University, Loyola University, Northeastern Illinois ...

April 8, 2020

The rapid spread of COVID-19 across the globe has created large-scale economic distress and halted the mechanisms of exchange and business activity–leaving an extensive trail of damage to the world’s economic infrastructure. Governments and legislators reacted immediately with relief packages. They likely will continue to make additional economic adjustments to stabilize the weakening economy by...…

April 7, 2020

Learn how a thriving NetSuite Business Process Outsourcing Partner graduated from providing onsite accounting services to an outsourced, cloud-based accounting model to best support their clients.

April 7, 2020

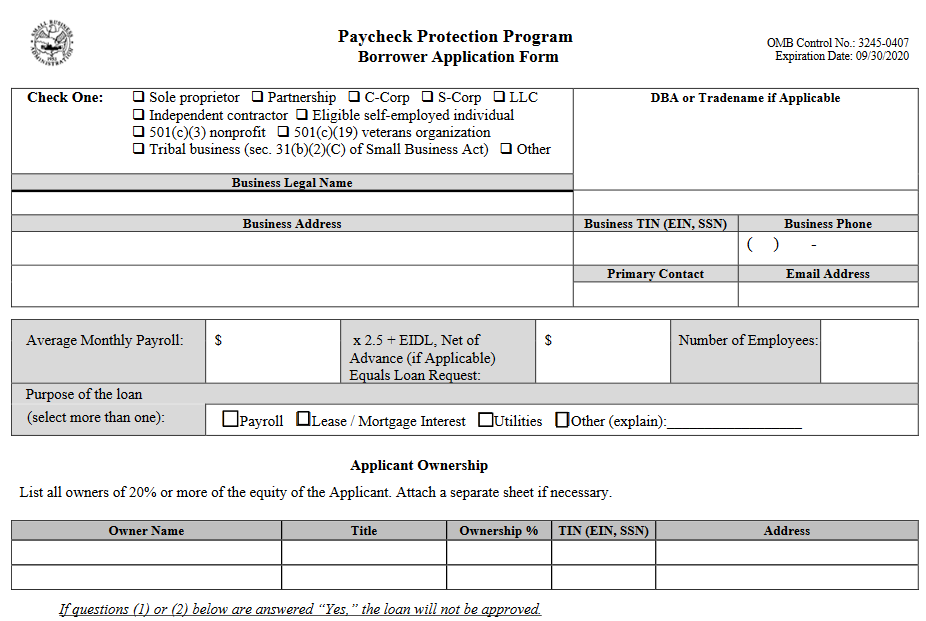

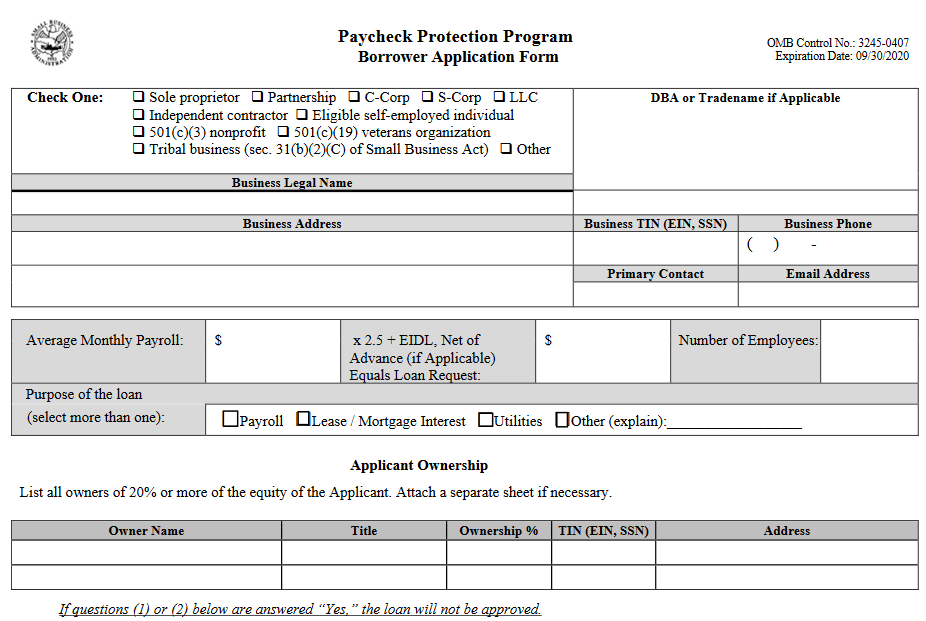

The American Institute of CPAs (AICPA) is thanking the Treasury Department and Small Business Administration (SBA) for providing further clarity on the application process for the Paycheck Protection Program (PPP), the $349 billion small business ...

April 7, 2020

The American Institute of CPAs (AICPA) has recommended a defined set of documents for lenders to rely on as well as some key clarifications in the Treasury Department and Small Business Administration’s Paycheck Protection Program (PPP) application ...

April 6, 2020

Paycheck Protection loans, which are provided through SBA-approved lenders, are available to small business borrowers to cover payroll and other operating costs. Included among the application requirements is specific documentation related to payroll.

April 6, 2020

The federal Coronavirus Aid, Relief and Economic Security (CARES) Act includes the Paycheck Protection Program (PPP) to help more than 30 million U.S small businesses. The program offers $349 billion in loans to businesses and nonprofits with no more ...

April 5, 2020

For the calculation of the Average Monthly Payroll cost under the Paycheck Protection Program (PPP), the Gross Payroll approach should be used for the application, according to the recommendation from the AICPA-led small business funding coalition.

April 4, 2020

The Department of the Treasury (Treasury) announced on April 1 that Social Security beneficiaries who are not typically required to file tax returns will not need to file an abbreviated tax return to receive an economic impact payment.

April 4, 2020

Assisting an attest client with a COVID-19 PPP loan application is a nonattest service. If CPAs comply with the interpretations of the Nonattest Services subtopic, independence will not be impaired.

April 3, 2020

The $349 billion PPP program focuses on small businesses impacted by the coronavirus pandemic. Basically, it offers any eligible business or charitable nonprofit with less than 500 employees a grant of up to $10 million, if the business keeps its workforc

April 3, 2020

Downloadable PDF of the Small Business Administration's Paycheck Protection Program borrower application form. For use by small businesses requesting Coronavirus relief loans from the SBA.