Accounting February 6, 2026

AICPA News – Feb. 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

Accounting February 6, 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

February 5, 2026

February 4, 2026

February 4, 2026

February 4, 2026

July 24, 2019

Doc.It Connect is a secure portal site that allows accounting firms and clients to share, sign, and manage financial statements, tax returns, invoices, reports, and other documents. Firms implement the Connect portal to drastically reduce the number of hours spent on routine tasks, such as pursuing client files, transferring email attachments and chasing signatures on...…

![HEROAccountantConnect4552x[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2022/07/34263/HEROAccountantConnect4552x_1_.5d2b80f522033.png)

July 24, 2019

ADP’s Accountant Connect continues to evolve from input from our advisors, industry leaders and workplace innovations. A free cloud-based, mobile-friendly platform, it connects accountants to their ADP clients’ payroll data, industry-leading practice management tools and tax resources, industry market research reports and more. In the fall of 2018, ADP greatly enhanced Accountant Connect by adding...…

July 24, 2019

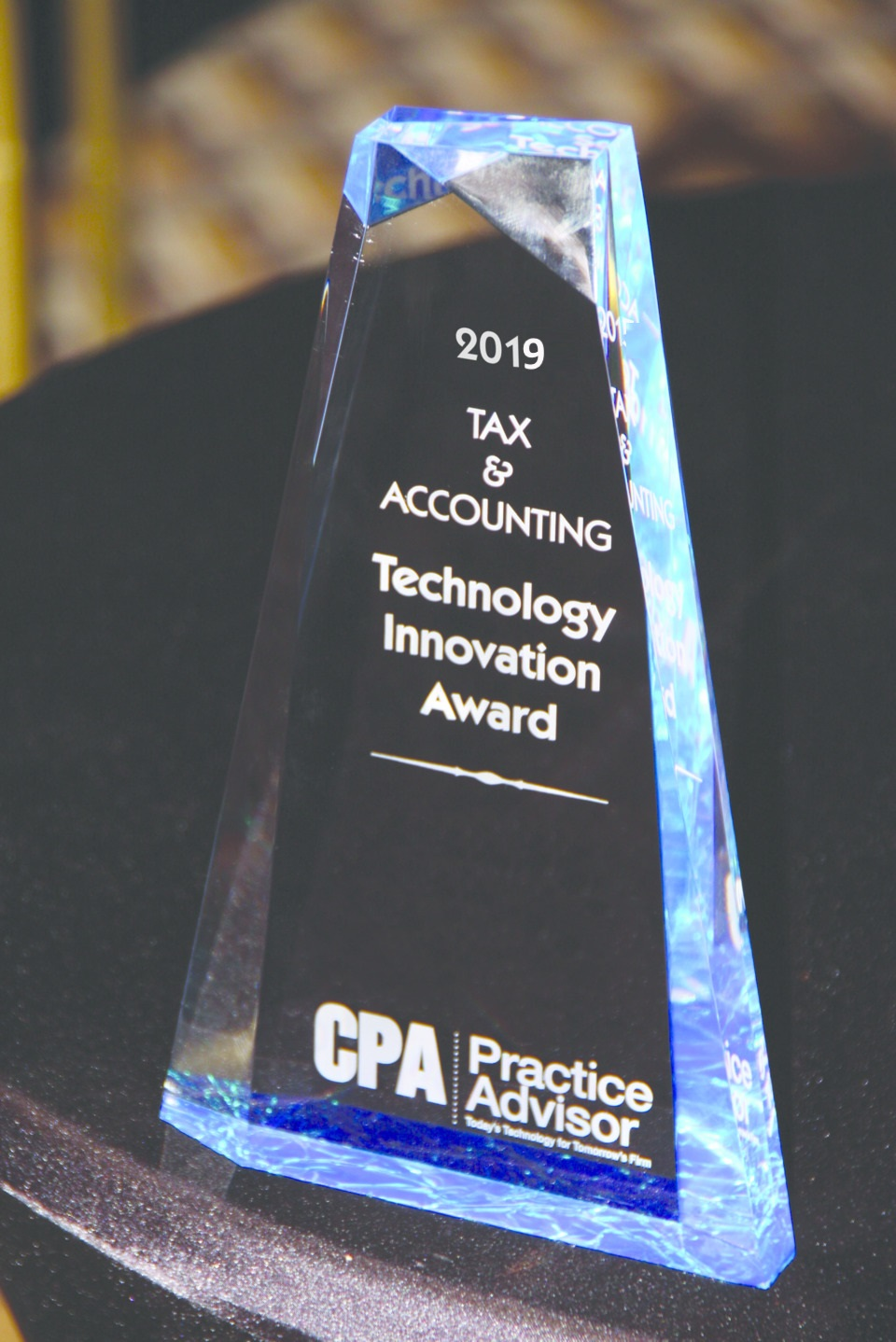

The Tax & Accounting Technology Innovation Awards honor new technologies that help accounting firms and their small business clients operate more efficiently and profitably through improved workflow, increased accessibility, or enhanced collaboration.

![k50Rz55m_1_.593ee8ac31030[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2022/07/34325/k50Rz55m_1_.593ee8ac31030_1_.5d2f462fe5a3a.png)

July 24, 2019

AuditFile is a complete, cloud-based all-in-one audit automation platform for public accounting professionals that scales to meet the specific needs of firms of all sizes and specialties. The Company continues to deliver on its mission of delivering a sophisticated tool set that helps practitioners improve the efficiency of the audit process and productivity of the...…

July 24, 2019

The travel industry is dynamic with transactions increasingly completed online and any room booking requires hotel or lodging taxes. For operators of hotels & motels, online booking services, resorts, vacation rentals, Airbnb’s, timeshares or any other type of accommodations, calculating and remitting the correct hotel taxes is a critical part of the process. For accounting...…

July 24, 2019

Bill.com delivers financial process efficiency and greater control to accounting firms and clients through streamlined and automated AP and AR management. The Inbox Virtual Assistant (IVA), AI built into Bill.com, automatically extracts data from invoices including vendor name, invoice number, invoice date, due date, and amount due and creates bills in real-time. It then notifies...…

July 24, 2019

The significant changes made to the U.S. tax code in 2018 due to tax reform touches on virtually every area of taxation, including estate and trust planning. So, in order for today’s leading organizations to stay ahead, they needed a comprehensive research platform to transform current tax law into actionable plans for their clients. The...…

July 24, 2019

Depreciation Calculator calculates depreciation for tax and financial purposes for use in small to medium sized CPA firms and companies and is affordably priced. Annual updates are issued to update the program to include any changes made in the tax laws relative to fixed asset depreciation. The program includes the changes made by the TCJA....…

July 24, 2019

CPApp (pronounced “C-P-App”) was designed to consolidate all those separate software packages, Excel docs, stick-it notes and vague recollections you use to run your accounting firm. We accomplish this by offering a central piece of online software that does everything an accounting firm needs. Client information is entered once and syncs throughout the software to...…

July 24, 2019

ExpensifyApproved! University provides free, all-in-one Expensify training for any accountant or bookkeeper. The program engages learners of all levels with in-depth instructional articles, visual product walkthroughs, and interactive review questions. The curriculum covers critical Expensify terms, accountant-friendly product functionality, and client management best practices. Self-led training like ExpensifyApproved! University is essential for accountants on a...…

July 24, 2019

Treehouse has the ability to capture information at the lowest SPV level, and tier up such information (via pro-rata allocations, special allocations, IRC Section 704(c) amounts, and GP promote allocations) to a diverse investor base including public and private REITs, foreign investors and sovereigns, tax exempt investors, and taxable investors. Client general ledger data integration...…

July 24, 2019

Prep for taxes replaces the old ‘trial balance’ functionality with a reimagined seamless experience of preparing and filing year end taxes. Before, trial balance helped you find issues in your client’s books and assisted in mapping the books to the tax return. The old experience was a digital replication of the even older physical, ledger...…