Accounting February 6, 2026

AICPA News – Feb. 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

Accounting February 6, 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

February 5, 2026

February 4, 2026

February 4, 2026

February 4, 2026

June 30, 2015

Example disclosure topics include food safety, labeling & marketing integrity, climate change adaptation, and supply chain management. The standards average six topics per industry, and 71 percent of metrics are quantitative.

June 30, 2015

Results also show that employees are price-conscious while traveling on the company dime, with the majority sticking to the same diet (40%) or indulging a little (35%) and very few saying they took advantage of the company expense account (3%).

June 29, 2015

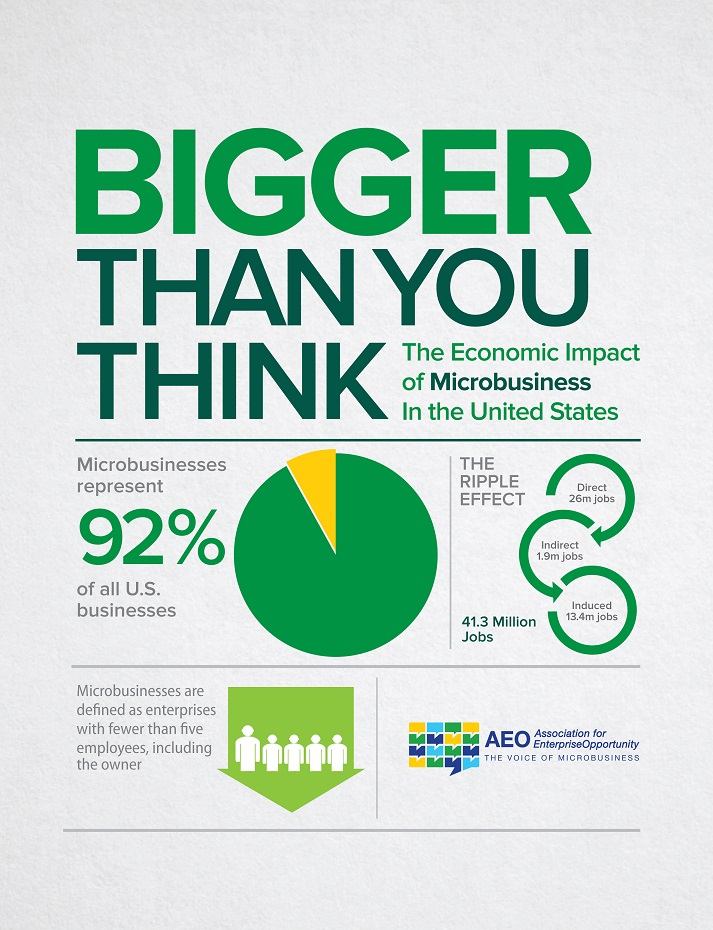

Finding, and securing, these owners as clients is a matter of doing what accountants have done since day one. Exchange referrals with your current clients, attend public networking events, join LinkedIn groups to participate in conversations, and ...

June 29, 2015

Infinitely Virtual recently released several new products this past spring and solidified its position among the fastest growing cloud server providers, according to Host Review. In early June, the company released InfiniteApp QuickBooks.

June 28, 2015

Imagine this: You've found the perfect business idea, one that seems to add up from every angle and couldn't be better for you and your future plans. The only problem is that you don't have the capital to open the doors.

June 27, 2015

A contributing factor to the emotional impact of financial fraud or abuse is how often this situation involves family members. The most common types of elder financial abuse or fraud seen by CPA financial planners over the past five years were ...

June 26, 2015

The new guide, available as an eBook and in print format, was written to assist CPAs in interpreting and applying SSARS No. 21, as well as to provide interpretative guidance and implementation strategies for all preparation, compilation and ...

June 25, 2015

Most business executives said their companies are not yet planning on shifting their allocation of cash due to regulatory changes next year that may make it harder to put cash in institutional money-market funds as a short-term tactic to ensure liquidity.

June 25, 2015

FBAR refers to Form 114, Report of Foreign Bank and Financial Accounts, which must be filed with the Financial Crimes Enforcement Network (FinCEN), a bureau of the Treasury Department. It is not a tax form and cannot be filed with the IRS.

June 25, 2015

Scholarship recipients are proposed by BKR member firms in each of three designated regions and are then approved by the Worldwide Board.

June 24, 2015

The majority of CFOs plan to take on more strategic leadership roles (69 percent) and cite a culture of analytics as a key competitive advantage in today’s business climate (56 percent).

June 23, 2015

The American Institute of CPAs (AICPA) offered more than 40 recommendations to the Internal Revenue Service (IRS) last week for the Form 990, Return of Organization Exempt from Income Tax, and instructions.