Accounting February 6, 2026

AICPA News – Feb. 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

Accounting February 6, 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

February 5, 2026

February 4, 2026

February 4, 2026

February 4, 2026

August 29, 2014

State tax collections fell short of expectations by $281 million last year, providing potential difficulties in the future for the state budget and immediate fodder for this fall's tight governor's race.

August 28, 2014

In the Florida Keys, mosquitoes are a major nuisance, and one big enough that it apparently requires local government involvement in fight against the little blood-sucking fiends. Unlike many municipal positions, however, in the Keys this race is partisan.

August 27, 2014

Unhappy with the choices her insurance broker was offering, Denver publishing company owner Rebecca Askew went to Colorado's small business health insurance exchange last fall. She found exactly what she'd been hoping for: affordable insurance options tailored to the diverse needs of her 12 employees.

August 27, 2014

The Center for Audit Quality (CAQ) has released the Professional Judgment Resource, a guide designed to provide auditors with an example of a decision-making process to facilitate important auditing and accounting judgments in a professionally skeptical manner.

August 26, 2014

A new accounting firm case study examines the challenge of "over-auditing," and the effects it can have on efficiency.

August 26, 2014

As with domestic travel (i.e., travel within the 50 U.S. states and the District of Columbia), you can deduct all of your travel expenses if the trip is entirely for business purposes. Otherwise, you’re entitled to travel deductions only if the primary purpose of the trip is business-related. Again, the days spent on business versus…

August 25, 2014

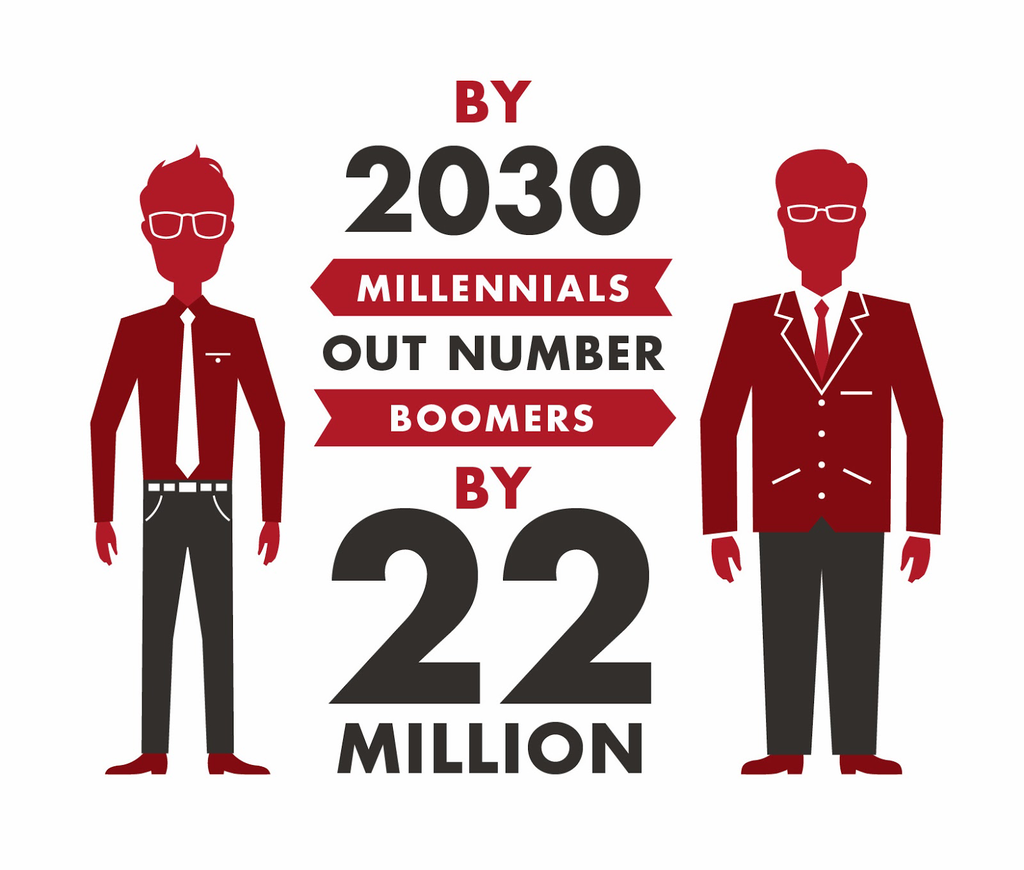

TD Bank survey finds most millennials wish they were better prepared for life events.

August 25, 2014

The bipartisan-approved program, adopted in October 2011, was a way to help small businesses stymied by the credit gap that dragged on after the 2008 recession, when banks were not lending.

August 25, 2014

Kansas Secretary of Revenue Nick Jordan told Wichita Republicans Friday that the state's system for giving sales tax exemptions to charities is too political -- and politics will probably keep it from getting changed.

August 25, 2014

It is well-known in tax circles that taxpayers can deduct the cost of traveling “away from home” on business. For this purpose, your tax home is usually your principal place of business. As an example, if you live and work in New York and fly to L.A. for a two-day whirlwind of business negotiations, the…

August 22, 2014

Business continues to slump for Las Vegas homebuilders. Local developers sold 499 new homes last month, down 23 percent from July 2013, according to a report out today from Las Vegas-based Home Builders Research.

August 22, 2014

Google Maps Business View allows people to step inside and tour a building without leaving their home. The virtual tour, an extension of Google Maps Street View, gives business owners the ability to showcase their space online with 360-degree panoramas and close-up photos.