Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Taxes July 11, 2025

The IRS said July 7 in a Texas court filing that churches and other religious nonprofits can make political endorsements to their congregations without endangering their tax-exempt status

Taxes July 10, 2025

The IRS has nixed 83 pieces of older guidance considered obsolete as part of the Trump administration's push to reduce regulations that are considered burdensome, outdated, expensive, or unnecessary.

Taxes July 9, 2025

A new court filing reinterprets a longstanding tax law, signaling that houses of worship may now be able to endorse political candidates without losing their tax-exempt status as nonprofit organizations.

Taxes July 9, 2025

U.S. Rep. Emilia Sykes (D-OH) introduced legislation on July 9 called the “Get Your Money Back Act" to secure the future of the Direct File tax filing program and require that all states make it available to their residents.

Payroll July 8, 2025

Justices let President Trump move ahead with plans to dramatically reduce the size of the federal government, lifting a court order that had blocked several departments and agencies, including the IRS, from slashing their workforces.

IRS July 8, 2025

Now in its 10th year, the campaign is part of a larger effort by the Security Summit coalition—which includes the IRS, state tax agencies, and the nation’s tax community—to help practitioners combat tax-related identity theft.

Taxes July 4, 2025

President Donald Trump held an outdoor signing ceremony at the White House on Friday, formally enacting a major tax and spending bill that passed through the Senate and House earlier in the week.

Income Tax July 3, 2025

The adoption of an electronic system for federal disbursements and receipts would increase efficiency, reduce costs, and significantly diminish the occurrence of lost or stolen checks.

AICPA July 1, 2025

The U.S. Senate passed its reconciliation bill earlier today, which removes the limit on pass-through businesses’ state and local tax (SALT) deductions entirely, generating optimism for those affected businesses.

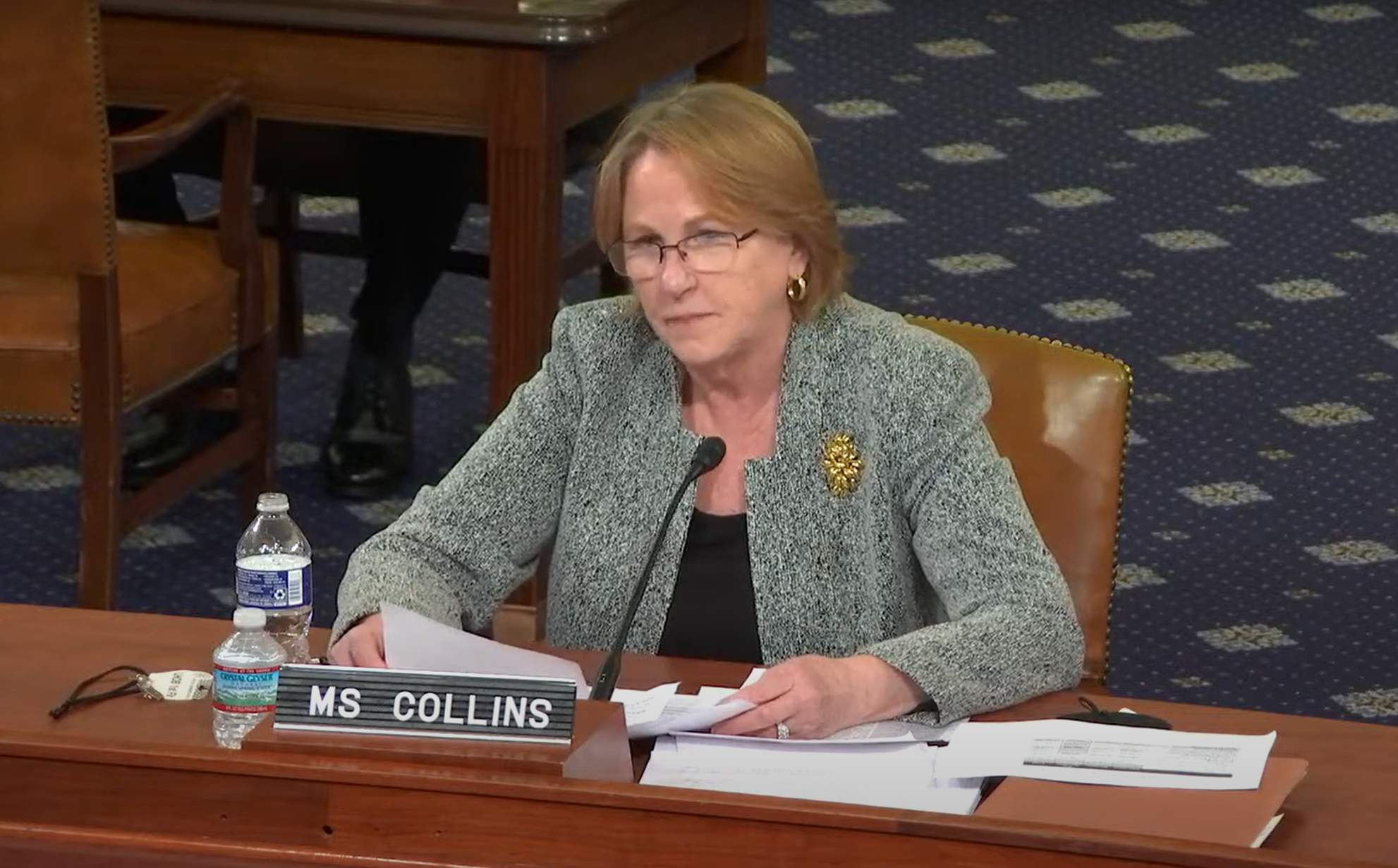

Taxes June 25, 2025

Despite calling this past tax filing season one of the most successful in recent memory, National Taxpayer Advocate Erin Collins warned there are potential risks heading into the 2026 tax season and that "it is critical that the IRS begin to take steps now to prepare."

Taxes June 25, 2025

The agency said it's aware of a delay in processing some electronic payments and that some taxpayers are receiving IRS notices indicating a balance due even though payments were made on time.

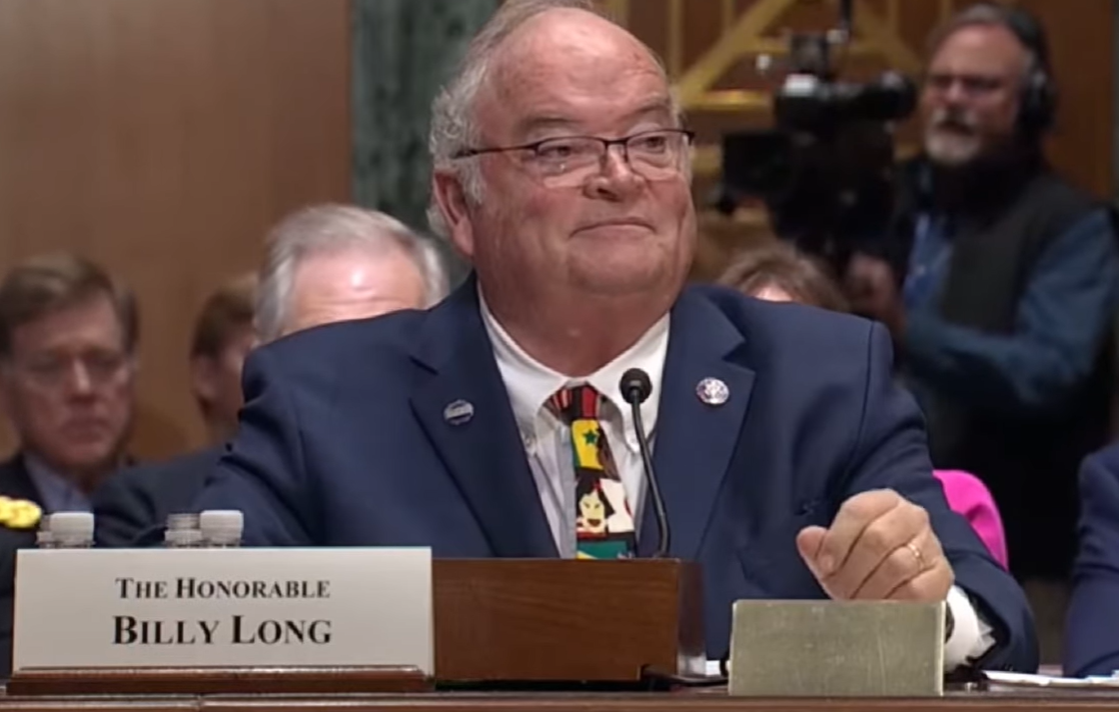

IRS June 23, 2025

The former Missouri lawmaker, who was sworn in on June 16, said transforming the culture at the tax agency is at the top of his to-do list.