Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

December 17, 2013

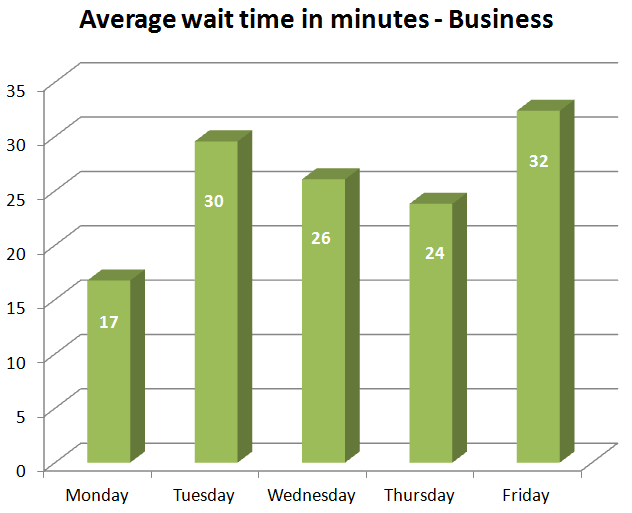

Anyone who has ever tried to call the Internal Revenue Service knows what to expect first ... a wait. Sometimes a really long one. For tax professionals who need to reach the IRS more frequently, this can be a waste of precious time and productivity.

December 12, 2013

Thomson Reuters Checkpoint Releases Special Report for Tax Professionals on New Capitalization Regulations

December 10, 2013

Report says the IRS needs to do more to prevent fraud committed using stolen EINs.

December 3, 2013

Like most practitioners, I had trouble successfully billing for post-filing work. The reasons are complicated. It’s often an issue of back-and-forth time with clients or the IRS/state taxing authorities.

December 1, 2013

This proposed guidance defines the term “candidate-related political activity,” and if accepted, would amend current regulations by indicating that the promotion of social welfare does not include this type of activity.

November 21, 2013

The Treasury Department agency tasked with overseeing the Internal Revenue Service has issued a report saying that the nation's taxing authority needs to do a better job of tracking its efforts to eliminate identified flaws in the security of systems involving taxpayer data.

November 20, 2013

Must know tax advice for 2013

November 19, 2013

The American Institute of CPAs (AICPA) sent a letter to the Internal Revenue Service (IRS) and Department of the Treasury on Nov. 18 urging that the IRS, as soon as possible, announce the contingency plan that would be in effect in the event of a government shutdown on Jan. 16.

November 19, 2013

The Internal Revenue Service (IRS) needs to improve its use of return on investment (ROI) data in managing tax enforcement resources, according to a report publicly released today by the Treasury Inspector General for Tax Administration.

November 18, 2013

One of Oklahoma's Representatives in the U.S. Congress, Jim Bridenstine, has filed legislation that could lead to repeal of the 16th Amendment to the U.S. Constitution -- the amendment enabling the current federal income tax.

November 14, 2013

IRS targets US taxpayers with offshore bank accounts in the Caribbean

November 11, 2013

A sophisticated phone scam is sweeping the country, using fear of the Internal Revenue Service to target recent immigrants and others, IRS officials warn.