Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Taxes June 23, 2025

Victims of severe storms that produced flooding and damaging winds in areas of Texas and Mississippi in mid- to late March have more time to file various federal individual and business tax returns and make tax payments, the IRS said.

Taxes June 23, 2025

Improvements made to the IRS Pre-Filing Agreement program will provide greater tax certainty for large business and international taxpayers, the agency announced on June 17.

IRS June 16, 2025

Probationary employees' jobs were in limbo for weeks. Meanwhile, many IRS workers across the agency are looking to leave.

IRS June 12, 2025

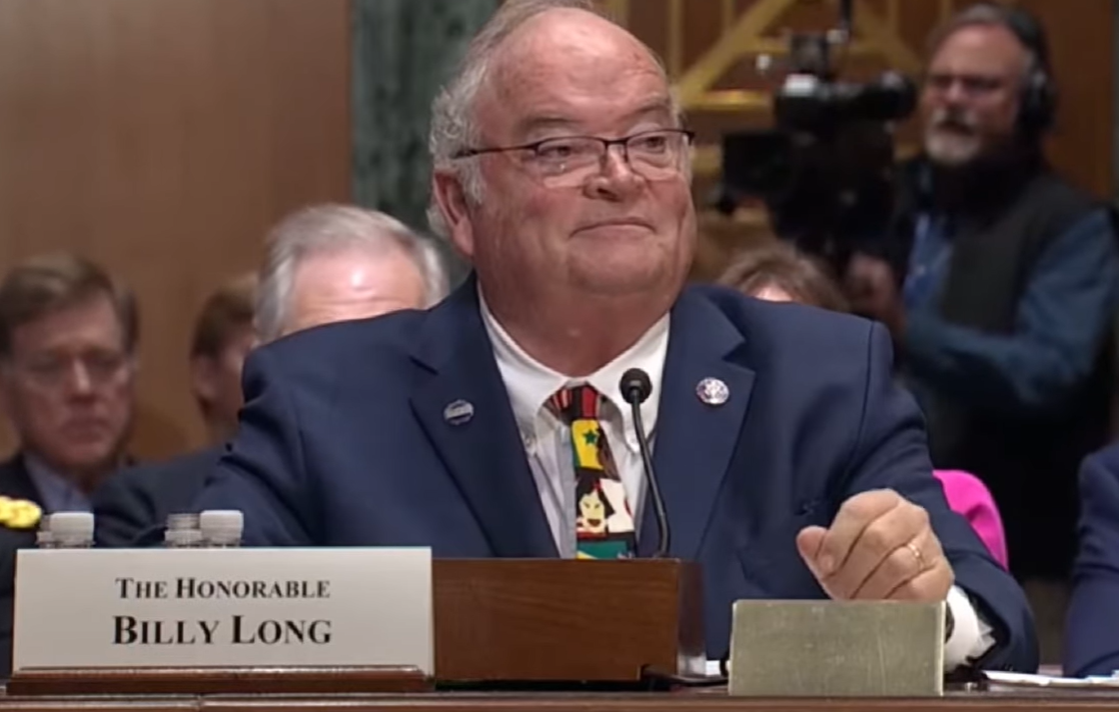

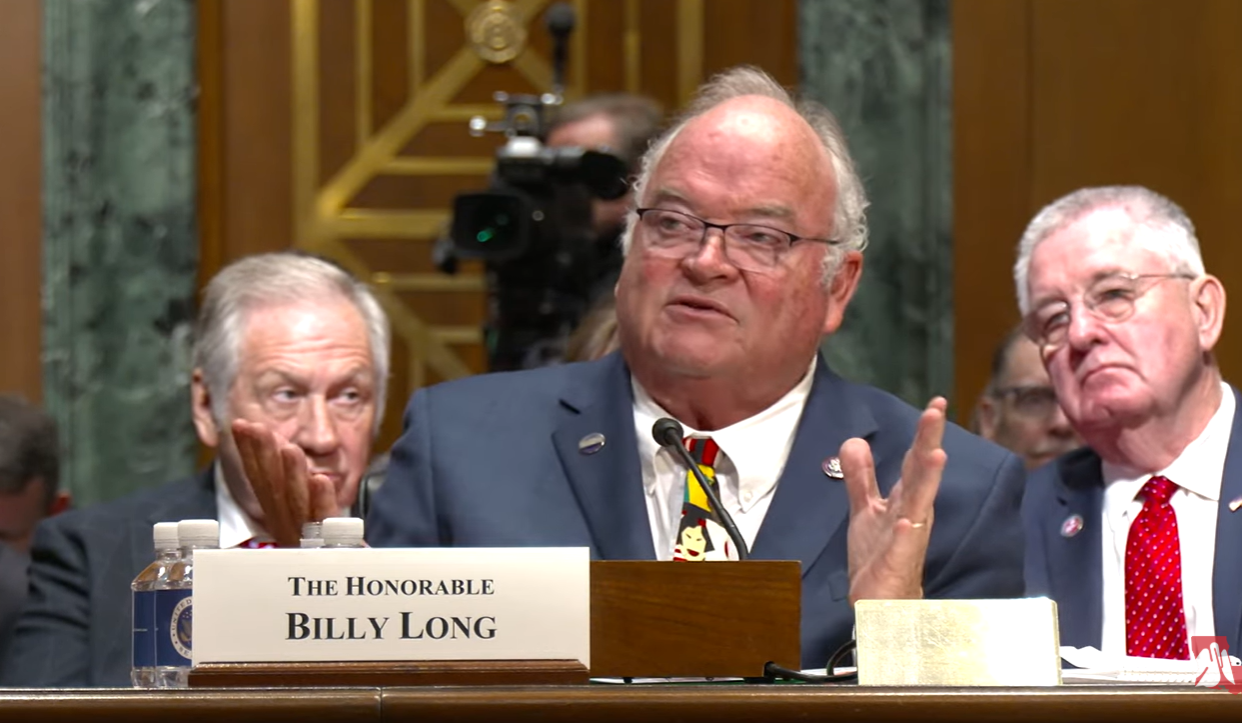

The former Missouri lawmaker won confirmation on June 12 to be the next commissioner of the IRS, leading an agency that will play a key role in administering new tax breaks if Congress passes the “big, beautiful” reconciliation package.

IRS June 12, 2025

A coalition representing tax professionals urged the Treasury Department in a letter to take immediate steps to preserve core IRS functions—for both taxpayers and practitioners—amid workforce reductions at the tax agency.

IRS June 11, 2025

Danny Werfel, who served as IRS commissioner during the Biden administration, has joined the strategic advisory board of alliant, a Houston-based professional services and consulting firm formerly known as alliantgroup.

Taxes June 10, 2025

A company that sells automobiles through an auction house claimed a software glitch outside of its control led to the non-filing of Form 8300. Did the Tax Court give the company a pass?

Taxes June 10, 2025

Those impacted by the wildfires that destroyed at least 530 homes and businesses in parts of Oklahoma last March will now have until Nov. 3, 2025, to file various federal individual and business tax returns and make tax payments.

Taxes June 5, 2025

The IRS just released its annual “Data Book” providing vital information about the agency’s activities for its 2024 fiscal year (FY2024) spanning October 1, 2023, through September 30, 2024 .

Taxes June 4, 2025

The Senate Finance Committee voted along party lines on June 3 to approve President Donald Trump’s nomination of former Missouri Rep. Billy Long to lead the IRS over the objections of Democrats.

Taxes June 3, 2025

The IRS completed a "successful 2025 filing season" with 87% of taxpayer phone calls answered by customer service representatives and average wait times of three minutes, the agency said last week, despite workforce reductions and leadership changes that have put the IRS at times in a state of turmoil.

Taxes June 2, 2025

Frank Santucci Sr., owner of Santucci’s Original Square Pizza, agreed to plead to two counts of tax evasion and two counts of filing false tax returns for failing to pay nearly $375,000 in taxes, federal court records show.