Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

IRS April 16, 2025

About one-fifth of the IRS workforce has requested to take an offer through the second deferred resignation program to be put on paid administrative leave through the end of September.

IRS April 16, 2025

Monday was the last day for IRS workers to upload their resumes, so agency leaders could determine their qualifications, which they were instructed to do earlier this month as part of a planned reduction in their workforce.

IRS April 15, 2025

Rajiv Uppal, who has served as CIO since January 2024, is leaving the agency, adding to the growing list of IRS leaders who are planning their exits as a result of the Trump administration's plan to reduce the federal workforce.

Taxes April 15, 2025

According to the Institute on Taxation and Economic Policy, undocumented taxpayers contributed an estimated $8.5 billion in state and local taxes in California in 2022, more than in any other state.

Taxes April 15, 2025

Through April 4—the latest date currently available—the IRS has issued 67,745,000 refunds, roughly 1.4% more than the 66,799,000 that had been issued by that time last year.

Taxes April 15, 2025

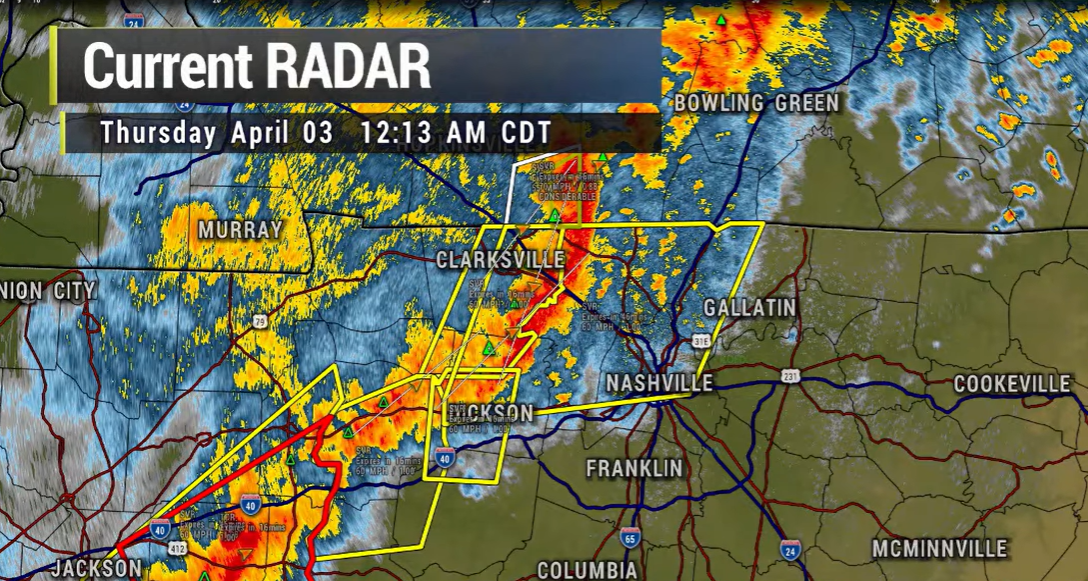

The same early April severe storm that caused the IRS to extend the federal tax filing deadline for the entire state of Tennessee on Monday will also give all of Arkansas a Tax Day reprieve.

Taxes April 15, 2025

New legislation proposed by Sen. Joni Ernst (R-IA), called the "Audit the IRS Act," is aimed at ensuring that IRS employees are up to date with their taxes.

Taxes April 14, 2025

As a result of the severe storms, which included tornados and flooding, that began on April 2, taxpayers now have until Nov. 3 to file various individual and business tax returns and make tax payments.

IRS April 11, 2025

Thousands of newer IRS workers—told to return to their jobs on April 14 after being laid off by the Trump administration in February but reinstated and put on paid administrative leave in March—will remain on leave after two court decisions this week paused plans to bring them back to the office.

Taxes April 11, 2025

Tax season is when some consumers learn they were fraudulently enrolled in an Affordable Care Act plan or switched to a different one without their knowledge.

Taxes April 11, 2025

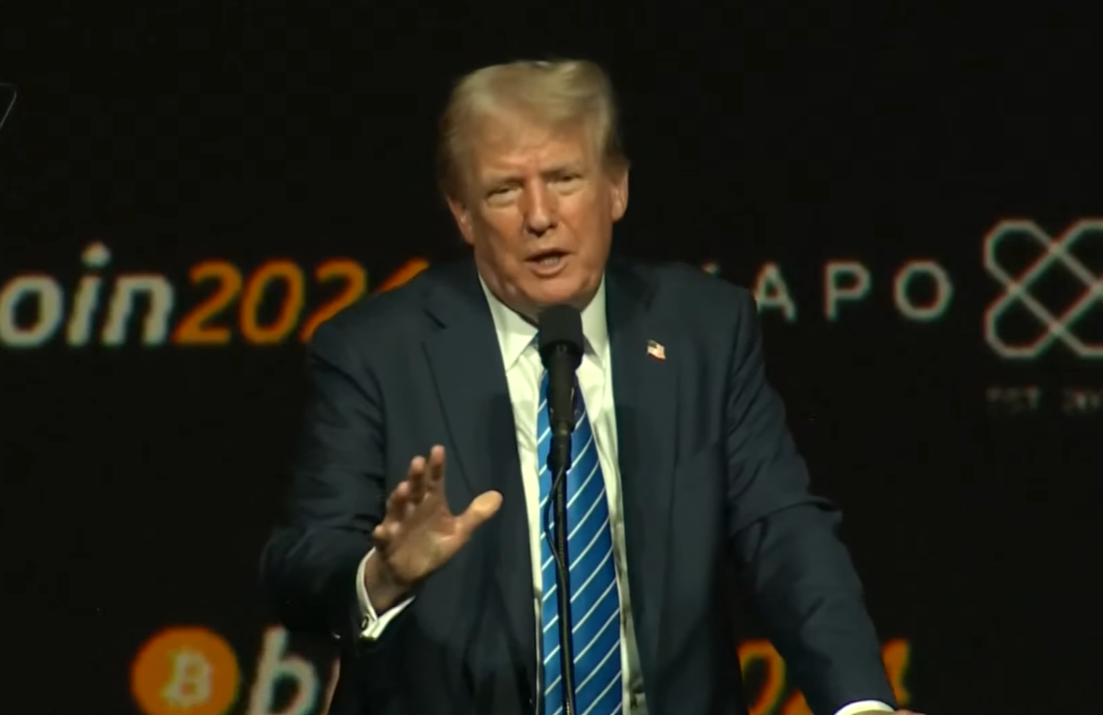

President Donald Trump signed legislation to block an IRS rule that would have forced some cryptocurrency brokers to provide tax information on transactions conducted on their platforms.

Taxes April 10, 2025

The IRS is at risk of losing an estimated $313.3 billion in revenue over the next 10 years as undocumented immigrants could become less likely to file taxes if they fear their tax information could be used to deport them.