Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Taxes February 19, 2025

As it has become a more common asset among your average investors, these folks have had many questions about the tax implications of investing in cryptocurrency, or virtual currency, as it is also known. The answers can be somewhat complicated.

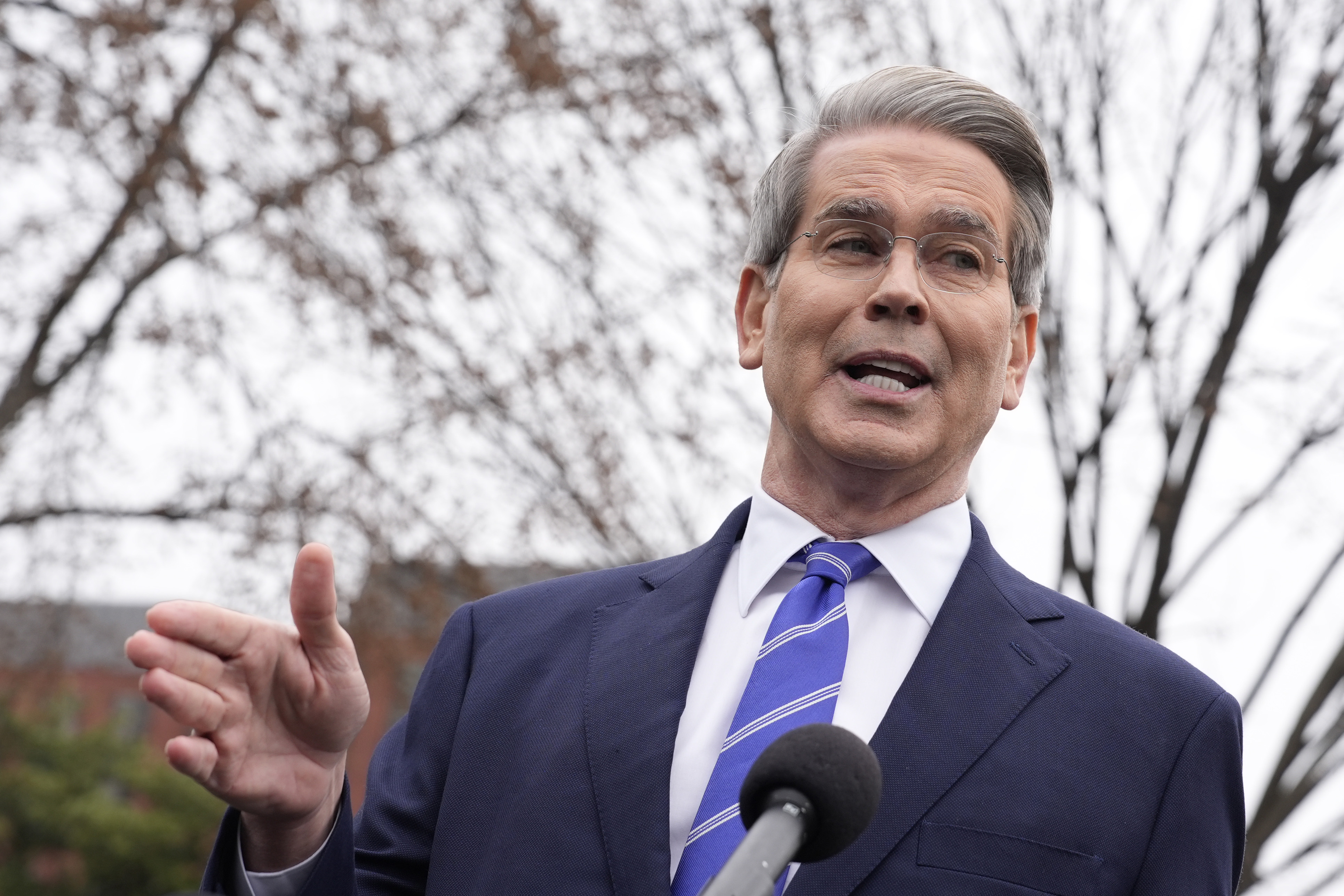

IRS February 18, 2025

Treasury Secretary Scott Bessent said Americans “don’t have to be concerned about any of this,” referring to attempts by the DOGE team to access a broad range of taxpayer data, including on individuals.

Taxes February 17, 2025

Secretary of Defense Pete Hegseth accused former President Joe Biden’s administration of rushing an IRS audit into him in a post to social media platform X on Monday.

IRS February 17, 2025

The IRS is poised to hand over unlimited access to taxpayer data to an adviser from Elon Musk’s government efficiency group, according to a draft agreement between the tax agency and the Office of Personnel Management.

Taxes February 16, 2025

Updated Feb. 16, 2025. Tax season has just begun, but it may be about to get more difficult for taxpayers and tax preparers such as CPAs and accountants. The move could also delay income tax refunds. The IRS started accepting income tax returns on January 27, 2025, which means tax filing season is officially upon...…

Taxes February 16, 2025

According to ABC News and the Associated Press, up to 15,000 workers at the Internal Revenue Service could be laid off from their positions in the next week.

Taxes February 15, 2025

The CPA Practice Advisor Weekly Tax News Roundup is a weekly recap of tax-related news from the past week. From IRS news and tax court cases, to state, SALT, legislation and other related areas, the roundup can help you catch-up on recent changes. === Let us know if you like this new feature using the...…

Taxes February 14, 2025

Data released on Feb. 14 by the IRS shows the average refund is coming in at $2.065, up from $1,741 in 2024.

Taxes February 13, 2025

With cryptocurrency's increase in popularity, the IRS has introduced some complicated reporting requirements to ensure compliance with U.S. tax laws.

AICPA February 12, 2025

The AICPA has long supported the proposals and will continue to work to advance comprehensive proposals that enhance Internal Revenue Service (IRS) operations and improve the taxpayer experience.

Taxes February 11, 2025

Since the start of the 2025 tax filing season on Jan. 27, the IRS has issued 3.23 million refunds with an average refund amount of $1,928 as of Jan. 31, the agency said last week.

Taxes February 7, 2025

Ippei Mizuhara, who stole nearly $17 million from the Los Angeles Dodgers superstar to cover debts, was ordered to pay nearly that sum in restitution to Ohtani and a little more than $1 million to the IRS.