Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

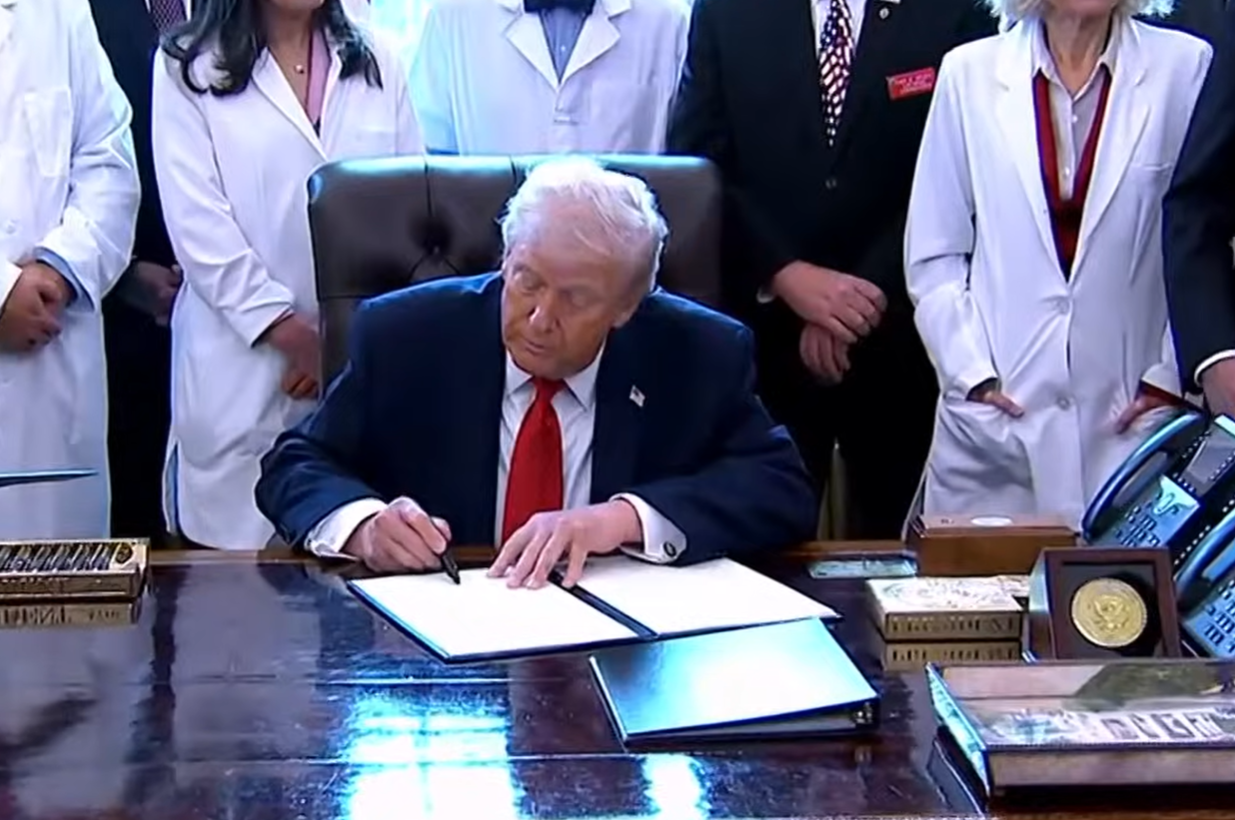

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Taxes December 26, 2025

The IRS announced tax relief for individuals and businesses in Washington state affected by severe storms, straight-line winds, flooding, landslides, and mudslides that began on Dec. 9.

Taxes December 23, 2025

The IRS Whistleblower Office said Dec. 19 that it's making it easier for whistleblowers to report tax cheats to the IRS with the launch of the new digital Form 211, "Application for Award for Original Information."

Taxes December 23, 2025

Announcement 2026-01, which was issued on Dec. 22, notes that future IRS guidance will explain the process of how eligible taxpayers can submit a dyed fuel refund claim.

Taxes December 22, 2025

The IRS on Monday opened a 90-day public comment period, which ends March 22, for proposed updates to its voluntary disclosure practice, including a more streamlined penalty framework.

Taxes December 22, 2025

Notice 2026-01 provides a safe harbor for businesses that wish to claim the Section 45Q tax credit for qualified carbon oxide captured and disposed of in secure geological storage occurring during calendar year 2025.

Taxes December 22, 2025

This new credit, established under the One Big Beautiful Bill Act, is for contributions to scholarship granting organizations that serve elementary and secondary school students from low- and middle-income families.

Taxes December 18, 2025

The confirmation follows Monday’s posting of a draft IRS Form W-2G, reflecting changes mandated by the OBBBA, which amended federal information-reporting requirements for certain payments, including casino gambling winnings.

Taxes December 18, 2025

Among the most immediate impacts of rescheduling marijuana as a Schedule III drug would be relief from IRS Code 280E, which prevents businesses that handle Schedule I or II substances from deducting routine expenses such as rent, payroll and equipment.

Taxes December 12, 2025

Of the $10.59 billion, $4.5 billion resulted from tax fraud, marking an increase of 111.8% from FY24, the agency said this week.

Taxes December 11, 2025

The Treasury Department and the IRS provided guidance in Notice 2026-05 on Dec. 9 on new tax benefits for health savings account participants under this summer's One Big Beautiful Bill Act.

Taxes December 8, 2025

Even if you never claim a tax deduction, the federal government may still know which charities you support.

Taxes January 5, 2026 Sponsored

Filing corrected returns can be confusing—but it doesn’t have to be. Join Amanda Watson, EA, for a practical session designed to help you confidently navigate amended and superseded returns.