Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Taxes December 27, 2023

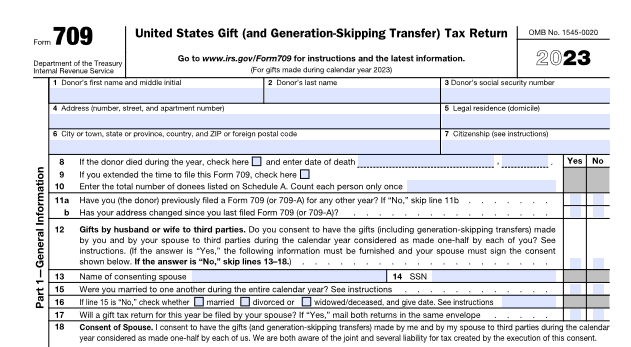

The annual gift tax exclusion allows you to gift up to a specified amount to each recipient each year without any gift tax liability.

IRS December 27, 2023

Businesses interested in taking advantage of the voluntary disclosure program have until March 22, 2024, to apply.

Taxes December 27, 2023

The Inflation Reduction Act (IRA) of 2022 provides a production credit for each kilogram of qualified clean hydrogen produced by a taxpayer at a qualified clean hydrogen production facility.

Taxes December 19, 2023

The IRS has hit the restart button on sending out automated collection notices, ending a two-year hiatus because of the COVID-19 pandemic.

Taxes December 15, 2023

The corporate AMT imposes a 15% minimum tax on the adjusted financial statement income of large corporations.

Taxes December 14, 2023

U.S. officials will take money away from FTX victims unless a judge rejects the government’s demand for $24 billion in unpaid taxes.

IRS December 14, 2023

The optional standard mileage rate for business use of a vehicle will increase 1.5 cents from 2023, the IRS said on Thursday.

IRS December 13, 2023

Expected to occur in early 2024, this is the first leadership reorganization at the tax agency in more than two decades.

Taxes December 12, 2023

Biden’s lawyers argue that all gun and tax charges should be dropped because their client has immunity under a deal he struck in July.

IRS December 11, 2023

In September, the IRS pressed pause on the ERC program until at least the end of this year due to a wave of fraudulent claims.

IRS December 11, 2023

Starting next year, employees can contribute up to $3,200 tax-free to a flexible spending account through payroll deduction.

Taxes December 11, 2023

Biden is accused of failing to pay his taxes on time from 2016 to 2019, filing false and fraudulent tax returns in 2018, and tax evasion.