Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Taxes August 11, 2023

At-risk freshmen and centrist groups in the GOP view the child credit as an important policy tool that has across-the-aisle support.

Taxes August 10, 2023

A new program gives eligible solar and wind facilities in low-income areas increased investment tax credits of 10% or 20%.

Taxes August 10, 2023

An IRS memo in June said name, image, and likeness collectives may not qualify as tax-exempt if the main objective is paying players.

August 7, 2023

Under the proposal, monetized installment sale deals would be considered listed transactions by the IRS.

Taxes August 7, 2023

Over the past two decades, the IRS has offered four principal post-filing alternative dispute resolution programs.

Taxes August 7, 2023

Proposed regulations are coming on a new tax imposed on sales of “designated drugs,” established by the Inflation Reduction Act.

Taxes August 4, 2023

The IRS informed taxpayers on the home energy audit requirements in order to claim the energy efficient home improvement tax credit.

Taxes August 3, 2023

Under current law, net operating losses (NOLs) can no longer be carried back for two years, but they may be carried forward indefinitely.

Taxes August 3, 2023

Among the warning signs businesses should be wary of are vendors that require large, upfront contingency fees and those who fail to sign the amended payroll tax returns.

Taxes August 3, 2023

The report found that required tracking documents, such as Forms 3210, Document Transmittal, are not included with these shipments and/or not prepared properly.

Taxes August 2, 2023

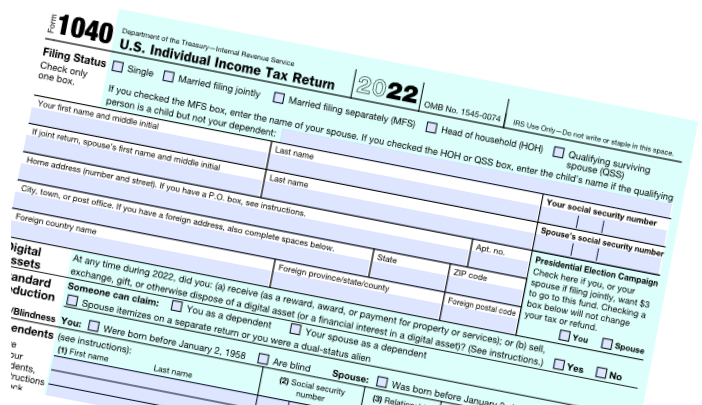

By the 2025 filing season, the IRS will digitally process 100 percent of tax and information returns that are submitted by paper, as well as half of all paper correspondence, non-tax forms, and notice responses.

Taxes July 28, 2023

Although Congress has chipped away at many traditional tax shelters in recent years, the main benefits of life insurance remain intact.