Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

November 10, 2021

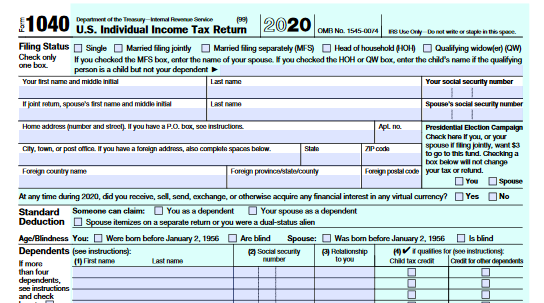

The standard deduction for married couples filing jointly for tax year 2022 rises to $25,900 up $800 from the prior year. For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022, up $400, and for...

September 27, 2021

So will the 2022 tax filing season be normal? Not likely. In addition to lasting health concerns, a number of new tax law provisions will create complications for some filers, as well as potential pitfalls to avoid. And maybe new tax laws by year's end.

September 16, 2021

Taxpayers can file now and schedule their federal tax payments up to the Oct. 15 due date. They can pay online, by phone or with their mobile device and the IRS2Go app. When paying federal taxes electronically taxpayers should ...

June 15, 2021

The Treasury Department and the Internal Revenue Service have unveiled an online Non-filer Sign-up tool designed to help eligible families who don’t normally file tax returns register for the monthly Advance Child Tax Credit payments, scheduled to ...

June 8, 2021

The Internal Revenue Service reminds taxpayers who pay estimated taxes that they have until June 15 to pay their estimated tax payment for the second quarter of tax year 2021 without penalty.

June 8, 2021

The Internal Revenue Service has started sending letters to more than 36 million American families who, based on tax returns filed with the agency, may be eligible to receive monthly Child Tax Credit payments starting in July.

May 27, 2021

Under the Internal Revenue Code, the rate of interest is determined on a quarterly basis. For taxpayers other than corporations, the overpayment and underpayment rate is the federal short-term rate plus 3 percentage points.

May 17, 2021

Roughly 39 million households—covering 88% of children in the United States—are slated to begin receiving monthly payments without any further action required.

May 14, 2021

The Internal Revenue Service will begin issuing refunds this week to eligible taxpayers who paid taxes on 2020 unemployment compensation that the recently-enacted American Rescue Plan later excluded from taxable income.

April 24, 2021

Homeless Americans who don’t have a permanent address or a bank account may still qualify for the Coronavirus stimulus payments, also known as Economic Impact Payments, and other tax benefits, according to the IRS.

April 22, 2021

With the Dec. 27, 2020, enactment of the Consolidated Appropriations Act, 2021, businesses now may claim these deductions even though they received PPP loans to cover original eligible expenses. These businesses can use the safe harbor provided by this...

March 31, 2021

Because a change in the taxability of unemployment benefits was made into law after some people filed their taxes, the IRS will automatically calculate the amount those taxpayers should be refunded, starting in May.