Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Payroll September 18, 2025

Under the One Big Beautiful Bill Act (OBBBA), employees can deduct overtime pay in certain situations—no questions asked.

Taxes September 15, 2025

The regulations include final rules related to a SECURE 2.0 Act provision requiring that catch-up contributions made by certain higher-income participants be designated as after-tax Roth contributions, the IRS said.

Taxes September 15, 2025

Schedule 1-A, "Additional Deductions," for Form 1040 will be used during the 2026 tax season to calculate new deductions for tips, overtime, car loan interest, and senior citizens.

Taxes September 15, 2025

More than a quarter of large U.S.-based influencers—those with at least 100,000 followers—reported earning tips, according to a 2024 study by the Creative Class Group.

Taxes September 11, 2025

For the first time in history, the new law creates a “floor” for deducting charitable donations deductions. At the same time, it opens up deductions to non-itemizers as well as itemizers.

Taxes September 11, 2025

The deduction isn’t just for teachers (although they are the most common benefactors). It may also be claimed by someone who works as an instructor, counselor, principal, or aide for students in K-12.

Taxes September 9, 2025

Thousands of taxpayers have filed inaccurate or frivolous returns that falsely claim the Fuel Tax Credit and the Sick and Family Leave Credit, often resulting in the denial of refunds and steep penalties, the IRS said Sept. 8.

Payroll September 9, 2025

The rule of 55 can benefit workers who have an employer-sponsored retirement account and are looking to retire early or need access to the funds if they’ve lost their job near the end of their career.

Taxes September 9, 2025

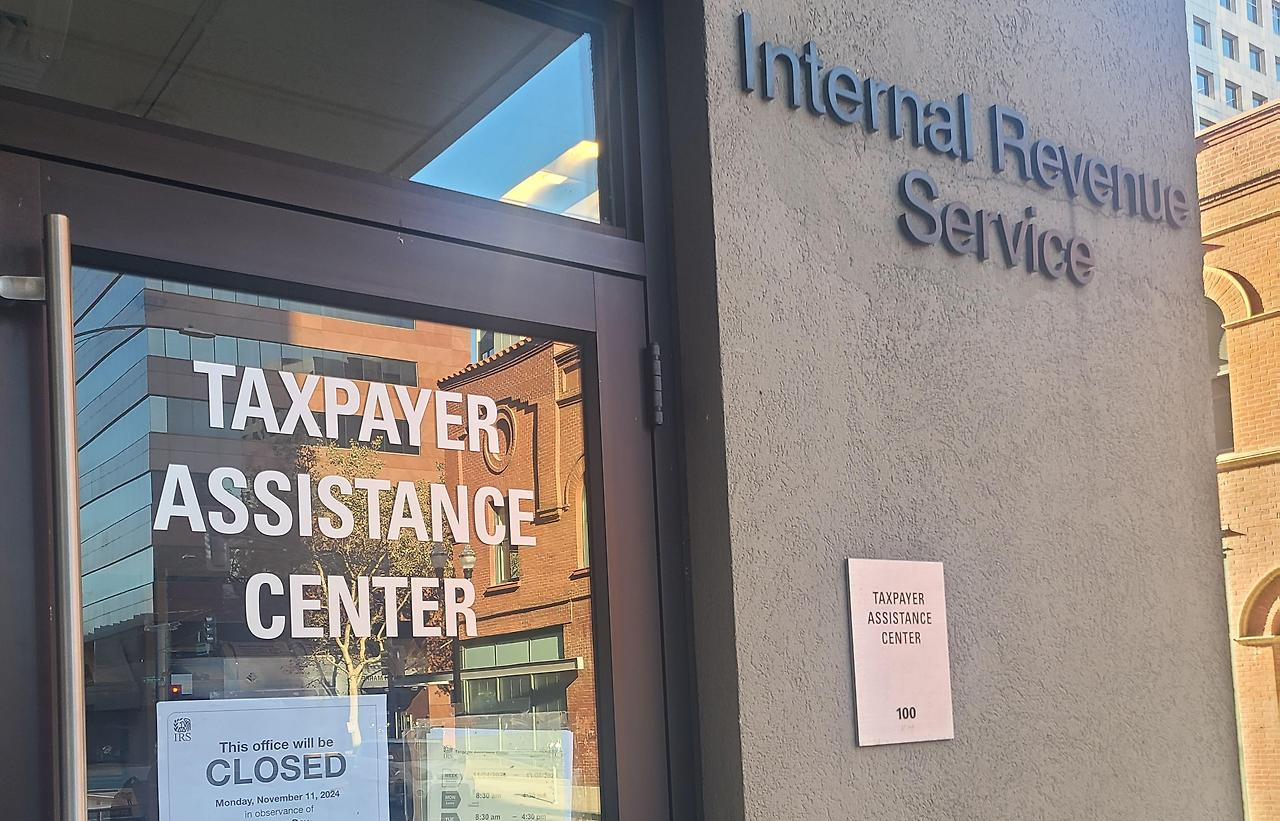

The IRS is reportedly closing nine taxpayer assistance centers in six states later this year in an apparent cost-savings move, as the agency faces a potentially smaller budget for fiscal year 2026.

Taxes September 4, 2025

The IRS has already shared the residential addresses of more than 40,000 foreigners with immigration authorities, who are seeking to have the confidential information of at least 1 million more people incorporated directly into their database.

Taxes September 3, 2025

The Treasury Department and the IRS issued a notice on Aug. 19 proposing to tweak rules that currently "may serve as an impediment to publicly traded foreign corporations redomiciling into the United States."

IRS September 3, 2025

In the first half of the year there were nearly 300 data breaches reported impacting as many as 250,000 clients.