Payroll Software February 2, 2026

AI + the Human Touch: The Best Answer to HR Software Chaos

The U.S. payroll and HR technology market now includes more than 5,700 software tools, many of which don’t communicate with one another.

Payroll Software February 2, 2026

The U.S. payroll and HR technology market now includes more than 5,700 software tools, many of which don’t communicate with one another.

November 12, 2025

October 6, 2025

July 31, 2025 Sponsored

June 28, 2025

June 9, 2025 Sponsored

September 30, 2013

RUN Powered by ADP Payroll for Partners is a wholesale payroll platform designed for accounting professionals. The RUN platform is designed exclusively for Internet-based payroll processing and can be implemented across a wide range of industries. Backed by ADP, one of the premiere online payroll vendors, extensive marketing materials are provided to aid accounting professionals...…

September 30, 2013

Paychex Online is an outsourced Internet-based payroll solution designed for small businesses, but scalable to work for larger organizations. The solution is designed around processing payroll as quickly and efficiently as possible. As an outsourced solution, all required filings and deposits are handled directly by Paychex. Recently, Paychex Online has been re-engineered from the ground...…

September 30, 2013

Payroll Relief is a cloud-based payroll solution specifically designed for accounting professionals to offer payroll services to their clients. The solution is focused on quickly processing payroll for a large number of payroll clients. New features this year include a newly redesigned user interface, full support for independent contractor workers, and new tools to...…

September 19, 2013

The web-based RUN Powered by ADP payroll and human resources management system is now serving more than 250,000 small business clients, ADP announced on Thursday.

August 7, 2013

The ezLaborManager solution from payroll and human resources company ADP is now fully integrated with RUN Powered by ADP Payroll for Partners.

May 20, 2013

Acquisition extends Wolters Kluwer’s leading position in Tax & Accounting software

November 16, 2012

All-inclusive platform keeps employers compliant with taxes and deductions while saving time and money

November 14, 2012

Paychex has launched its newly redesigned Paychex Accountant Knowledge Center, a free online resource available through www.paychex.com that brings valuable information and time-saving online tools to accounting professionals.

July 12, 2012

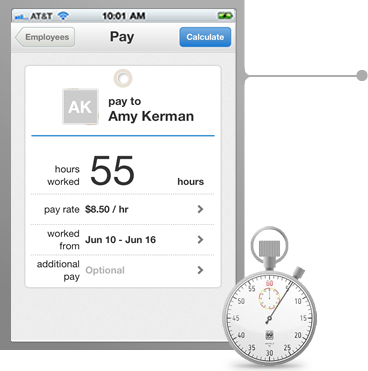

Intuit Inc. recently released a mobile payroll app for employers and small businesses.

May 28, 2012

As advanced and streamlined online payroll systems have allowed accountants to bring payroll back as a profitable service in their firms, many of the leading providers of those payroll programs have started offering mobile apps for smart phones that allow users to quickly process payrolls.

May 10, 2012

Release includes enhancements to its signature, award-winning electronic pay offering .

March 30, 2012

SurePayroll Inc., provider of online payroll to small businesses nationwide, announced its March results for its SurePayroll Small Business Scorecard.