Taxes January 26, 2026

Welcome to Tax Season 2026

The IRS today opened the 2026 tax filing season and began accepting and processing federal individual income tax returns for tax year 2025.

Taxes January 26, 2026

The IRS today opened the 2026 tax filing season and began accepting and processing federal individual income tax returns for tax year 2025.

November 12, 2025

September 23, 2025

Tax Planning October 18, 2024

The event on Oct. 25 is geared toward firm owners looking to start offering or enhance their existing tax planning and advisory services.

Technology October 15, 2024

With a multitude of storm-related extension opportunities, maybe tax season isn’t quite over after all. However, for most of you, the flurry of activity has passed. It's time to turn to the projects needed to prepare for the new year.

Accounting Technology Lab Podcast September 6, 2024

Hosts Randy Johnston and Brian Tankersley, CPA, review Thomson Reuters Checkpoint Edge with CoCounsel. Designed for tax professionals and firms, Checkpoint Edge with CoCounsel is a research platform that includes new AI-assisted research capabilities to help tax professionals get trusted answers to complex tax research questions by using everyday language.

Technology August 1, 2024

Each taxpayer saves an average of $41,700 through the firm’s use of TaxPlanIQ’s advanced tax planning software.

Taxes June 12, 2024

Changes to certain Inflation Reduction Act renewable credits, as well as to federal corporate tax rates, are among their concerns.

Tax Planning May 28, 2024

Corvee has announced the release of nine new strategies and two updated strategies to Instead and Instead Pro.

Taxes April 16, 2024

By taking the right steps, it's possible to avoid overpaying taxes and enjoy tax benefits.

Taxes February 19, 2024

As more entrepreneurs embrace remote and hybrid work, they are making sure to write off their home office—but know the rules first.

Tax Planning December 29, 2023

Depending on your situation, you might elect to forgo preferential tax treatment on certain long-term capital gains and qualified dividends in favor of deducting investment interest expenses.

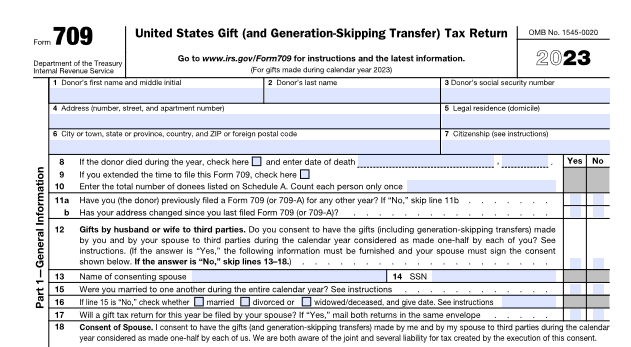

Taxes December 27, 2023

The annual gift tax exclusion allows you to gift up to a specified amount to each recipient each year without any gift tax liability.

Tax Planning December 21, 2023

Recent tax changes coupled with the potential for an economic slowdown have made it even more critical for companies and individuals to make smart decisions on investments and financing.

Taxes December 10, 2023

Let’s talk through how these two functions differ, and how you as a tax professional can better define them for your clients to create additional revenue streams.