Taxes January 26, 2026

Welcome to Tax Season 2026

The IRS today opened the 2026 tax filing season and began accepting and processing federal individual income tax returns for tax year 2025.

Taxes January 26, 2026

The IRS today opened the 2026 tax filing season and began accepting and processing federal individual income tax returns for tax year 2025.

November 12, 2025

September 23, 2025

August 30, 2017

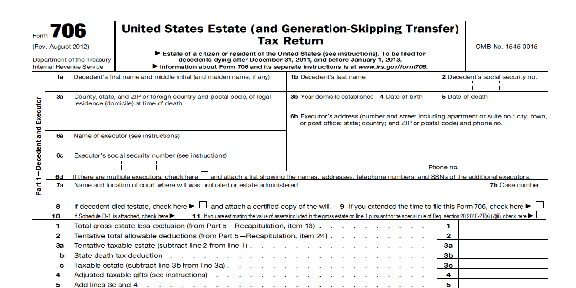

Just because you don’t have a taxable estate doesn’t mean that you shouldn’t do estate planning. If you die without an estate plan, then you die testate, meaning your assets will be divided up according to state law. Everyone needs some sort of an ...

August 30, 2017

Most business owners want the same thing; they want to pass on their business to their kids. Others may want to sell the business, and some just want to give it away. However, all these options have unique tax concerns that must be considered.

January 12, 2017

Thomson Reuters has released a special report, Sales to Intentionally Defective Irrevocable Trusts, which discusses the sale to an intentionally defective irrevocable trust (IDIT) in exchange for its promissory note. The report establishes that the ...

September 15, 2016

If taxes remained the same from year to year, there would be no need for tax planning. But as a professional, you know how valuable tax planning is; for your clients and for your bottom line. For your clients, effective tax management can often ...

September 14, 2016

Ideal for small to mid-sized firms, Lacerte Tax Planner, from Intuit, offers an easy to use tax planning product that is well suited for those looking for a stand-alone product, as well as those wishing to integrate with other Intuit financial products.

September 14, 2016

Thomson Reuters Planner CS : https://cs.thomsonreuters.com/planner Best Fit: Firms of any size that are currently or planning to use CS Professional Suite of applications with gain the most benefit using Planner CS. Product Strengths: Product offers excellent integration with other CS Professional Suite of applications Excellent report customization and built-in word processing capability Numerous deployment...…

August 9, 2016

Trying to reclaim some momentum in his presidential election campaign, Donald Trump, the Republican candidate, is tweaking his tax plan. In a far-ranging speech on economic policies on August 8, Trump proposed cuts in individual tax rates, although not as drastic as in previous proposals. The billionaire also advocated tax reforms in line with the...…

May 19, 2016

In the wake of the entertainer Prince’s death, it has been called “the worst estate planning sin a wealthy artist could commit: leaving no will at all.”

May 6, 2016

One of the issues that often causes a high degree of client confusion is whether or not a withdrawal from their IRA account will be taxable, and if so, to what extent.

February 1, 2016

The American Institute of CPAs (AICPA) has submitted comments to the Internal Revenue Service (IRS) and U.S. Department of the Treasury about IRS draft Form 8971, Information Regarding Beneficiaries Acquiring Property from a Decedent, and draft ...

January 19, 2016

The figure that is likely to grab your attention is 52 percent. That is the top tax bracket proposed by Sanders, a plateau that hasn’t been reached since a watershed 70 percent rate was scaled back in the 1980s. The top tax bracket peaked at 91 percent...

January 15, 2016

Thomson Reuters has released a special report highlighting key tax developments in 2015 to aid practitioners in 2015 tax return preparation and support 2016 planning.