Taxes January 26, 2026

Welcome to Tax Season 2026

The IRS today opened the 2026 tax filing season and began accepting and processing federal individual income tax returns for tax year 2025.

Taxes January 26, 2026

The IRS today opened the 2026 tax filing season and began accepting and processing federal individual income tax returns for tax year 2025.

November 12, 2025

September 23, 2025

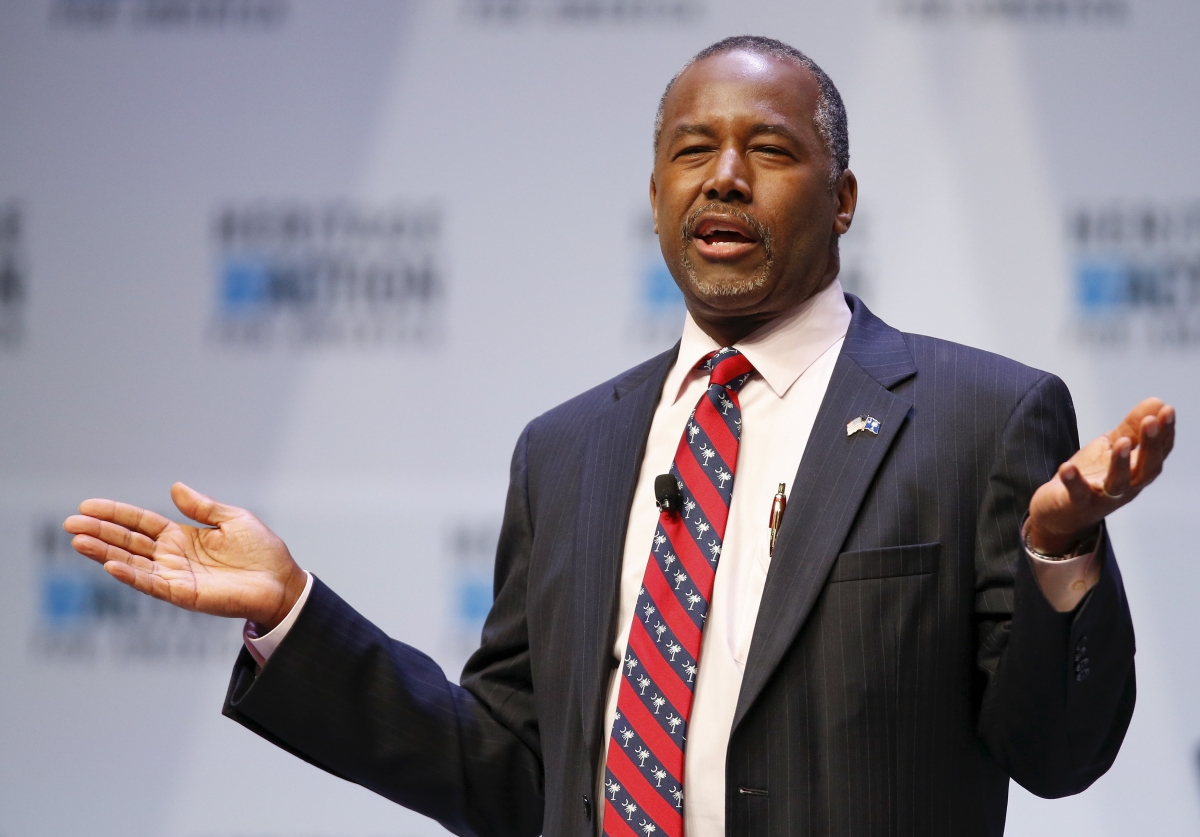

January 15, 2016

Carson would also eliminate deductions for charitable contributions, mortgage interest and state and local income taxes, while repealing the alternative minimum tax (AMT), the earned income credit and the rules for depreciation.

January 12, 2016

The American Institute of CPAs (AICPA) has submitted comments to the Internal Revenue Service (IRS) about the IRS’s new policy of issuing estate tax closing letters only upon a separate request four months after filing the estate tax return. The IRS announced changes related to the issuance of estate tax closing letters on the...…

December 28, 2015

Calls for federal income tax cuts are a time-honored tradition by presidential candidates of all stripes, but the Tax Policy Center study says that Trump’s plan dwarfs the proposals made by other GOP contenders.

December 22, 2015

Each year, employers across the country realize that they need to adjust their payroll data after their final payroll run of the year. Here are three of the most common adjustments that can be avoided with just a little planning.

December 17, 2015

The Federal Tax Guide offers coverage of a wide range of timely topics most important to tax practitioners as they prepare 2015 returns and plan for the year ahead with new content on health care reform, including individual and employer mandates ...

November 29, 2015

Rubio’s proposed tax plan includes a dramatic change in the way capital gains are treated. With this little-noticed proposal, holders of capital assets – including securities, real estate and small business interests – would calculate their potential ...

November 18, 2015

With this guide, we hope to help you navigate the ins and outs of getting your compliance and benefits ready for end of year.

November 17, 2015

As the year winds down, the holiday season brings with it tax reporting season – which can be a hectic time for businesses. Changing regulations, looming deadlines and the threat of penalties can quickly replace “jolly” with “humbug.”

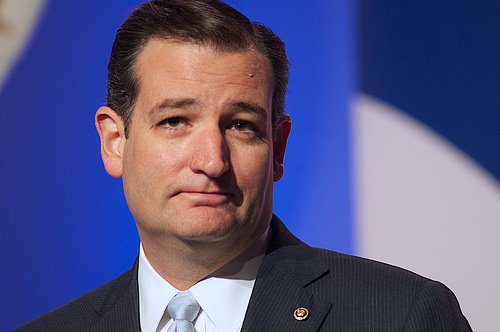

October 30, 2015

According to most media reports, Senator Ted Cruz (Rep.-TX) was one of the “winners” in the Republican presidential debate held on October 28. At the very least, the radical tax plan released by Cruz just prior to the debate tip-off is generating ...

October 28, 2015

From a business perspective, there’s practically nothing worse than providing goods or services to a customer or client and not getting paid. Or maybe you’ve made loans to vendors or suppliers that haven’t been repaid. It can take a long time to get ...

October 22, 2015

As 2015 draws to a close, a turbulent economic and legislative environment means taxpayers need to keep a close eye on several major planning issues, according to Grant Thornton LLP.

September 29, 2015

With summer vacation over and school back in session, it’s time to help those extreme tax procrastinators get their returns filed. But what about the rest of your clients − the “good” ones whose taxes you completed way back in April?