Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes December 30, 2025

If passed by California voters in November 2026, the measure would impose a one-time tax of 5% on individuals with assets worth $1 billion or more.

Taxes December 29, 2025

In a new case, Alioto, TC Memo 2025-125, 12/4/25, a C corporation paid the personal expenses of its main shareholder, with adverse tax consequences.

Income Tax December 28, 2025

Easy way to estimate when you can get your income tax refund in 2026. No calculator and no need to enter personal information, just an easy chart.

Taxes December 26, 2025

As a result of the new stipulation, the date stamped on mailed items may be several days later than when the mail was actually deposited, raising concerns for taxpayers who rely on the postmark to document the timing of charitable gifts.

Taxes December 26, 2025

The IRS announced tax relief for individuals and businesses in Washington state affected by severe storms, straight-line winds, flooding, landslides, and mudslides that began on Dec. 9.

Taxes December 26, 2025

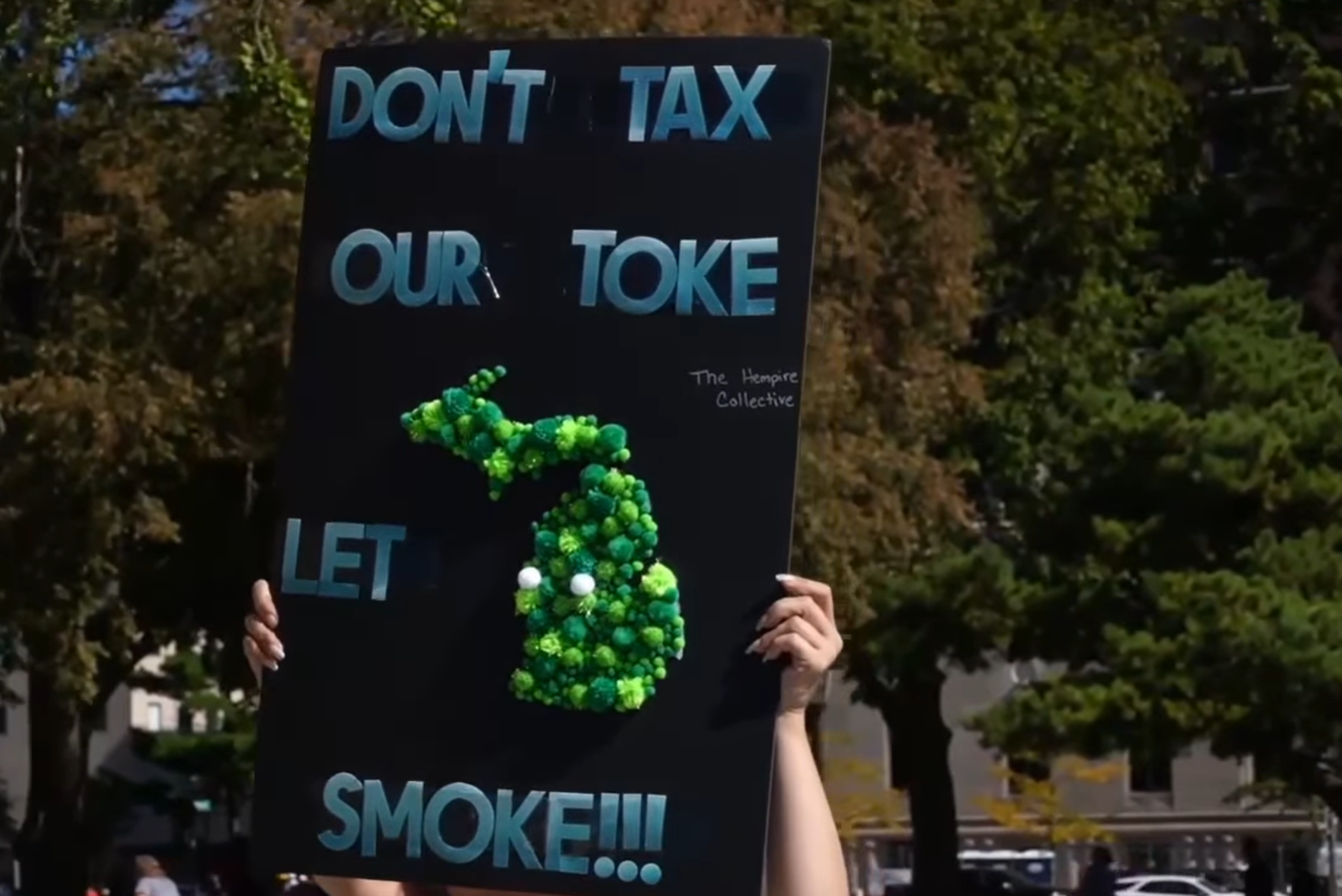

The Michigan Cannabis Industry Association on Tuesday appealed a lower court ruling that upheld the imposition of a new 24% wholesale tax on marijuana sales, set to take effect Jan. 1, 2026.

Taxes December 26, 2025

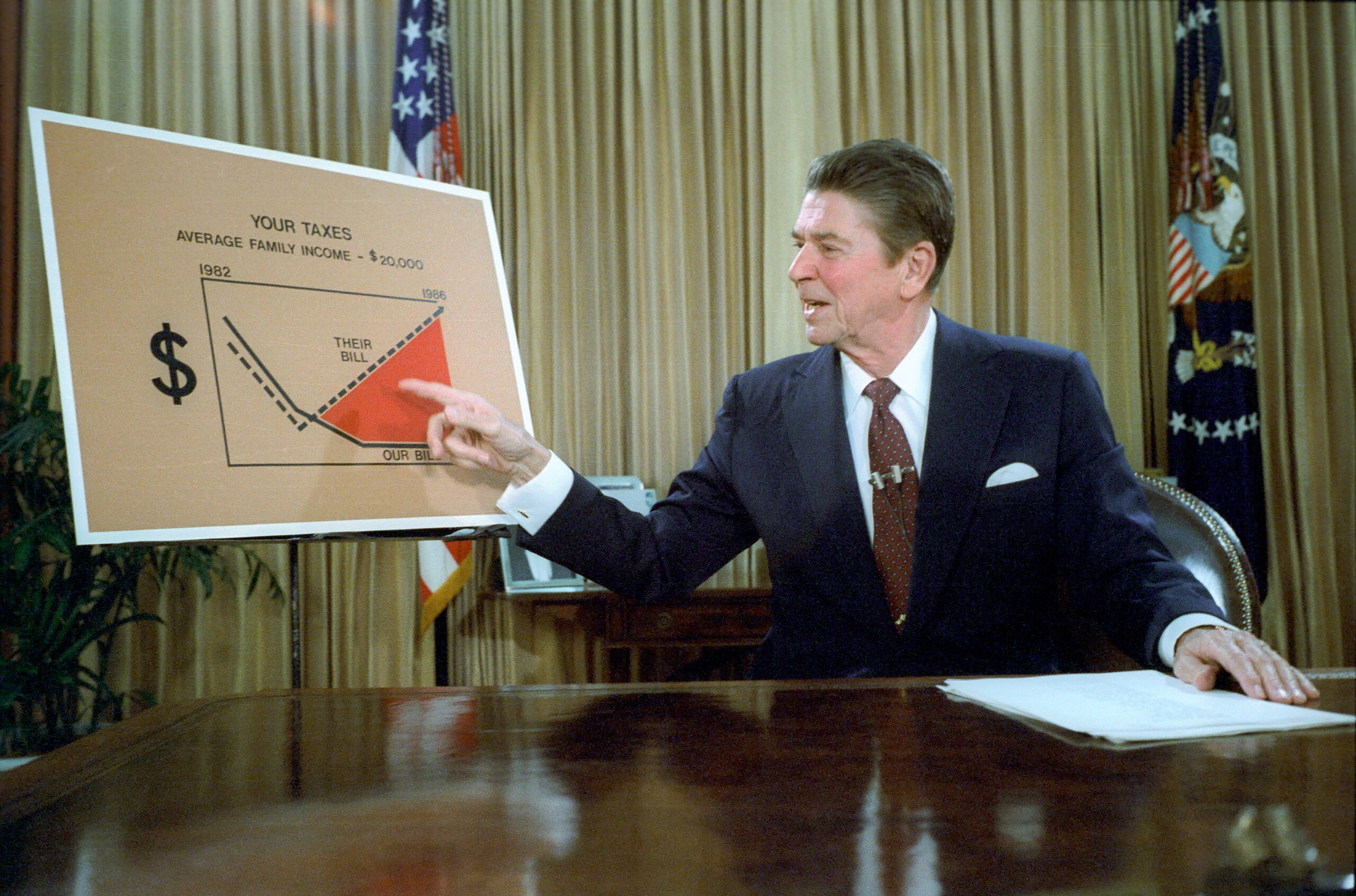

The legendary 1981 Reagan tax cut included a little-known provision called tax indexing, which has been saving taxpayers money ever since—far more money than most of us can imagine.

Taxes December 26, 2025

Gov. Bob Ferguson said Dec. 23 the proposal would be tied to reducing sales taxes on baby and hygiene items, expanding the working families tax credit, increasing K-12 school funding, and lowering the key tax rate for small businesses.

Taxes December 24, 2025

If you acquire permanent whole life insurance as opposed to term life insurance, your premium payments build up a cash value in the policy.

Special Section: Guide to 2025 Tax Changes December 23, 2025

This series of articles spotlights key tax issues and changes made to tax law in 2025 that will affect the 2026 income tax filing season and the years to come, as a result of the One Big Beautiful Bill Act.

Taxes December 23, 2025

The IRS Whistleblower Office said Dec. 19 that it's making it easier for whistleblowers to report tax cheats to the IRS with the launch of the new digital Form 211, "Application for Award for Original Information."

Taxes December 23, 2025

Announcement 2026-01, which was issued on Dec. 22, notes that future IRS guidance will explain the process of how eligible taxpayers can submit a dyed fuel refund claim.