Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes September 16, 2024

Donald Trump floated the idea of tariff hikes to offset some income tax cuts to House Republicans in June.

Taxes September 16, 2024

Comments may be submitted through the Federal Register. Tribal leaders may also submit comments through the Tribal consultation process.

Taxes September 13, 2024

The legislation tightens rules around Chinese business ties in determining which electric vehicles qualify for federal tax credits.

Taxes September 13, 2024

Trump said his no-tax-on-overtime idea would help companies lure more workers and keep them on the job site for longer.

Taxes September 13, 2024

These taxpayers now have until Feb. 3, 2025, to file various federal individual and business tax returns and make tax payments.

![globe-flags[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2022/07/33706/globe_flags_1_.5ce342f3a9102.png)

Small Business September 13, 2024

The Avalara Global Turnkey Tax Activation's touchless automation simplifies and reduces months of data cleansing and imports down to a few hours.

Taxes September 12, 2024

The proposed regulations provide definitions and general rules for determining and identifying AFSI. They also include rules regarding various statutory and regulatory adjustments in determining AFSI.

Taxes September 11, 2024

Coloradans will soon be able to file their federal income taxes online for free under a program created by the Inflation Reduction Act.

Taxes September 11, 2024

Bloomberg Tax's annual Projected U.S. Tax Rates Report provides early, accurate notice of the potential tax savings that could be realized due to increases in deduction limitations, upward adjustments to tax brackets, and increases to numerous other key thresholds.

Taxes September 11, 2024

The two presidential candidates attacked each other on the economy, taxes, immigration, and abortion, among other issues.

Taxes September 10, 2024

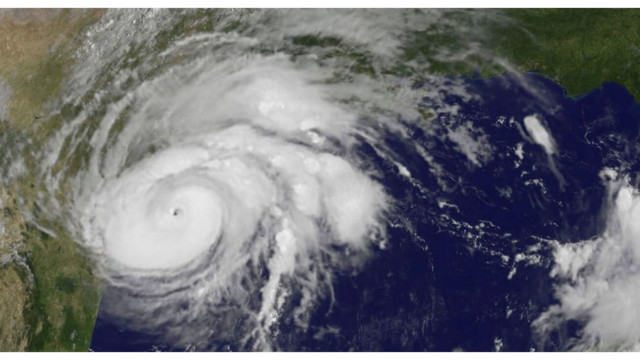

Impacted residents and business owners have until Feb. 3, 2025, to submit a variety of tax filings and payments.

Taxes September 10, 2024

The Tax Blotter is a collection of briefs of recent tax legislation and tax court decisions.