Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes August 22, 2024

Starting on Oct. 1, the rate for tax overpayments and underpayments for individuals will be 8% per year, compounded daily.

Taxes August 21, 2024

The tax court judge figured out that the husband would have had to work 40 hours at his regular job and 48 hours a week on the real estate activity.

Taxes August 21, 2024

The Coalition Against Scam and Scheme Threats is comprised of the IRS, state tax agencies, tax software firms, associations, and others.

Taxes August 21, 2024

The process for obtaining these credits is unlike that of any previous program, and online resources have added to make it easier to navigate.

Taxes August 20, 2024

The Democratic presidential nominee's plan is in line with the corporate tax rate the Biden administration proposed in March.

Taxes August 20, 2024

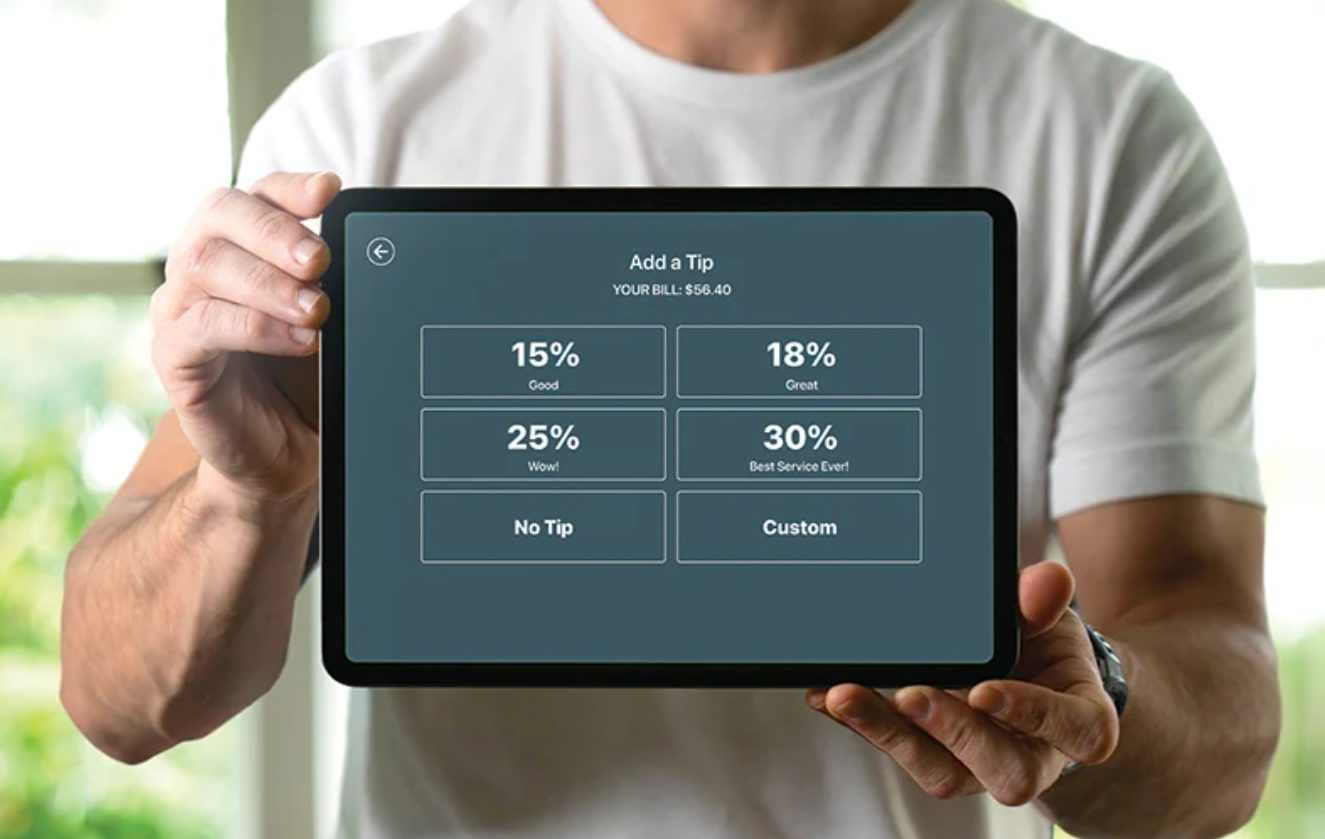

Both presidential candidates are pledging to exempt workers from paying taxes on their tips, but experts say it's bad policy.

Taxes August 20, 2024

Information Returns customers will be transitioned to Greatland’s Yearli platform. Yearli offers the most complete federal, state and recipient wage and information reporting platform for businesses, accountants, and related service providers in the market.

Taxes August 19, 2024

The SECURE 2.0 ACT permits employers to provide matching contributions for employees based on their payments on student loans.

Taxes August 19, 2024

Until 2016, the U.S. taxed Olympic medal winners on the value of the medals won. A law enacted in 2016 excluded the value of Olympic medals from tax for those with incomes of $1 million or less, starting in 2016.

Taxes August 19, 2024

The agency recommends that taxpayers submit the pre-filing registration at least 120 days before the planned filing date.

Taxes August 19, 2024

Taxpayers who operate large trucks and buses have until Sept. 3 to file Form 2290 for vehicles used in July 2024, the IRS said.

Taxes August 19, 2024

Gordian Ndubizo of New Jersey who taught accounting at Drexel University was convicted Aug. 15 by a federal jury on all eight counts.