Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Sales Tax August 16, 2024

The company says this significant milestone reflects its dedication to positively impacting its employees, clients, communities, and the planet.

Taxes August 16, 2024

The application period for the 2025 Compliance Assurance Process program will be from Sept. 4 until Oct. 31, the agency said Thursday.

Taxes August 16, 2024

The proposal, which Kamala Harris will announce on Aug. 16, would provide a $6,000 child tax credit within a newborn child’s first year.

Taxes August 15, 2024

Businesses that apply for and are accepted into the program have to repay 85% of the credit back to the agency.

Taxes August 15, 2024

Details on her tax positions will likely become a crucial campaign issue, as polls show economics is one of voters' top concerns.

Taxes August 14, 2024

Over 3.4 million U.S. families claimed $8.4 billion in tax credits to lower the costs of their home energy upgrades, new data shows.

IRS August 14, 2024

The new Written Information Security Plan template was updated to help protect practitioners and their clients from identity thieves.

Taxes August 14, 2024

The sports-betting company said it would scrap its plan to add a "gaming tax surcharge" to winning bets in 2025.

Taxes August 14, 2024

The presidential candidates are trying to court voters in key battleground states ahead of a battle to rewrite the tax code.

Taxes August 13, 2024

The cost of fully exempting Social Security benefits from taxes could top $1.6 trillion over a decade, according to the Tax Foundation.

Taxes August 13, 2024

The 4% surtax on incomes over $1 million, also known as the “Fair Share Amendment,” was approved by voters in 2022.

Taxes August 13, 2024

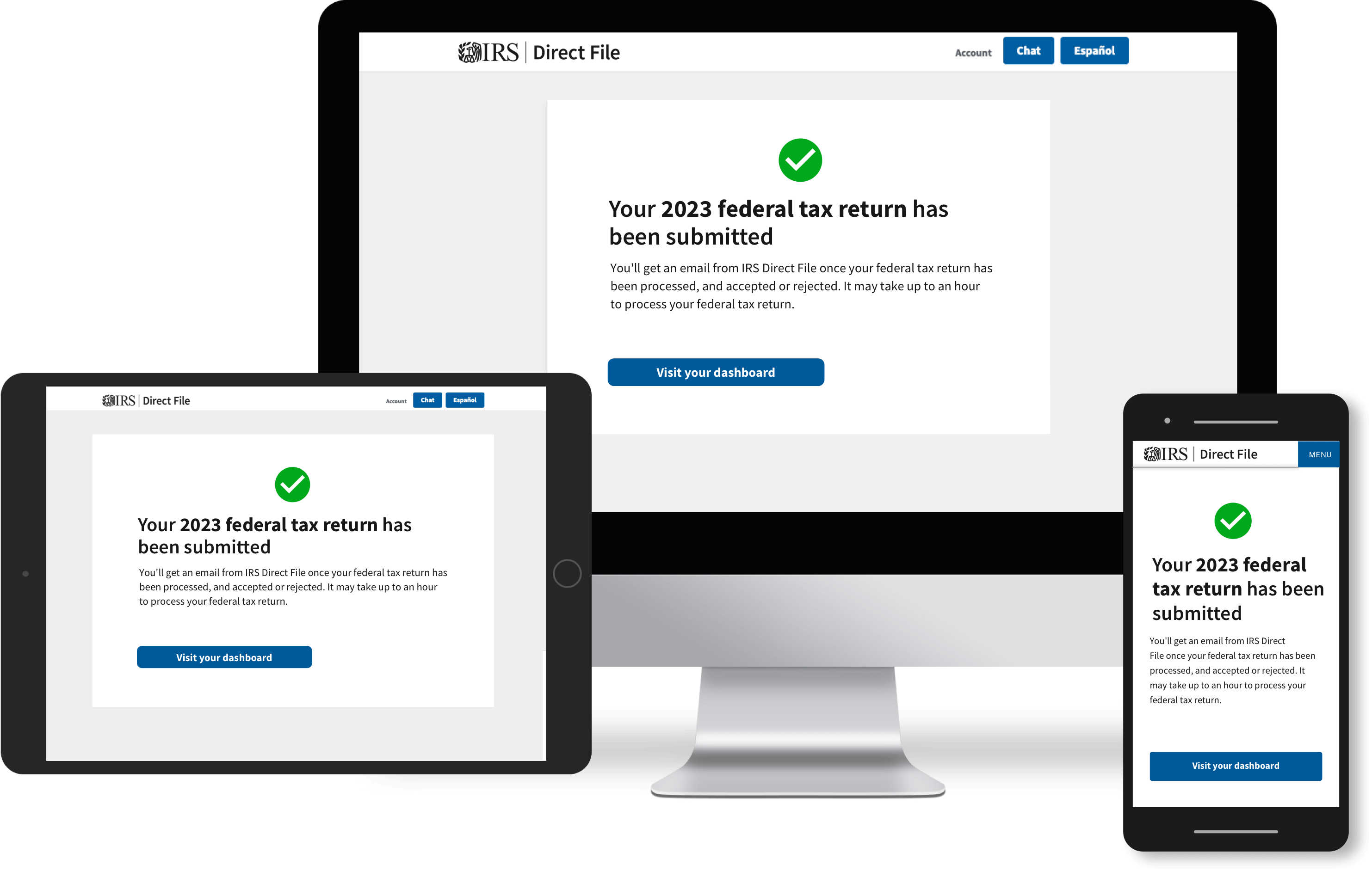

New Mexico became the fourth new state that can use the IRS's new system for filing federal taxes during the 2025 tax season.