Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Advisory April 19, 2024

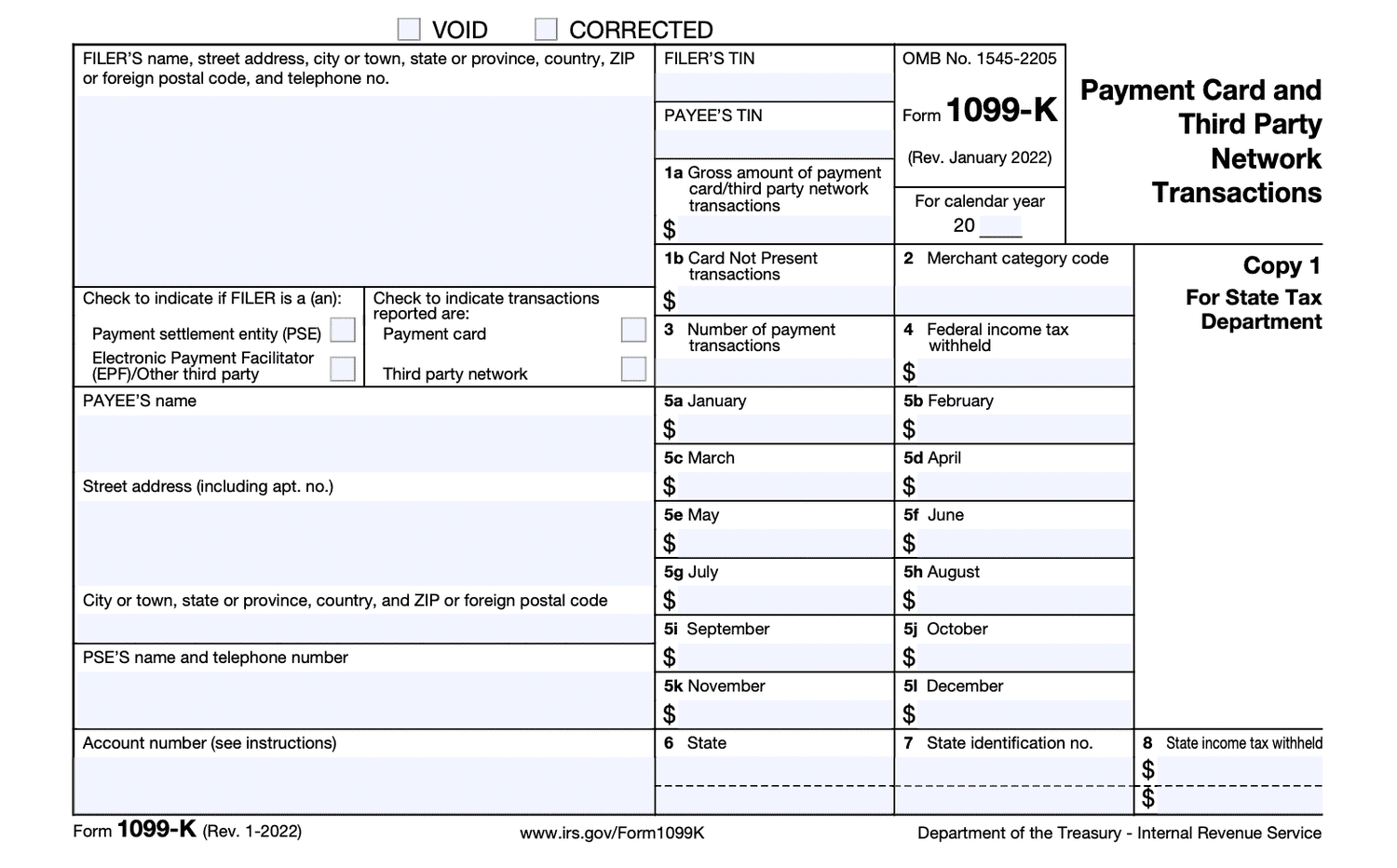

There’s a high demand for 1099 services, according to the 2022 CPA.com and AICPA PCPS Client Advisory Services (CAS) Benchmark Survey.

Taxes April 19, 2024

Georgia’s 2019 abortion law allows expectant parents to claim an embryo or fetus as a dependent on their taxes.

![natural_disasters_list_1_.56117a5e5df03[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2021/12/natural_disasters_list_1_.56117a5e5df03_1_.61c1db14bf0ea.png)

Accounting April 18, 2024

Under current law, taxpayers affected by a major disaster often have less time to make a refund or credit claim than those who are not affected.

Taxes April 18, 2024

Ndeye Amy Thioub was indicted on three counts each of filing false tax returns and filing false tax returns as an employee of the U.S.

Taxes April 18, 2024

The rapper, whose legal name is Daniel Hernández, had his property seized for “nonpayment of internal revenue taxes.”

Taxes April 18, 2024

Some tax returns are being rejected because filers failed to provide information about ACA coverage they didn't know they had.

Taxes April 17, 2024

This relief was provided to certain RMDs in 2021, 2022, and 2023, and is being extended in Notice 2024-35 to 2024.

Taxes April 17, 2024

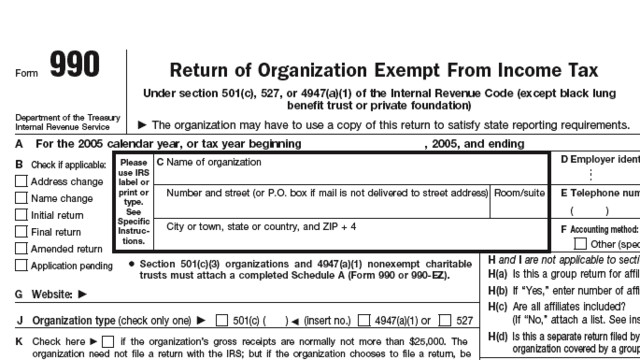

The AICPA’s comments also include a matrix for the Form 990 series which focuses on specific sections and the recommendations for those sections.

Taxes April 17, 2024

The digital services tax currently before Canada's Parliament would impact U.S.-based companies like Alphabet and Meta Platforms.

Taxes April 17, 2024

The revised FAQs pertain to the new, previously owned, and qualified commercial clean vehicle credits.

Taxes April 17, 2024

It’s Tax Day, so there’s no better time for the IRS to pat itself on the back for a job well done as filing season ends for most Americans.

Taxes April 16, 2024

The use of such referral and information services would be excluded from employees' taxable gross income, according to the IRS.