Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes December 13, 2023

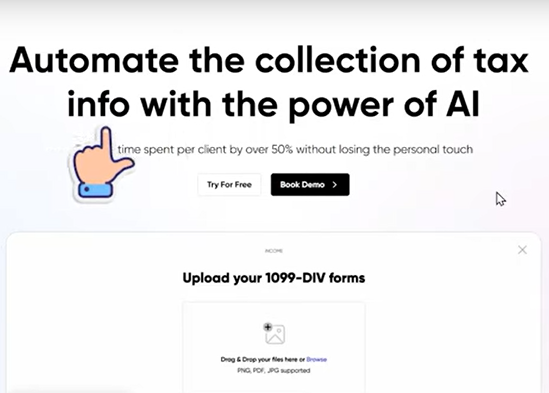

The software connects with tax platforms including Pro System FX, Pro Series, Ultra Tax, CCH Axcess, CCH Prosytem fx, UltraTax, Lacerte, ProSeries, Drake, and ATX.

![natural_disasters_list_1_.56117a5e5df03[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2021/12/natural_disasters_list_1_.56117a5e5df03_1_.61c1db14bf0ea.png)

Taxes December 13, 2023

Slower approvals, emotional trauma and shortage of building materials, skilled labor, utilities and the other services for rebuilding add to the difficulty some taxpayers experience.

Taxes December 12, 2023

Biden’s lawyers argue that all gun and tax charges should be dropped because their client has immunity under a deal he struck in July.

IRS December 11, 2023

In September, the IRS pressed pause on the ERC program until at least the end of this year due to a wave of fraudulent claims.

Taxes December 11, 2023

Eight in 10 tea merchants (82%) feel anxiety related to staying on top of their tax obligations. In the U.S., there are more than 900 sales tax rules on tea products.

IRS December 11, 2023

Starting next year, employees can contribute up to $3,200 tax-free to a flexible spending account through payroll deduction.

Taxes December 11, 2023

Biden is accused of failing to pay his taxes on time from 2016 to 2019, filing false and fraudulent tax returns in 2018, and tax evasion.

Taxes December 10, 2023

Let’s talk through how these two functions differ, and how you as a tax professional can better define them for your clients to create additional revenue streams.

Accounting December 9, 2023

Over two days and 14 one-hour sessions, the profession's top thought leaders served on panel discussions of a variety of subject areas related to tax, accounting, practice management and ethics.

Taxes December 7, 2023

Jack Lee Oliver of Rivesville, WV, used a foster child he never met to inflate his tax refund, according to the Justice Department.

IRS December 7, 2023

The IRS has no plans to send a fourth round of stimulus checks, despite claims made in a series of widely-shared social media posts.

Taxes December 6, 2023

Democratic dreams of imposing a wealth tax on the richest Americans risk being snuffed out by a dispute over a $14,729 bill.