Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Accounting September 6, 2023

The Innovation Awards are presented to honor new or recently enhanced technologies that benefit tax and accounting professionals and their clients through improved workflow and efficiencies, increased accessibility, enhanced collaboration, greater accuracy, or other means.

Payroll September 6, 2023

More than 4 million student loan borrowers are enrolled in the Biden Administration’s new income-driven repayment plan, including nearly 332,000 borrowers in California.

Taxes September 5, 2023

Compliance Tracker ensures accurate and timely tax filings, reducing risk of non-compliance and penalties by incorporating trusted data compiled and maintained by Bloomberg Tax’s in-house tax analysts.

Taxes September 4, 2023

The accumulated earnings tax must be paid in addition to the regular corporate income tax. Despite recent threats by Congress to raise the ante, this penalty tax remains at the 20% rate.

September 1, 2023

The guidance is being issued as part of the IRS's efforts to provide additional certainty to states and their residents regarding the federal income tax consequences of state payments made to taxpayers.

Taxes September 1, 2023

These taxpayers now have until Feb. 15, 2024, to file various federal individual and business tax returns and make tax payments.

Payroll August 30, 2023

Under proposed changes from the Dept. of Labor, any salaried employee making less than $55,000 per year, or $1,059 per week, would be eligible for overtime. That would be a significant jump from the current cutoff at $35,568 per year.

Small Business August 30, 2023

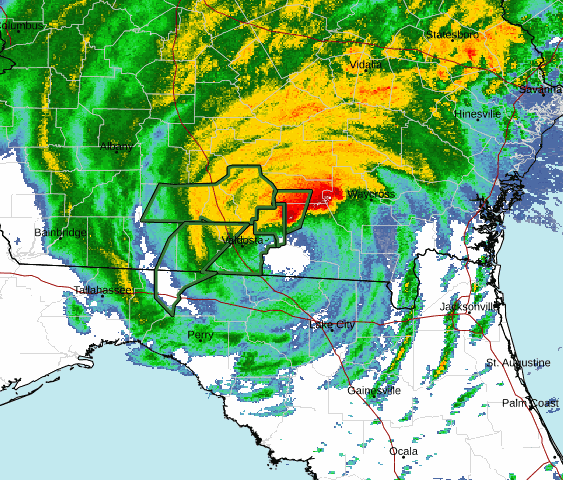

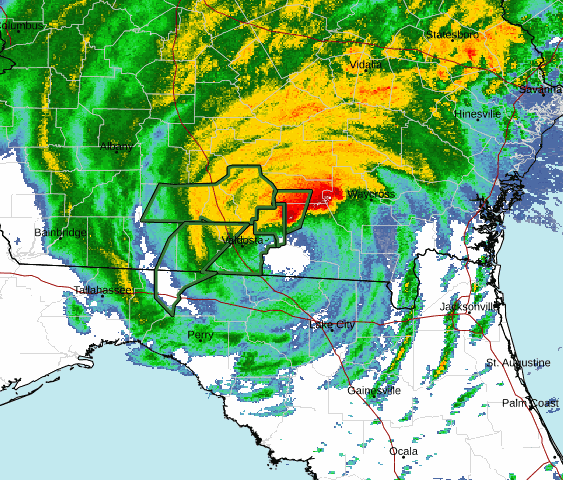

Hurricane Idalia made landfall in Florida early Wednesday morning as a Category 3 hurricane, and with sustained winds of 125 mph or greater. As of noon Eastern time, the hurricane was still a Category 1, and moving over southern Georgia.

Taxes August 29, 2023

Under the 2015 Fixing America’s Surface Transportation (FAST) Act, the IRS can deny, revoke or limit a passport if you have a seriously delinquent tax debt.

Taxes August 29, 2023

The proposed regulations include prevailing wage and registered apprenticeship requirements for clean energy projects.

Taxes August 28, 2023

In comment letters sent to the IRS, the AICPA requested improvements be made to two tax returns pertaining to foreign trusts.

Taxes August 28, 2023

In addition to IRS representation training sessions, the partnership will enable tax professionals to explore adding new revenue streams to their practices with tax resolution services.