Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Accounting June 6, 2023

A new version of Wayfair may be underway, as stricter regulation of transfer pricing becomes more broadly implemented around the world, affecting even small businesses.

Taxes June 1, 2023

A program established by the Inflation Reduction Act incentivizes solar and wind power in certain low-income communities.

Taxes June 1, 2023

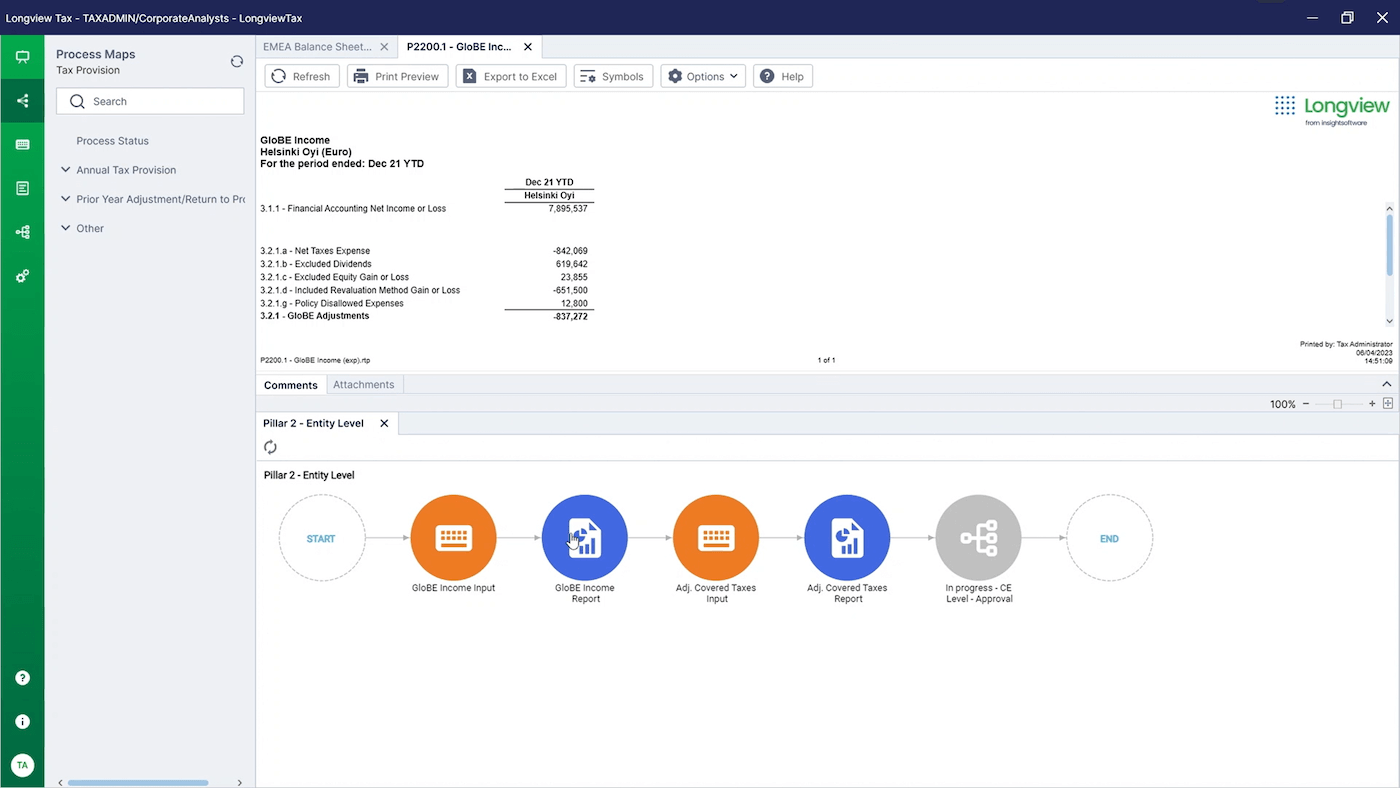

Organizations should aim to remove inefficient and time-consuming processes associated with tax reporting, while empowering tax managers to collaborate with the executive team and prioritize strong policies.

Taxes June 1, 2023

The qualifying advanced energy project credit program was re-established last year by the Inflation Reduction Act.

Accounting June 1, 2023

The hard choices on how to adjust government services are mostly left to Congress to negotiate in separate spending packages due before the Oct. 1 start of the next federal fiscal year.

Small Business May 31, 2023

The Regulate Marijuana Like Alcohol coalition is gathering signatures across the state in hopes of qualifying for the November ballot. Ohio already has a medical marijuana program.

Accounting May 30, 2023

The CPAs asked members of Congress to support the Freedom to Invest in Tomorrow’s Workforce Act, a bill that would expand eligible uses of 529 savings plans.

Taxes May 30, 2023

The agency says marketing fraudsters are misrepresenting and exaggerating who can qualify for the employee retention credit.

Taxes May 29, 2023

Biden and McCarthy announced a deal to increase the government's debt limit, enabling the nation to avoid a debt default and economic turmoil.

Accounting May 27, 2023

The deal struck Saturday night offers a lot for the two parties not to like, from expanded work requirements for food stamps opposed by Democrats to higher spending levels than conservatives demanded.

Taxes May 26, 2023

The IRS is actively auditing and conducting criminal investigations related to these false claims. People need to think twice before claiming this.

Sales Tax May 26, 2023

The Florida Legislature erred in including items eligible in two of the sales tax holidays, but that have different tax treatments.