Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Accounting April 17, 2023

The Readers’ Choice awards give professionals the chance to see which tech and workflows their peers use and trust, which can help them build more efficient and profitable workflows for their own practice.

Taxes April 17, 2023

The Tax Court denied net operating loss carryforwards for a CPA who operated several Fuddruckers restaurants.

Accounting April 14, 2023

Reporting entities can now elect to account for qualifying tax equity investments using the proportional amortization method.

Taxes April 13, 2023

The favorable tax treatment isn’t automatic. To avoid current tax, you and the qualified intermediary must sign a "Qualified Exchange Accommodation Agreement."

Taxes April 12, 2023

Taxpayers usually have three years to file and claim their tax refunds. If they don't file within three years, the money becomes the property of the U.S. Treasury.

Taxes April 12, 2023

if you can’t present clear and convincing evidence that the loan is tied to a business transaction, the transaction may be deemed to be a gift.

Taxes April 12, 2023

Depending on the circumstances, it may be better to bypass the exclusion on a current sale and save it for the time when it will do you more tax good.

Taxes April 12, 2023

Now that the IRS has just released its Strategic Operations Plan which lays out the allocation of the funds, you may want to pay close attention to this plan.

Accounting April 12, 2023

The spending plan includes goals and timetables covering areas such as operations support, enforcement, taxpayer services and IT modernization.

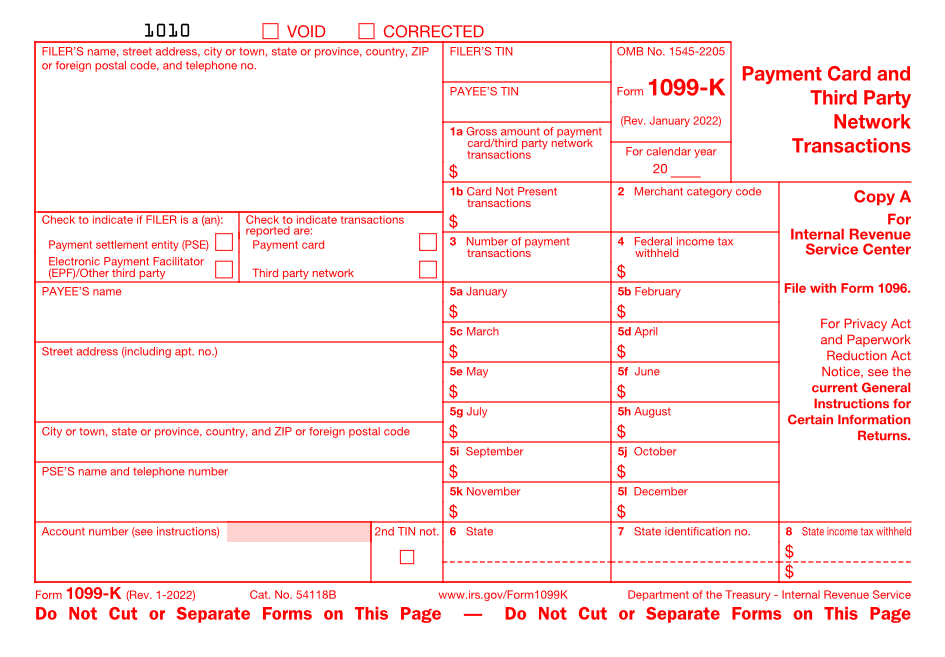

Taxes April 12, 2023

The IRS lists 21 different 1099 forms. Here is an overview of each form, as of March 2023, and why you could receive one.

Taxes April 11, 2023

When you officially add your spouse to the company payroll, they are taxed on the compensation, but are also eligible for benefits just like any other employee.

Taxes April 10, 2023

No matter how big an accommodation platform provider is, complying with state and local accommodation tax requirements can quickly become a burden.