Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes February 17, 2023

Marketplace facilitators are being required to monitor and vet high-volume marketplace sellers in a growing number of states, including Arkansas, California, and Oklahoma.

Taxes February 17, 2023

To fight identity fraud and cybercrime, tax preparers and filers must collaborate and adopt effective methods to secure their data and financial resources.

Taxes February 16, 2023

The AICPA supports the deferral of IRC Section 174 amortization requirement of the research and experimental expenditures and requests that Congress retroactively extend the effective date to ...

Sales Tax February 16, 2023

Initially focusing on bookkeeping and payroll services, VARC Solutions has expanded to offer fully outsourced business management, payment processing, invoice management, consulting, implementation, and training.

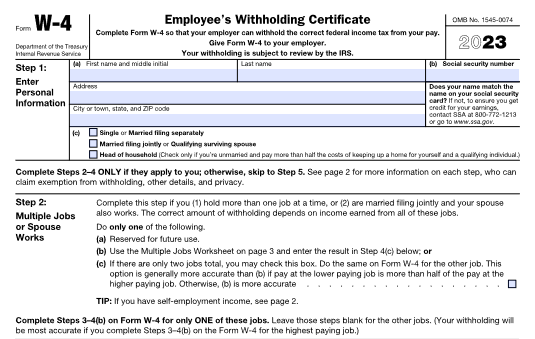

Payroll February 15, 2023

If you know Form W-4 like the back of your hand, knowing these 2023 changes should be enough to close out this article and go about your day.

Taxes February 15, 2023

This guidance applies to owners of certain solar and wind facilities placed in service in connection with low-income communities that are eligible for the section 48 energy investment credit.

Taxes February 15, 2023

The CAP program began in 2005 as a way to resolve tax issues through open, cooperative and transparent interactions between the IRS and taxpayers before the filing of a return.

Taxes February 15, 2023

Under the Internal Revenue Code, the rate of interest is determined on a quarterly basis. For taxpayers other than corporations, the overpayment and underpayment rate is the federal short-term rate plus 3 percentage points.

Taxes February 14, 2023

According to the new survey, three-quarters of tax departments report experiencing difficulties in recruiting and retaining talented tax professionals.

Taxes February 14, 2023

The annotations show the locations he supposedly visited in connection with either business. For several reasons, the Tax Court didn’t find this evidence credible.

Taxes February 13, 2023

For 2023, a participating employee can contribute up to $22,500 in elective deferrals or up to $30,000 if they are age 50 or over.

Taxes February 13, 2023

To leverage a 1031 exchange, an investor has to ensure the income from a real estate investment property sale is reinvested (or “exchanged”) in like-kind property.