Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes January 11, 2023

Taxpayers in any county covered by a federal emergency declaration have until May 15 to pay their income taxes.

Taxes January 11, 2023

“We have begun to see the light at the end of the tunnel,” Erin Collins wrote in her latest report to Congress.

Taxes January 10, 2023

Allen Weisselberg, 75, admitted to receiving more than $1.7 million in off-the-books perks over 15 years.

Accounting January 10, 2023

Those who supported the original funding bill say the increase will help the agency increase collections on existing tax laws, and therefore increase revenue, by ...

Taxes January 10, 2023

These returns included fictitious federal income tax withholding figures as well as other fraudulent items that generated fraudulent refunds for the clients.

Taxes January 9, 2023

The bill had been a 2022 campaign priority for most GOP Congressional candidates, but to take effect, it would need to next pass in the ...

Taxes January 9, 2023

At 42 years old, Smith will become the youngest-ever chairman of the powerful tax-writing panel.

![tax-refund1_10916239[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2022/07/36076/tax_refund1_10916239_1_.5e09733c8f20a.png)

January 9, 2023

The below chart shows an estimated timeline for when a taxpayer is likely to receive their refund, based on the information we have now, and using projections based on previous years.

Taxes January 9, 2023

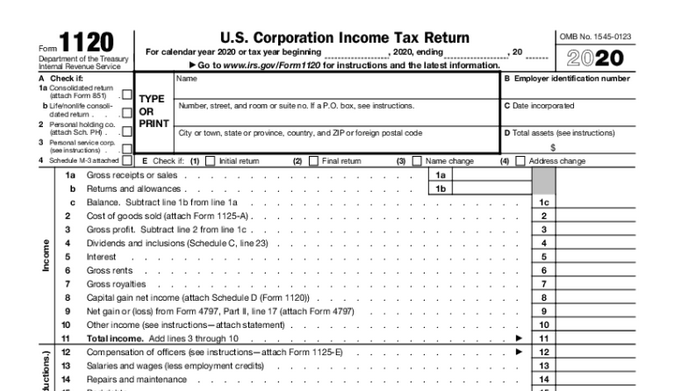

A corporate alternative minimum tax (CAMT) will apply to certain corporations reporting more than $1 billion in annual adjusted book income averaged over a three-year period...

Taxes January 9, 2023

Many of the 12 million refunds come from a change in the way unemployment insurance was taxed.

Taxes January 9, 2023

The first bill in the GOP package aims to rescind the increased funding for the IRS in the Inflation Reduction Act.

![2018_SurePrep_Logo.5b858829593b3[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2022/07/35740/8_SurePrep_Logo.5b858829593b3_1_.5dd6bd904beee.png)

Taxes January 9, 2023

SurePrep will become part of Tax and Accounting Professionals operations, with revenues in both Tax & Accounting Professionals and Corporates.