Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes December 27, 2022

When possible, limit your lifetime gift-giving to amounts covered by the annual gift tax exclusion.

Taxes December 27, 2022

The Retirement Savings Contributions Credit, also known as the Saver's Credit, helps offset part of the first $2,000 workers voluntarily contribute to ...

Payroll December 27, 2022

A list of the most prominent compliance-related topics employers will face in 2023.

Taxes December 27, 2022

The Infrastructure Investment and Jobs Act amended the tax code to expand reporting rules on digital assets by brokers.

Taxes December 27, 2022

The government annually establishes a flat rate for certain “high-cost areas” such as New York, Chicago and Los Angeles and other major cities.

Taxes December 27, 2022

Generally, investors in activities such as real estate in which they don’t materially participate can only take deductions up to the amount of their passive income for the year.

Firm Management December 27, 2022

While stress is difficult to avoid during this hectic time, practice leaders can mitigate the impact of stress on employees through rewarding employees who ...

Accounting December 26, 2022

On Thursday, 166 members voted by proxy, taking advantage of the pandemic-era policy that Republicans have vowed to end in the next Congress,

Taxes December 25, 2022

At this time of year, Congress usually addresses a number of tax law provisions that are going off the books.

Taxes December 23, 2022

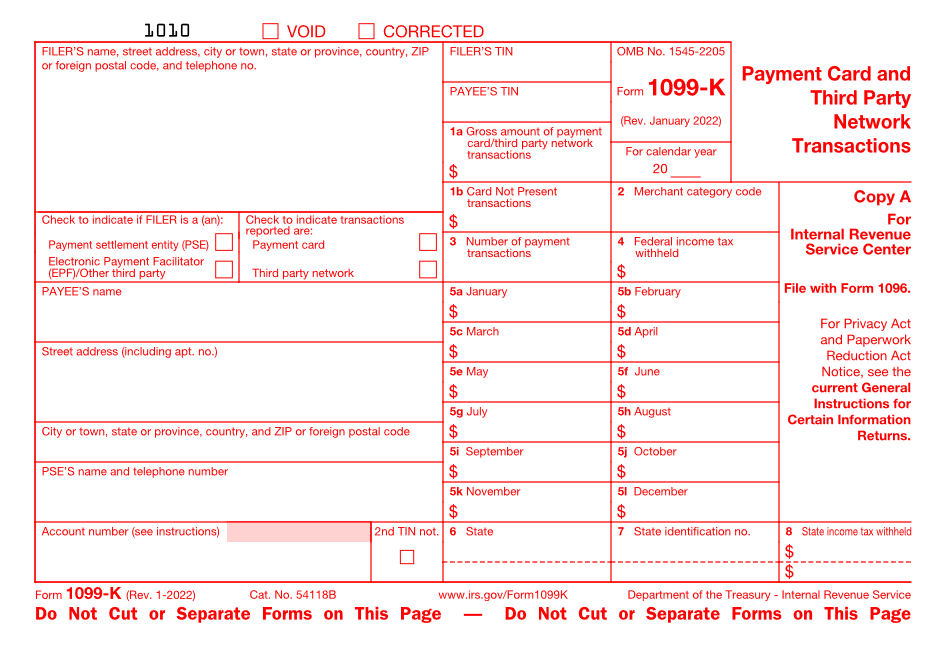

The Internal Revenue Service today announced a delay in reporting thresholds for third-party settlement organizations set to take effect for the upcoming tax filing season.

December 23, 2022

This chart shows an estimated timeline for when a taxpayer is likely to receive their refund, based on information we have now, and using projections based on previous years- and depending on when a person files their return.

Digital Currency December 22, 2022

The bail package requires him to stay with his parents and submit to electronic monitoring.