Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

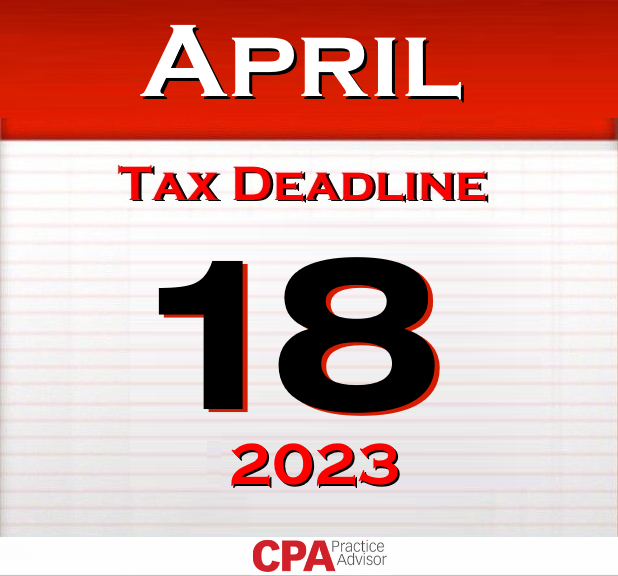

Taxes December 22, 2022

This chart shows an estimated timeline for when a taxpayer is likely to receive their refund, based on the information we have now, and using projections based on previous years.

Taxes December 22, 2022

The 2023 tax filing season is about to kick off. Individual taxpayers should start assembling all the information needed for filing their 2022 returns.

Payroll December 21, 2022

That represents an increase of 50 cents-an-hour for businesses with 26 or more employees, and $1.50 an hour for those with 25 or fewer.

Taxes December 21, 2022

Donald Trump was the first major party presidential candidate in decades to refuse to release his returns to the public during his 2016 campaign.

Small Business December 21, 2022

After voters in Colorado and Washington approved ballot measures to legalize the recreational use and sale of small amounts of cannabis in 2012, the first retail cannabis stores opened in 2014.

Taxes December 21, 2022

Analysis shows Trump was able to use questionable deductions and aggressive tax strategies to minimize his tax bills.

Taxes December 21, 2022

The former president claimed he lost some $5 million in 2020 and therefore paid no taxes when he filed last year.

Taxes December 20, 2022

If the IRS were to change its filing dates so that 1/12 of the taxpayers had tax returns due each month, instead of 100% of the taxpayers having tax returns due in the same month...

Taxes December 20, 2022

Before year’s end, Treasury said it will release information on the tax provisions contained in the legislation.

Taxes December 20, 2022

Exactly when and how six years of the former president’s tax information will be released remains unclear.

Small Business December 19, 2022

18% of e-commerce transactions between Nov. 24 and Nov. 28 in the U.S. were suspected to be fraudulent.

Taxes December 19, 2022

The word of caution from the IRS comes due to a change in how the tax agency issues 1099-Ks.