Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes December 19, 2022

It applies to a qualified fuel mixture containing sustainable aviation fuel for sales or uses in calendar years 2023 and 2024.

Digital Currency December 19, 2022

The disgraced FTX co-founder is expected to disclose in court today that he won’t fight extradition.

December 18, 2022

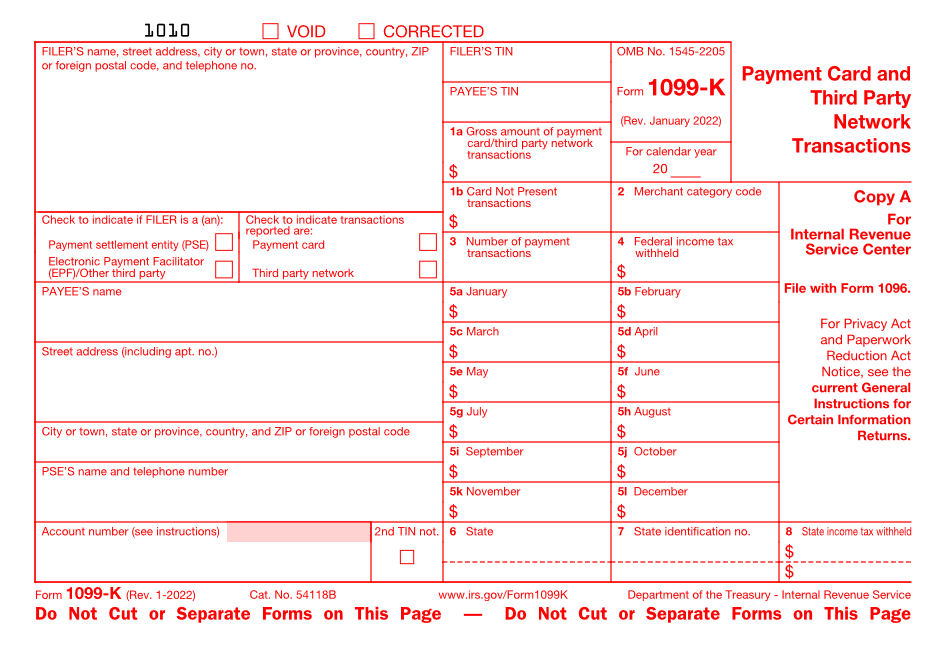

The $600 threshold is based on a threshold established by the Internal Revenue Code section 6041 established in 1954 and does not account for increases in ...

Taxes December 17, 2022

The meeting will be held in the panel’s hearing room at 3 p.m. Eastern time on Tuesday.

Taxes December 16, 2022

More and more governments are imposing new regulations and taxes on e-cigarettes, vaping products, and similar products.

Taxes December 16, 2022

ACAChamp works to simplify Affordable Care Act (ACA) implementation, compliance, cost management and IRS reporting for employers.

Taxes December 15, 2022

A Social Security provision currently limits benefits for public workers who also get government pensions.

Taxes December 15, 2022

Tax experts sound off on the funding the IRS will get from Congress and what it could mean for the 2023 tax season.

Taxes December 15, 2022

It’s set to take effect on April 1, 2023, and it’s already causing shock waves in the Los Angeles housing market.

Small Business December 15, 2022

A recent survey revealed that 63% of decision-makers do not know if they are eligible to claim the ERC.

Payroll December 14, 2022

Money that’s put into FSAs must be used by Dec. 31; however, some firms allow you to roll over a portion of unused money.

Accounting December 14, 2022

Some SPACs face investor meetings that will give clients a chance to exit ahead of a new tax that could hurt their returns.