Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes February 4, 2026

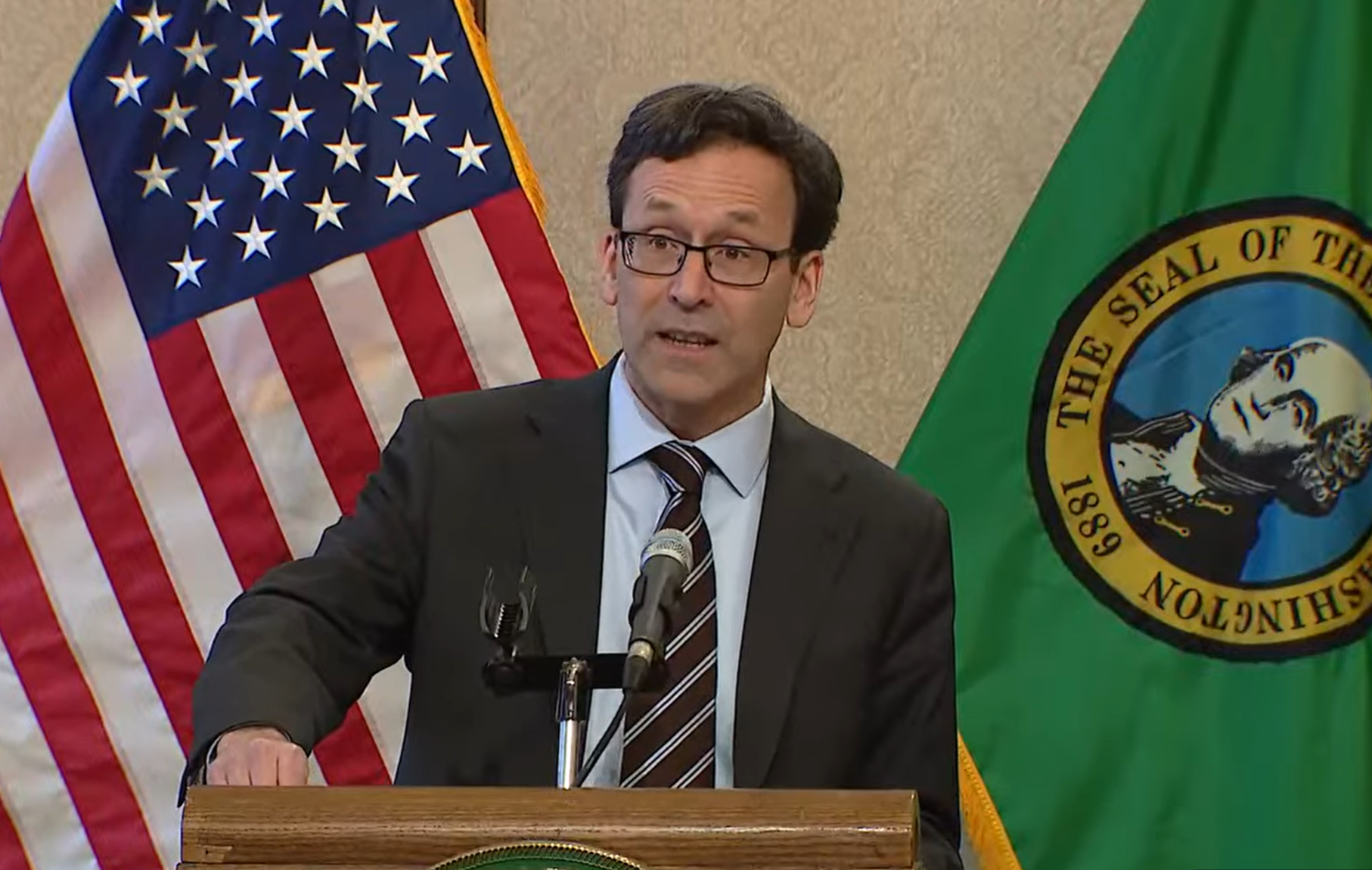

The lawsuit claims the wording of signature petitions to qualify for the ballot were "misleading and deceptive" because it didn't mention the cuts would cover all three categories of income taxes, including capital gains taxes paid by businesses.

Technology February 4, 2026

Through a partnership with tax technology platform april, OnePay Cash customers can now file federal and state taxes with confidence at no cost, OnePay says.

Sales Tax February 3, 2026

A new report by Vertex, a provider of indirect tax solutions, shows that 2025 was one of the most active and complex years in more than a decade.

Taxes February 3, 2026

The House is preparing to vote on a disapproval resolution this week that would reverse a recent measure passed by the D.C. Council that separates some local tax policies from the revamped federal tax code.

Taxes February 3, 2026

Two key Oregon Democrats on Monday unveiled a plan to increase state revenue by dropping several state tax breaks copied from President Donald Trump’s sprawling tax-and-spending law passed last year.

Taxes February 3, 2026

In a long-anticipated bill, which is getting formally introduced this week, legislative Democrats are proposing a 9.9% tax on annual earnings of more than $1 million starting in 2028.

Taxes February 3, 2026

This collaboration introduces a new integration, enabling customers to leverage GruntWorx’s AI-enhanced Optical Character Recognition automation.

IRS February 2, 2026

Core tax systems remain operational during a shutdown, meaning Americans can still file their tax returns and receive refunds, according to the Internal Revenue Service.

Sales Tax February 2, 2026

For the third year in a row, Louisiana has the highest average combined state and local sales tax rate in the country at 10.11%, according to a new report from the Tax Foundation.

Taxes February 2, 2026

In an email to tax professionals on Monday, the IRS said it recently updated qualifications for Simple Payment Plans, formerly known as “streamlined installment agreements,” to include business taxpayers.

IRS February 2, 2026

The IRS announced last week that it's accepting applications for the Electronic Tax Administration Advisory Committee through Feb. 28.

Taxes February 2, 2026

Economists have their doubts about a proposal from Connecticut gubernatorial candidate Betsy McCaughey, a Republican, to repeal the state's income tax.