Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

September 28, 2022

Even companies that have claimed the ERC may want to review their documentation of qualification for the credit.

September 28, 2022

In late August, the IRS announced it would offer automatic penalty relief to certain taxpayers for taxable years 2019 and 2020.

Sales Tax September 28, 2022

These integrations enable customers of Avalara partner solutions to benefit from Avalara’s real-time calculation of applicable taxes for billing line items. A

Accounting September 28, 2022

Almost half of organizations surveyed globally (49%) responded that they have conducted scenario analysis – which is also a TCFD recommendation ...

![NJCPA[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2022/07/35734/NJCPA_1_.5dd68391bdb25.png)

September 27, 2022

The New Jersey Society of Certified Public Accountants (NJCPA) has launched its thirteenth annual food drive to benefit the Community FoodBank of New Jersey.

September 27, 2022

The new enhancement to Bloomberg Tax Provision makes it easy for users to keep track of the latest tax rate changes and update ...

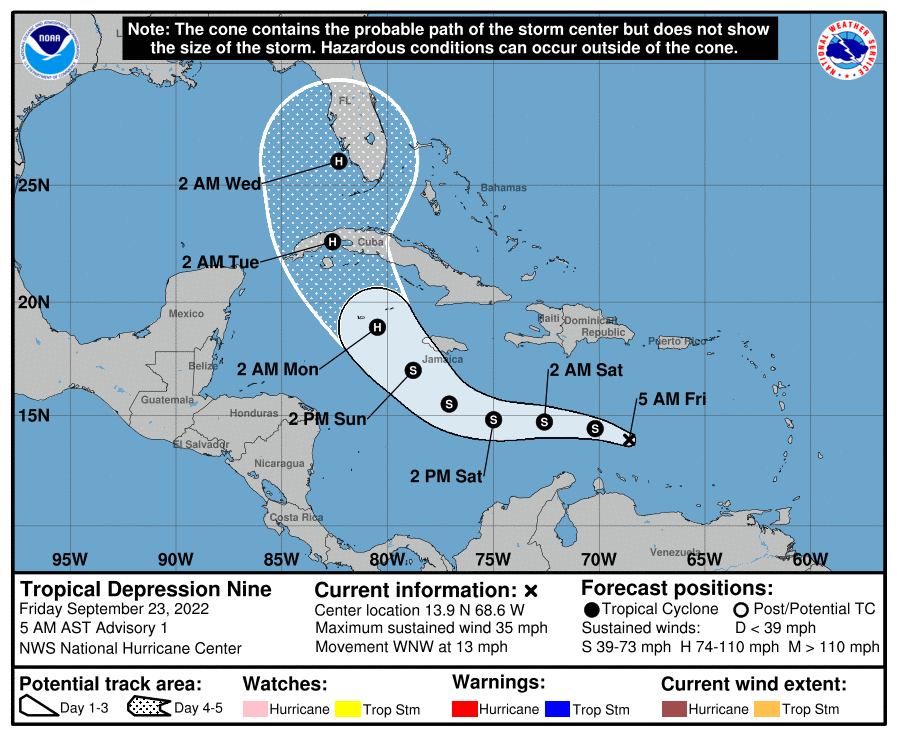

Small Business September 23, 2022

The storm may eventually target the Gulf Coast of Florida as a major hurricane by the middle of next week, with winds that could reach over 120 MPH.

September 22, 2022

For Amazon sellers in Pennsylvania, their marketplace inventory may not create an obligation to collect state sales tax after all.

Accounting September 22, 2022

Accountants who have a thorough understanding of legal issues can offer more complete advice to their clients. Likewise, lawyers who have an advanced understanding of accounting can better ...

Taxes September 22, 2022

Colorado residents can use digital currency to pay taxes of all kinds, including personal and business.

September 21, 2022

When a taxpayer's loan is forgiven based upon misrepresentations or omissions, the taxpayer is not eligible to exclude the forgiveness from income and must include in ...

September 21, 2022

The Internal Revenue Service has announced that Hurricane Fiona victims in all 78 Puerto Rican municipalities now have until February 15, 2023, to file various federal individual and business tax returns and make tax payments.