Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes July 11, 2022

A growing number of companies, including Airbnb, have told employees they can “live and work anywhere.” This can pose a world of new tax obligations.

Taxes July 11, 2022

The next generation of tax professionals are at a different place in their lives and careers than the owners of the firms they are applying to.

Taxes July 7, 2022

The coincidence is so great that the IRS commissioner asked the department’s inspector general Thursday to investigate, after the audits were uncovered by The New York Times.

Taxes July 7, 2022

This popular tax conference series is designed to benefit attorneys and accountants seeking to refresh their knowledge and learn more about the latest developments in legislation and regulations.

Accounting July 6, 2022

William Kawam, 57, of Hewitt, N.J., pleaded guilty on June 30 to charges of subscribing to false tax returns and conspiracy to defraud the U.S.

July 5, 2022

Seattle's tax requires businesses with at least $7 million in annual payroll to pay between 0.7% and 2.4% on salaries and wages paid to Seattle employees who make at least $150,000 per year.

Taxes July 5, 2022

The 2022 report groups a total of five recommendations into two sections: recommendations to Congress and recommendations to the IRS.

Taxes June 30, 2022

Although Wayfair was strictly a sales tax case, states have also begun to assert economic nexus for income tax purposes. Unlike sales tax, currently only a handful of states...

Accounting June 27, 2022

The Financial Accounting Standards Board (FASB) recently decided to tackle a project that could result in new rules being created on how companies should account for environmental credits, such as renewable energy credits and carbon offset credits.

Taxes June 21, 2022

The CP14, which is required by law to be issued within 60 days after the IRS assesses a tax liability, is the most common IRS notice sent to taxpayers, according to the Taxpayer Advocate Service, and requests payment within 21 days. The reason why taxpayers have a balance due can be related to a number…

June 21, 2022

More than half of consumers surveyed now prefer to find new products in-store rather than online, according to a new report by 5WPR. They enjoy speaking with sales people, getting their hands on products, and simply basking in the in-store ambiance ...

Taxes June 21, 2022

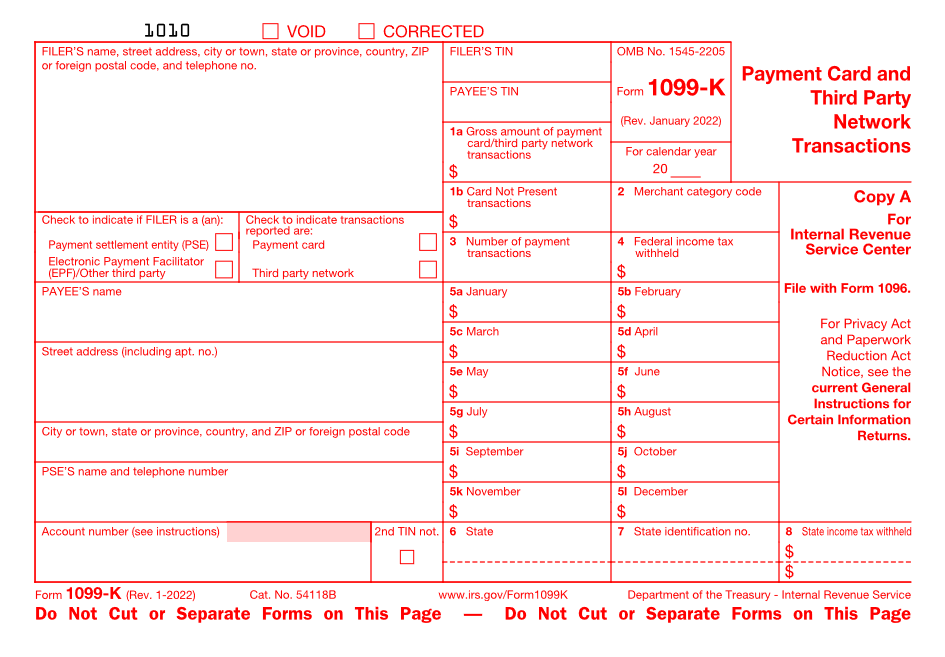

It used to be that receiving a Form 1099-K was relatively rare. The form, technically known as Form 1099-K Payment Card and Third-Party Network Transactions was used to report payments received from various third-party resources. Prior to 2022, the monetary threshold to receive a 1099-K was $20,000, with 200 sales-related transactions required. Both requirements had…