Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

April 10, 2022

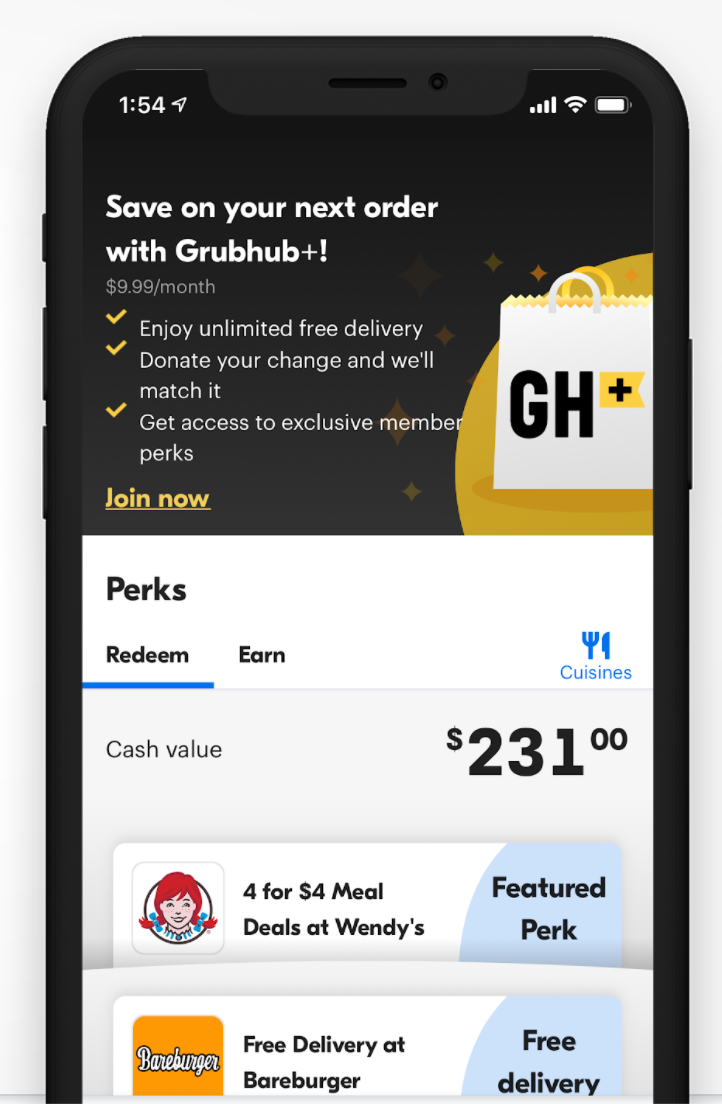

Restaurants contracting with the delivery app are responsible for remitting to the state the tax due on meals.

April 5, 2022

Marketplacer is now part of Avalara's "Certified for AvaTax" program, which features integrations that perform at the highest level to provide the best possible customer experience. The new partnership with Avalara gives both marketplace operators ...

March 28, 2022

Avalara is expanding opportunities for partners to build compliance integrations and experiences. To offer flexibility and control to developers, Avalara is pursuing a headless compliance approach that decouples the front-end presentation layer of a ...

![godaddy-logo[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2022/03/godaddy_logo_1_.623df9327ae69.png)

March 25, 2022

The sales tax automation feature upgrades GoDaddy Online Store capabilities and frees business owners from having to manually track their transaction thresholds for each state to know if/when they owe sales tax, log the sales tax rates for each ...

March 24, 2022

Many different factors can affect the timing of a refund after the IRS receives a return. A manual review may be necessary when a return has errors, is incomplete or is affected by identity theft or fraud.

March 18, 2022

Corvee, a software and solutions company serving tax and accounting firms, has launcehd state and local tax planning within the company’s award-winning tax planning product. Now, firms can quickly and easily analyze client tax scenarios at the federal ...

March 3, 2022

Will the IRS find out if you don't report your income? This is the question everyone wants to ask, but tax professionals don't want to answer because of ethical or liability concerns.

February 21, 2022

These integrations enable customers of Avalara partner solutions to benefit from Avalara’s real-time calculation of applicable taxes for billing line items. Avalara software reduces the tedium and complexity of determining taxes for millions of ...

February 8, 2022

With this new Vertex integration, Dynamics 365 Finance customers now have the option of implementing Dynamics 365 Finance, AP automation and tax compliance all in one.

February 7, 2022

Getting tax wrong can be costly for any business, but particularly for marketplace facilitators with a high volume of sales. Unless a marketplace facilitator can demonstrate that a failure to collect and remit applicable taxes was due to receiving ...

February 7, 2022

Tax statutes written decades ago likely didn’t contemplate these sorts of services. That said, the plain language in many state and local communication tax statutes often has basic wording around the taxable terms of SMS and messaging and may not ...

February 4, 2022

By focusing on the shifting responsibilities of the tax workforce along with the integration of tax technology, businesses can plan for the tax department of the future.