Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

February 2, 2022

A sales tax holiday is a limited time period during which some normally taxable products are exempt from sales tax. Approximately 17 states provide one or more sales tax holidays each year; the precise number fluctuates because some states adopt new ...

January 28, 2022

That verification requirement will soon be required for all taxpayers to view other personal tax documents on the IRS website. Tax practitioners who use a secure service will still have access to IRS transcripts.

January 26, 2022

Sales transactions are presumed taxable in states with a sales tax (unless there’s a specific exemption or exclusion), most states haven’t yet clarified which sales tax laws apply to sales made in the metaverse. When will they start?

January 25, 2022

The commonwealth collected $74.2 million in marijuana excise tax through December 2021, WCVB reported. In comparison, alcohol collected $51.3 million.

January 25, 2022

To help prevent someone from selling stolen goods on a marketplace, California and several other states want marketplaces to obtain and share the names and contact information of high-volume marketplace sellers.

January 25, 2022

Though the United States economy is “dominated by services-oriented companies,” most states currently tax only select services, if any. That could change in 2022: Legislation seeking to tax services has been introduced in Indiana and ...

January 18, 2022

The policy change results from the repeal of Tennessee’s Sales and Use Tax Rule 96, which required Tennessee suppliers to collect Tennessee sales tax on products sold to out-of-state dealers unless such dealers provided a Tennessee resale ...

January 14, 2022

The solution enables global omnichannel retailers the ability to configure, automate and deploy containerized sales and use tax engines where transactions are being processed, delivering enhanced performance and scale for tax automation ...

January 9, 2022

The below chart shows an estimated timeline for when a taxpayer is likely to receive their refund, based on the information we have now, and using projections based on previous years- and depending on when a person files their return.

January 8, 2022

The estimated refund date chart is below if you just want to scroll down. Most Americans who are expecting an income tax refund receive it by direct deposit in as little as 2 weeks after filing electronically.

December 22, 2021

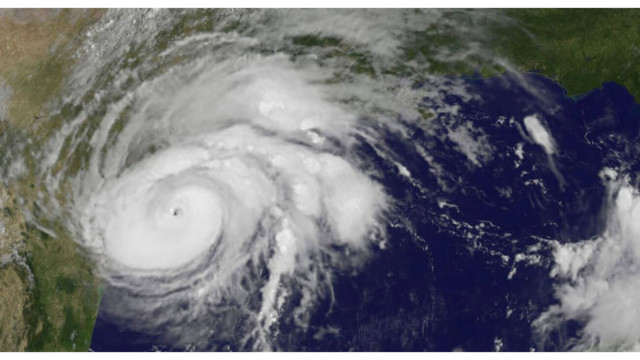

Victims of Hurricane Ida in six states now have until Feb. 15, 2022, extended from Jan. 3, to file various individual and business tax returns and make tax payments, the Internal Revenue Service announced.

December 22, 2021

The IRS is urging people receiving these letters to make sure they hold onto them to assist them in preparing their 2021 federal tax returns in 2022.