Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

October 22, 2021

Sovos will expand its Istanbul-based product development center of excellence in support of a growing base of channel partners, small-and-medium-sized businesses (SMB), and large enterprise customers in Turkey and across the region.

October 19, 2021

Avalara, Inc., a provider of tax compliance automation software for businesses of all sizes, has been named a Leader in three IDC MarketScape reports covering tax automation solutions for SMB, Enterprise, and VAT. “This is a watershed moment for Avalara as we continue to invest in our vision to be the global cloud compliance platform....…

October 18, 2021

Avalara has acquired CrowdReason Limited Liability Company, a developer of SaaS-based property tax compliance applications, as well as a related property valuation and advisory services business to help solve property tax compliance challenges.

October 18, 2021

Ecommerce was already driving changes for businesses before the Wayfair ruling, with many having customers across the U.S., but with little or no requirements to comply with other states’ sales tax obligations. The pandemic greatly increased the role ...

October 13, 2021

The overall result of these changes was that Mexico, which began taxing digital services in mid-2020, increased its tax revenues by $304 million - a 915% jump compared to 2019. Meanwhile, from June 2020 to June 2021, Chile has secured more than 194 ...

September 28, 2021

With remote work exploding in 2020, businesses have been faced with new challenges and opportunities. Of course, Zoom is now a household term, in much the same way Google became one 20 years ago. Beneath the surface, however, remote work affects ...

September 27, 2021

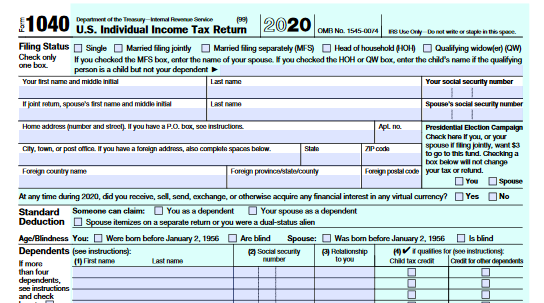

So will the 2022 tax filing season be normal? Not likely. In addition to lasting health concerns, a number of new tax law provisions will create complications for some filers, as well as potential pitfalls to avoid. And maybe new tax laws by year's end.

September 23, 2021

The West Virginia State Tax Department recently clarified that although digital products are exempt from sales and use tax in West Virginia, streaming services are subject to West Virginia sales and use tax. This is at odds with West Virginia’s earlier guidance. Previously, the Tax Department suggested it didn’t tax streaming services. It’s possible to...…

September 23, 2021

The Federal Universal Service Fund promotes unrestricted access to broadband, lifeline communication, and many other public services. It was established originally to ensure everyone in the United States had access to communication services, such as ...

September 16, 2021

Estate planning is often in the back of many people’s minds yet tends to be avoided due to the unsettling thoughts and fears regarding death. Nevertheless, estate planning is a necessity for anyone with children, a business, personal assets, or ...

September 16, 2021

Taxpayers can file now and schedule their federal tax payments up to the Oct. 15 due date. They can pay online, by phone or with their mobile device and the IRS2Go app. When paying federal taxes electronically taxpayers should ...

September 15, 2021

Nevada used to be on the short list of states where breweries, distilleries, and retailers could ship alcohol direct to consumers (DTC). With Nevada’s change of heart, the list of states where breweries, distilleries, and retailers can make ...