Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

January 18, 2021

The below chart shows an estimated timeline for when a taxpayer is likely to receive their refund, based on the information we have now, and using projections based on previous years- and depending on when they file their return.

January 17, 2021

The Covid / Coronavirus stimulus payments you received will NOT affect your tax refund. Here's a chart that shows estimated dates for income tax refunds in 2021. File early and use Direct Deposit to get it faster.

January 15, 2021

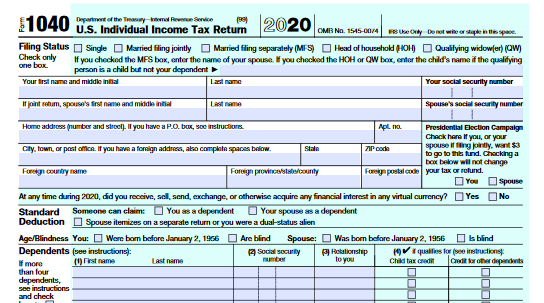

The Internal Revenue Service has announced that the nation's tax season will start on Friday, Feb. 12, 2021, when the tax agency will begin accepting and processing 2020 tax year returns.

January 15, 2021

President-elect Biden's new stimulus plan would send $1,400 stimulus payments to taxpayers who received the previous stimulus payments. Small businesses would see $15 billion in grants and $35 billion in low-interest loans.

January 8, 2021

To promote access to capital, initially only community financial institutions will be able to make First Draw PPP Loans on Monday, January 11, and Second Draw PPP Loans on Wednesday, January 13. The PPP will open to all participating lenders shortly ...

![sample-eip-card[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2021/01/sample_eip_card_1_.5ff774be74ff5.png)

January 7, 2021

Starting this week, the Treasury Department and the Internal Revenue Service are sending approximately 8 million second Economic Impact Payments (EIPs) by prepaid debit card.

January 7, 2021

A cloud sales tax returns solution designed exclusively for accounting firms, MRA enables firms to extend their practice with automated sales tax preparation and filing services, to provide clients with the benefits of a fully managed returns service.

January 6, 2021

Are you still waiting to get your second economic stimulus payment from Uncle Sam? You may have to wait a little longer because of a glitch in the system for some users of tax refund loan services.

January 6, 2021

The Treasury Department and the Internal Revenue Service have issued guidance allowing deductions for the payments of eligible expenses when such payments would result (or be expected to result) in the forgiveness of a loan (covered loan) under the ...

January 4, 2021

The direct deposit payments may take several days to post to individual accounts. Some Americans may have seen the direct deposit payments as pending or as provisional payments in their accounts before the scheduled payment date of Jan. 4, 2021...

January 3, 2021

Printable tax form 1040, for tax year 2020. For use with income taxes filed by April 15, 2021.

January 1, 2021

The second round of Coronavirus stimulus payments, $600 for most taxpayers, have started being processed, the U.S. Treasury Department has announced. People could receive them as early as Wednesday, Dec. 30, 2020.