Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

![Billtrust-logo-full-color[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/08/Billtrust_logo_full_color_1_.5f3d42ba947e8.png)

August 19, 2020

By partnering with Avalara, a tax compliance software provider, Billtrust customers will benefit from an automated process to collect, validate, store and manage sales tax exemption certificates, eliminating manual work and creating a ...

August 10, 2020

Retailers with no physical presence in Tennessee are currently required to collect and remit Tennessee sales tax if their annual sales into the state exceed $500,000. Starting October 1, 2020, out-of-state businesses and marketplace facilitators must ...

August 5, 2020

This year, the Food Fight’s fundraising goal is to raise 200,000 dollars statewide during the two-week competition. If that goal is reached, it will mark one million dollars raised in total since the inception of the Food Fight and the equivalent of...

August 4, 2020

As of July 1, 2020, wineries are required to collect Chicago liquor tax on sales made directly to consumers with a Chicago address. This is a significant departure from previous policy: Chicago liquor tax applied only to sales made physically in the city through June 30, 2020. The change to the Chicago liquor tax policy only affects wineries and other wine sellers, because breweries...…

August 4, 2020

Federal, state, and local officials scrambled to support struggling businesses and individuals when the coronavirus (COVID-19) first hit. They placed temporary moratoriums on evictions, pushed income tax due dates to July 15, and waived interest and ...

July 30, 2020

Gross domestic product shrank 9.5% in the second quarter from the first, a drop that equals an annualized pace of 32.9%, the Commerce Department’s initial estimate showed on Thursday. That’s the steepest annualized decline in quarterly records dating ...

![congress.5e7e132560d03[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/07/congress.5e7e132560d03_1_.5f21e3081912a.png)

July 29, 2020

As we head into August, when Congress is scheduled for a recess, lawmakers are poised to present another COVID-19 relief package to the president for his signature. But the Democratic-controlled House and the Senate Republicans still have to hash out ...

July 23, 2020

Instead of a payroll tax cut, the GOP will now back $1,200 checks for individuals who make up to $75,000 a year, exactly as in the March stimulus bill. Mnuchin said that would get money into the economy faster than cutting the payroll tax, which would ...

July 21, 2020

Avalara’s cross-border solution consists of Avalara AvaTax Cross-Border and Avalara Item Classification, providing users with an integrated approach or stand-alone offerings to address the complex processes of classifying products and ...

July 21, 2020

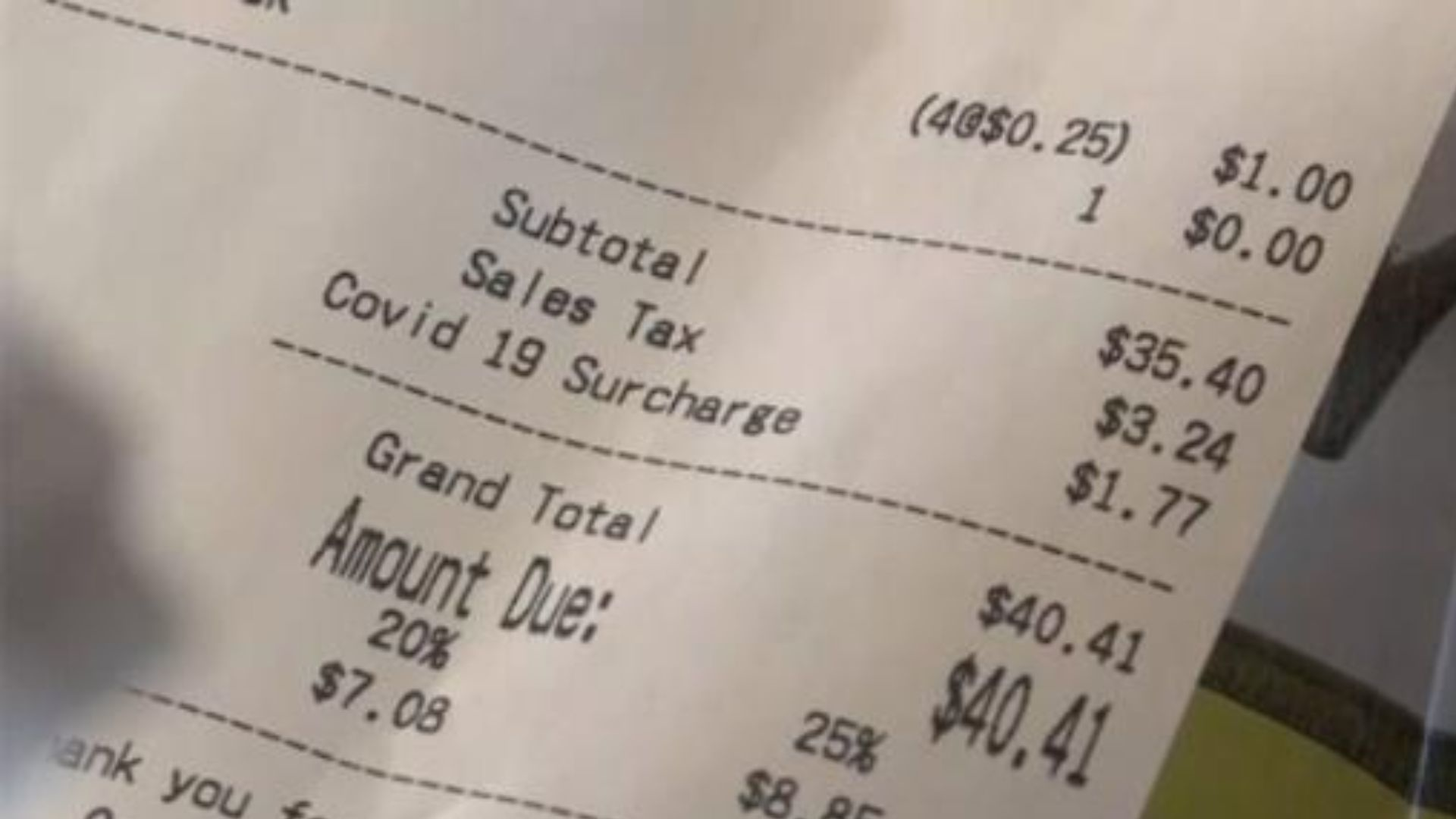

Business owners, especially restaurants and bars, should anticipate a sales tax audit if they are implementing Covid-related fees.

![telecommuting-map[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/07/telecommuting_map_1_.5f109c6053ecc.png)

July 16, 2020

The sudden shift to remote work for many corporations in response to Covid-19 may lead to costly compliance burdens as 36 state tax departments indicate that having just one employee telecommuting from their state will create nexus for ...

July 14, 2020

Due to the coronavirus pandemic, taxpayers have until the postponed due date of July 15, 2020, to file their taxes this year. But if they can't make this deadline, they can receive an extension that gives taxpayers until Oct. 15 to file, but taxes owed ..