Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

April 18, 2020

“Get My Payment” will show the projected date for when a deposit is scheduled, similar to the “Where’s My Refund” tool many taxpayers have previously used.

April 17, 2020

Veterans and their beneficiaries who receive Compensation and Pension (C&P) benefit payments from VA will receive a $1,200 Economic Impact Payment with no further action needed on their part. Timing on the payments is still being determined.

April 17, 2020

The FFCRA covers the costs of this paid leave by providing small businesses with refundable tax credits. Certain self-employed individuals in similar circumstances are entitled to similar credits.

April 17, 2020

During the first 10 days of the federal government’s small-business rescue program, the spigot was wide open in Nebraska. Firms there got enough money to cover about three-fourths of the state’s eligible payrolls. It was a different picture in New York.

April 16, 2020

Specifically, researchers asked a group of 15 influential individuals working in local, regional and international public accounting firms about when they recognized the seriousness of the crisis, how the pandemic has affected their client and ...

April 16, 2020

Since so many of us are now working from home, we thought it would be appropriate to survey members of the CPA Practice Advisor community to find out what apps they are using to make working from home more effective.

April 16, 2020

The Tax Blotter is a roundup of recent tax news and court rulings.

April 16, 2020

With reports that the PPP’s initial $349 billion pool of funds will be fully subscribed as early as today, the need for quick and decisive action by Congress is clear. Small businesses are the nation’s economic engine and supporting and stabilizing ...

April 15, 2020

At last, The Treasury issued guidance related to self-employed individuals and how the Paycheck Protection Program (“PPP”) applies to them. If you remember, the initial CARES Act language included 1099s as part of payroll costs for small businesses ...

April 15, 2020

SSI recipients will receive a $1,200 Economic Impact Payment with no further action needed on their part. The IRS projects the payments for this group will go out no later than early May.

![Islands-Group2[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/04/Islands_Group2_1_.5e973ed1511e8.png)

April 15, 2020

There’s a lot to learn, and not a lot of time to learn it. The business landscape is changing overnight: Another unknown may be how to handle sales tax on takeout or delivery services.

April 15, 2020

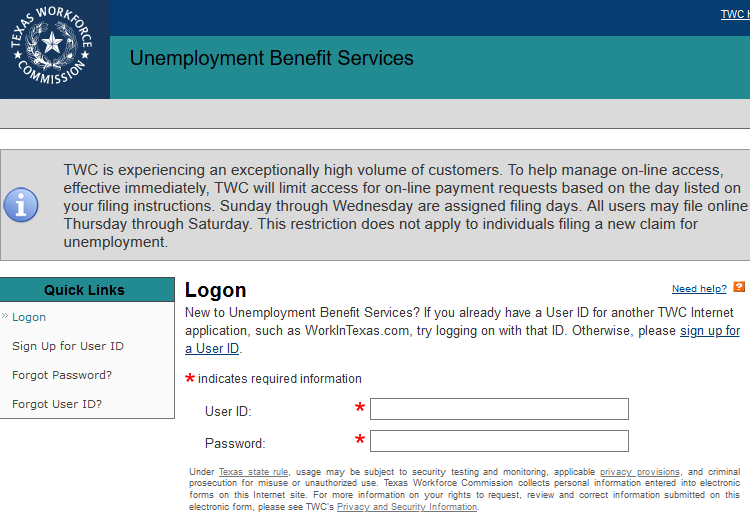

Overall, unemployment website crashes have been reported in Alabama, Arizona, Arkansas, Colorado, Connecticut, Florida, Hawaii, Illinois, Iowa, Kentucky, Louisiana, Maryland, Michigan, Mississippi, Missouri, Montana, Nevada, New Jersey, New York, ...