Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

December 19, 2019

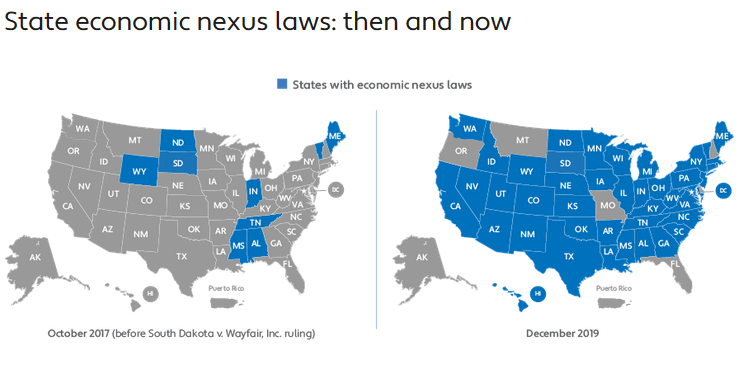

Some of the wackiest sales tax tales in 2019 centered on remote sales tax. States won the right to tax remote sales only recently, with the United States Supreme Court decision on South Dakota v. Wayfair, Inc. (June 21, 2018) — and implementation ...

December 19, 2019

Last year at this time, Missouri lawmakers introduced a couple of bills relating to remote sales tax. Both sought to implement economic nexus, requiring out-of-state vendors with a certain amount of sales in the state to collect and remit sales tax.

December 18, 2019

The new legislation is expected to be signed by President Trump soon after it hits his desk. Keeping that in mind, here are some of the key extensions granted by Congress right before Christmas.

![Candidate_Trump_Taxes.5ce5d3813adff[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2022/07/35978/ate_Trump_Taxes.5ce5d3813adff_1_.5df5beece20c1.png)

December 15, 2019

The appeal to the Supreme Court is the final bid in Trump’s long-standing crusade to shelter his tax returns from prying eyes. The lower courts have consistently ruled against the president in prior proceedings.

December 11, 2019

Avalara’s 2020 sales tax changes report reveals major changes in legislation and consumer preference that are poised to disrupt ecommerce in 2020.

December 10, 2019

The two-day Institute is intended for attorneys, accountants, state tax officials, tax directors, tax managers, and individuals who seek expert discussion on the latest technical, legislative, and planning developments. Attendees will learn practical ...

December 9, 2019

The January 2019 notice provided an exception for small remote sellers. Businesses with no physical presence in New York need to collect New York sales tax only if, in the immediately preceding four sales tax quarters ...

December 9, 2019

The Louisiana Supreme Court is currently deliberating a case that could have an enormous impact on marketplace facilitators in Louisiana.

December 6, 2019

Additionally, the TCJA changed how taxable income is calculated for purposes of the Foreign Tax Credit limitation by disregarding certain expenses and repealing the use of the fair market value method for allocating interest expense.

December 6, 2019

Certain Forms 1099-MISC, Miscellaneous Income, filed with the IRS to report non-employee compensation to independent contractors are also due at this time. Such payments are reported in box 7 of this form.

December 3, 2019

The below chart shows an estimated timeline for when a taxpayer is likely to receive their refund, based on the information we have now, and using projections based on previous years. If your IRS income tax refund is delayed ...

December 2, 2019

States can source sales by the location of the seller (the origin of the sale, aka origin sourcing), or the location where the consumer receives the item or service (the destination of the sale, aka destination sourcing). Most states use destination ...