Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

July 31, 2018

Keeping your clients out of sales tax trouble and in compliance are very important, of course, but if clients slip up without your knowledge and run late on tax payments, one thing they may never see coming is a seizure of property.

July 27, 2018

In 28 States and the District of Columbia, cannabis is legal in one way or another. The problem is when you are dealing with the Federal Government. Cannabis is an illegal Schedule I Narcotic. That being said, when it comes to cannabis, legal ...

July 20, 2018

The provision in the new Tax Cuts and Jobs Act (TCJA) limiting itemized deductions for state and local taxes – known by the acronym of SALT – remains a sticky issue months after enactment of the law. Now four states along the eastern seaboard ...

July 19, 2018

In the immediate term, the case has been remanded to the South Dakota Supreme Court for further review. In other words, assuming the final review isn’t a big surprise, South Dakota will be free to enforce its existing law as presented to SCOTUS in the ...

July 18, 2018

Recently, Avalara interviewed tax and technology consultant Brian Weaver, managing partner of Brian Weaver Consulting LLC, a firm serving client needs in transaction taxes, tax technology and taxation systems, and Sarbanes-Oxley (SOX) compliance.

July 16, 2018

While the South Dakota law which lead to the Supreme Court ruling envisions a $100,000 annual sales threshold, multiple large U.S. businesses as well as organizations such as the National Taxpayers Union Foundation have expressed their reservations or ...

July 12, 2018

Wolters Kluwer Tax & Accounting is offering the timely live webinar, Sales Tax Nexus – Post Wayfair, hosted by internationally recognized tax expert Mark Friedlich, Esq, CPA and Senior Director Corporate Indirect Tax at Wolters Kluwer Tax & ...

July 12, 2018

There used to be a time when brick and mortar stores thought they were losing ground to upstarts like Amazon, who initially didn’t charge sales tax because Amazon didn’t have a physical presence in the state where the sale was made. Eventually Amazon ...

July 11, 2018

With the increasing use of prescribed opioids, reportedly one out of every three persons took such a prescription in 2015, the likelihood that the issue will arise in either the hiring context or involving a current employee is significant.

July 3, 2018

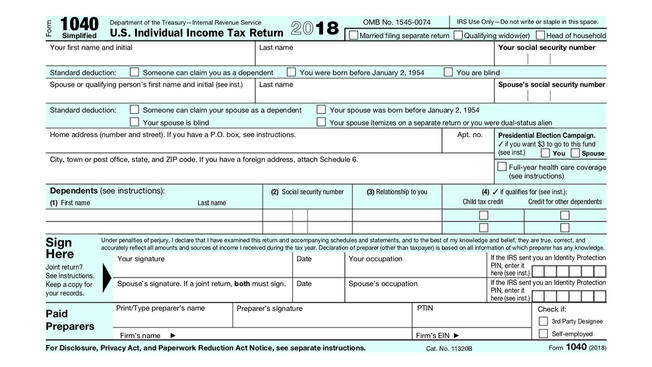

The Internal Revenue Service has released a prototype of the new Form 1040 that hundreds of millions of Americans use to file their annual taxes. The new "postcard sized" form will be used for the 2018 income tax year, which most Americans will file ...

July 3, 2018

The Court explicitly rejected the requirement that a remote seller must have a physical presence in a state before that state or its localities could require sales tax collection. A majority of the Court swept aside the rules that guided this area of ...

June 22, 2018

The Supreme Court has ruled the physical presence standard it upheld in Quill Corp. v. North Dakota (1992) is “unsound and incorrect.” That means states are allowed to tax businesses that don’t have a physical presence in the state.