Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

August 18, 2016

The new RIVIO Clearinghouse (see accompanying article) is a solution to a problem of financial hijinks with which you might not be familiar. After all, most CPAs perform their services ethically and expect their clients to represent their financial ...

August 18, 2016

The IRS will never call to demand payment using a specific payment method such as a prepaid debit card, gift card or wire transfer. Generally, the IRS will first mail you a bill if you owe any taxes. The will not contact you by email, either.

August 18, 2016

As the final weeks of summer tick away, back-to-school sales are ramping up and it's time to think about getting those kids back in the classroom. It's also a good time to think about a variety of tax breaks and deductions available for qualifying ...

August 18, 2016

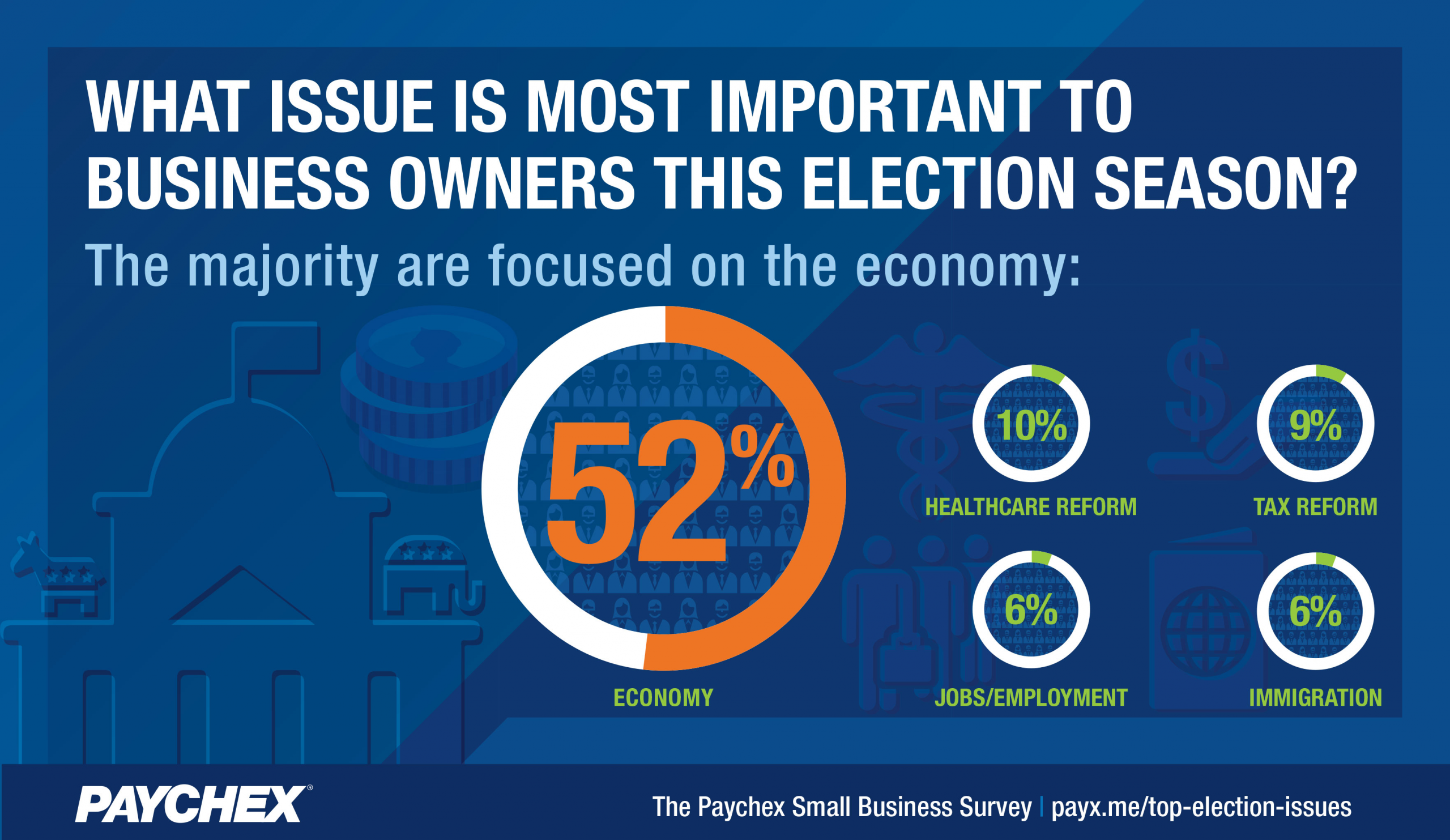

After the economy, the other issues cited by small business owners as most important follow in order as health care reform (10%), tax reform (9%), jobs and employment (6%), and immigration (6%).

August 18, 2016

Clinton also favors an expanded credit for child care expenses, although not quite as expansive as the proposals made by Trump. She also expects to hold the line on tax increases for the vast majority of Americans. There was no mention in her speech ...

August 17, 2016

Tired of Congressional inactivity on internet sales tax, a growing number of states have enacted legislation enabling them to tax sales made by out-of-state sellers. The majority of these laws maintain that a connection between a state and seller is ...

August 16, 2016

The U.S. average combined sales tax rate rose slightly in the second quarter due to minimal tax changes in most jurisdictions, according to the latest ONESOURCE Indirect Tax Report from Thomson Reuters.

August 16, 2016

To help ease the burden of hard-working parents, employers may institute a dependent care assistance plan for employees. Under such a plan, payments made to third parties like babysitters and day care centers are excluded from income if the costs ...

August 16, 2016

The email scheme is the latest in a series of attempts by fraudsters to use the IRS or other tax issues as a cover to trick people into giving up sensitive information such as passwords, Social Security numbers or credit card numbers or to make ...

August 16, 2016

Currently available as a free trial version, the cloud-based system offers early access to the brand-new TaxWise Online interface, the comprehensive bilingual TaxWise forms library, and complete calculations so that preview users can prepare sample ...

August 10, 2016

If taxpayers have an expired ITIN and don’t renew before filing a tax return next year, they could face a refund delay and may be ineligible for certain tax credits, such as the Child Tax Credit and the American Opportunity Tax Credit, until the ITIN is r

August 10, 2016

One of the biggest and best fringe benefits often isn’t technically thought of as a “fringe benefit.” It’s the matching contributions made to a 401(k) plan account by an employer on behalf of participating employees. Witt this add-on, an employee’s ...